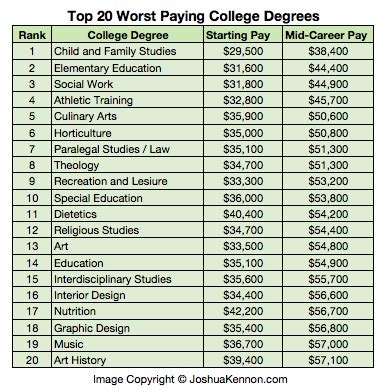

College Degrees That Might Not Pay Off: Analysis Reveals Lowest-Earning Majors

A college degree is often seen as a pathway to financial security, but a recent analysis indicates that some majors may not deliver the expected return on investment. According to a study highlighted by Yahoo Finance, certain fields of study consistently yield lower average salaries, leading graduates to question the value of their educational investment. The report identifies ten specific majors where graduates often face challenges in securing high-paying jobs, prompting students to carefully consider their career prospects before committing to these fields.

The analysis, drawing from various sources including data on median salaries and employment rates, paints a sobering picture for students pursuing degrees traditionally associated with passion rather than profit. While these fields offer intrinsic value and contribute significantly to society, the stark reality is that graduates may struggle to repay student loans and achieve financial stability. This report aims to shed light on these potential financial pitfalls, offering prospective students a realistic assessment of the job market and potential earnings associated with these ten majors.

The Ten Majors Under Scrutiny

The Yahoo Finance report highlights the following ten majors as potentially problematic in terms of financial return:

- Theology and Religious Vocations: While spiritually fulfilling, careers in theology and religious vocations often come with modest salaries.

- Early Childhood Education: Despite the crucial role early childhood educators play in shaping young minds, the profession is notoriously underpaid.

- Human Services and Community Organization: Professionals in this field dedicate their lives to helping others, but the salaries rarely reflect the impact of their work.

- Social Work: Similar to human services, social work is a helping profession with a significant societal impact but relatively low earning potential.

- Visual and Performing Arts: While a career in the arts can be creatively rewarding, securing stable, high-paying positions is highly competitive and often challenging.

- Family and Consumer Sciences: Careers related to family and consumer sciences, while important for community well-being, often have limited earning potential.

- Counseling Psychology: Although the demand for mental health services is increasing, entry-level positions in counseling psychology often offer modest salaries.

- Criminal Justice and Criminology: While some roles in law enforcement and the legal system offer higher salaries, many entry-level positions in criminal justice are not well-compensated.

- Sociology: A broad field of study, sociology graduates may find it challenging to translate their knowledge into specific, high-demand skills.

- Liberal Arts: Similar to sociology, the broad nature of a liberal arts degree can make it difficult to find specific, well-paying employment without further specialization.

These findings underscore the importance of researching potential career paths and salary expectations before choosing a major. The analysis isn’t intended to discourage students from pursuing their passions, but rather to encourage informed decision-making that considers both personal fulfillment and financial realities.

Why These Majors Often Lead to Lower Salaries

Several factors contribute to the lower earning potential associated with these majors. Some of the key reasons include:

- High Supply, Lower Demand: In some fields, such as the arts, the number of graduates often exceeds the available job opportunities, leading to increased competition and lower salaries.

- Non-Profit Focus: Many of the highlighted majors, such as social work and human services, lead to careers in non-profit organizations, which typically operate with limited budgets and offer lower salaries than for-profit companies.

- Public Sector Employment: Some majors, like early childhood education and criminal justice, often lead to employment in the public sector, where salaries are often lower than in the private sector.

- Generalist Skills: Some degrees, such as liberal arts and sociology, provide a broad range of skills but may lack the specific technical expertise that employers demand in high-paying industries. This can lead to the need for further education or specialized training to enhance employability.

- Passion-Driven Careers: Many students choose these majors because they are passionate about the subject matter and the potential to make a difference in the world. While this is admirable, it can sometimes lead to a lack of focus on career prospects and earning potential.

The Importance of Informed Decision-Making

The findings of this analysis emphasize the importance of students conducting thorough research and considering their career goals before choosing a major. While passion and personal fulfillment are important, students must also be aware of the potential financial implications of their educational choices.

“Choosing a major is a significant decision with long-term consequences,” says career counselor Sarah Miller. “Students should research the job market, explore potential career paths, and consider the salary expectations associated with their chosen field. Talking to professionals in the field and seeking advice from career counselors can also be invaluable.”

Beyond Salary: Considering the Intrinsic Value of Education

While salary is an important consideration, it is not the only factor to consider when choosing a major. Many of the highlighted fields offer intrinsic value and contribute significantly to society. Early childhood educators shape young minds, social workers provide essential support to vulnerable populations, and artists enrich our lives with their creativity.

“It’s important to remember that education is not solely about earning potential,” says Dr. Emily Carter, a professor of sociology. “These fields contribute to the social good, and the individuals who work in these roles are often highly dedicated and passionate about their work.”

The report doesn’t suggest that students should avoid these majors altogether. Instead, it encourages students to pursue these fields with a realistic understanding of the job market and potential financial challenges.

Strategies for Maximizing Earning Potential

Even if students choose to pursue one of the majors highlighted in the report, there are strategies they can employ to maximize their earning potential. These strategies include:

- Gaining Relevant Experience: Internships, volunteer work, and part-time jobs can provide valuable experience and help students develop the skills employers are looking for.

- Pursuing Advanced Education: A master’s degree or other advanced certification can often lead to higher salaries and greater career opportunities. For example, a social worker with a Master of Social Work (MSW) will typically earn more than a social worker with a bachelor’s degree.

- Developing Specialized Skills: Acquiring specialized skills, such as data analysis or grant writing, can make graduates more marketable and increase their earning potential.

- Networking: Building a strong professional network can help students find job opportunities and gain valuable insights into their chosen field.

- Negotiating Salaries: Graduates should be prepared to negotiate their salaries and benefits when accepting a job offer. Researching industry standards and knowing their worth can help them secure a fair and competitive salary.

- Considering Location: Salaries can vary significantly depending on location. Graduates may need to consider relocating to areas with higher demand and better pay for their chosen field.

The Broader Economic Context

The discussion of college majors and earning potential is also situated within a broader economic context. Factors such as inflation, student loan debt, and the overall job market can all impact the financial outcomes of college graduates.

The rising cost of tuition and the increasing burden of student loan debt have made it more important than ever for students to carefully consider the financial implications of their educational choices. As noted, “the average cost of tuition and fees at private colleges was $41,577” for the 2022-2023 academic year. This staggering number makes the decision of choosing a college major even more critical.

Conclusion

The Yahoo Finance report serves as a valuable resource for prospective college students, providing a realistic assessment of the earning potential associated with various majors. While passion and personal fulfillment are important considerations, students must also be aware of the potential financial challenges they may face. By conducting thorough research, seeking advice from career counselors, and developing strategies to maximize their earning potential, students can make informed decisions that align with their personal and professional goals. Ultimately, the goal is to empower students to make choices that will lead to both fulfilling careers and financial stability. The report isn’t intended to deter anyone from pursuing their dreams, but to help them navigate the complex landscape of higher education with their eyes wide open. The critical takeaway is informed decision-making, combining passion with practicality for a balanced and successful future. Students should use this information, alongside other resources, to create a plan that acknowledges both the potential rewards and the possible financial burdens associated with their chosen path. The proactive approach to career planning is the key to ensuring that a college degree, regardless of the chosen major, leads to a fulfilling and sustainable future.