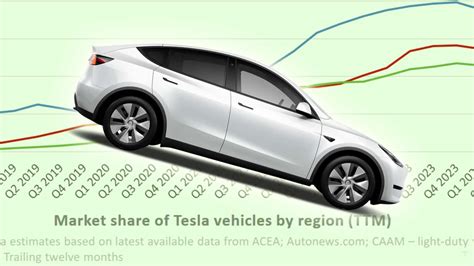

Tesla’s sales in Germany experienced a significant downturn in March, marking a potential “watershed moment” as registrations plummeted by nearly 70% compared to the same period last year, according to recent data. This sharp decline raises concerns about the electric vehicle (EV) giant’s performance in a crucial European market amid increasing competition and evolving consumer preferences.

The sales figures, reflecting a substantial drop from previous highs, have sparked debate among industry analysts regarding the factors contributing to this downturn. The data indicates that Tesla registered approximately 2,904 vehicles in Germany in March, a stark contrast to the approximately 8,434 registrations recorded in March of the previous year. This represents a decrease of roughly 65.6%, which is significantly impacting Tesla’s overall market share and revenue projections within the country.

The unexpected drop has triggered a series of questions about the sustainability of Tesla’s growth trajectory in Europe. While Tesla has been a dominant force in the EV market, the recent figures suggest that it might be facing challenges related to increased competition, shifting government incentives, and potential saturation among early adopters. The German market, known for its strong automotive industry and discerning consumers, is particularly important for Tesla’s global strategy.

“The scale of the drop is surprising,” said one analyst. “While fluctuations are common, a nearly 70% decrease points to more significant underlying issues.” These issues could range from macroeconomic factors impacting consumer spending to specific challenges Tesla faces in maintaining its competitive edge against established automakers and emerging EV brands.

The decline in sales coincides with a broader slowdown in the German automotive market, which has been affected by supply chain disruptions, inflationary pressures, and economic uncertainty related to geopolitical events. However, Tesla’s performance is notably weaker compared to other EV manufacturers, suggesting company-specific factors may be at play.

Competitive Landscape and Market Dynamics

The German EV market is becoming increasingly crowded as traditional automakers like Volkswagen, BMW, and Mercedes-Benz invest heavily in electric vehicle technology. These companies are leveraging their existing manufacturing infrastructure, brand recognition, and extensive dealer networks to compete directly with Tesla.

Volkswagen, in particular, has emerged as a strong contender with its ID series of electric vehicles. The ID.4 and ID.5 models have gained traction among German consumers, offering comparable range and features to Tesla’s Model 3 and Model Y at competitive price points. BMW and Mercedes-Benz are also expanding their EV portfolios with models like the i4, iX, and EQE, further intensifying competition.

The increase in competition is not only limited to established automakers. Several new EV brands, including Polestar, Nio, and BYD, are entering the German market, offering a range of electric vehicles with different features, designs, and price points. This influx of new models is giving consumers more choices and potentially eroding Tesla’s market share.

Government Incentives and Policy Changes

Government incentives play a crucial role in driving EV adoption in Germany. The German government has offered subsidies and tax breaks to encourage consumers to purchase electric vehicles. However, recent policy changes have affected the availability and structure of these incentives.

In early 2023, the German government reduced the amount of subsidies available for electric vehicles, particularly for higher-priced models. This change has made EVs less affordable for some consumers and may have contributed to the slowdown in sales. Furthermore, there has been uncertainty regarding the future of these incentives, which has made some potential buyers hesitant to commit to purchasing an EV.

The reduction in subsidies has had a disproportionate impact on Tesla, as its vehicles tend to be priced higher than some of its competitors. This has made Tesla less competitive in the German market, particularly among price-sensitive consumers.

Supply Chain Challenges and Production Constraints

Tesla, like many other automakers, has faced supply chain challenges in recent years, particularly related to the availability of semiconductors and battery components. These challenges have led to production delays and longer delivery times, which may have affected Tesla’s ability to meet demand in the German market.

The ongoing shortage of semiconductors has been a major obstacle for the automotive industry, as these components are essential for various vehicle systems, including infotainment, safety, and powertrain control. Tesla has been forced to adjust its production schedules and prioritize certain models due to the limited availability of semiconductors.

Battery components, particularly lithium-ion cells, have also been in short supply. Tesla has been working to diversify its battery supply chain and increase its in-house battery production capacity to mitigate these challenges. However, supply chain constraints continue to be a factor affecting Tesla’s ability to ramp up production and meet demand in key markets like Germany.

Consumer Preferences and Brand Perception

Consumer preferences and brand perception also play a significant role in driving EV sales. Tesla has built a strong brand reputation for innovation, performance, and technology. However, some consumers may be hesitant to purchase a Tesla due to concerns about build quality, reliability, and customer service.

Recent reports have highlighted issues with Tesla’s build quality, including panel gaps, paint defects, and software glitches. These issues have raised concerns among some consumers about the overall quality and durability of Tesla vehicles. Furthermore, Tesla’s customer service has been criticized for being slow, unresponsive, and difficult to deal with.

In contrast, traditional automakers like Volkswagen, BMW, and Mercedes-Benz have a long history of producing high-quality vehicles and providing excellent customer service. These companies are leveraging their established reputations to attract consumers who may be hesitant to switch to a new brand like Tesla.

Tesla’s Response and Future Outlook

Tesla is aware of the challenges it faces in the German market and is taking steps to address them. The company is investing in its production capacity, improving its customer service, and launching new products to regain market share.

Tesla’s Gigafactory Berlin-Brandenburg, located near Berlin, is a key part of its strategy to increase production capacity in Europe. The factory is currently producing the Model Y and is expected to ramp up production in the coming months. This will help Tesla reduce delivery times and meet demand in the German market.

Tesla is also working to improve its customer service by expanding its service center network and training its staff. The company is also addressing concerns about build quality by implementing stricter quality control measures at its factories.

In addition to these efforts, Tesla is planning to launch new products that will appeal to a wider range of consumers. The company is expected to release a refreshed version of the Model 3 and is also working on a new entry-level electric vehicle that will be priced more competitively.

Despite the recent challenges, Tesla remains a dominant player in the global EV market. The company has a strong brand, innovative technology, and a loyal customer base. However, Tesla will need to address the challenges it faces in the German market to maintain its competitive edge and sustain its growth trajectory.

Analysis of the “Watershed Moment” Claim

The term “watershed moment” implies a significant turning point or inflection point. Whether the sales decline in Germany truly represents a watershed moment for Tesla remains to be seen. While the drop is substantial, it is important to consider the context and potential mitigating factors.

The German automotive market is cyclical, and sales can fluctuate from month to month due to various factors, including seasonality, economic conditions, and government policies. It is possible that the decline in Tesla’s sales is a temporary phenomenon and that sales will rebound in the coming months.

However, the decline also highlights some underlying challenges that Tesla faces in the German market, including increased competition, changing government incentives, and potential saturation among early adopters. If Tesla fails to address these challenges, the decline in sales could be a sign of a more fundamental shift in the market.

Ultimately, whether the sales decline in Germany represents a watershed moment for Tesla will depend on the company’s ability to adapt to the changing market dynamics and maintain its competitive edge.

Tesla’s Global Performance and Strategy

While the focus is on the German market, it’s important to consider Tesla’s overall global performance. Tesla has been expanding its global footprint, with new factories in China and Germany. The company’s global sales have been growing rapidly, driven by strong demand for its electric vehicles.

Tesla’s strategy is to become a mass-market automaker by producing affordable electric vehicles and expanding its charging infrastructure. The company is also investing in new technologies, such as autonomous driving and battery technology, to maintain its competitive edge.

Tesla’s global strategy is not without its challenges. The company faces intense competition from established automakers and emerging EV brands. It also faces regulatory hurdles and supply chain constraints. However, Tesla has a proven track record of overcoming challenges and disrupting the automotive industry.

Impact on the Broader EV Market

Tesla’s performance in Germany has implications for the broader EV market. If Tesla’s sales continue to decline, it could signal a slowdown in EV adoption in Europe. This could affect the investment decisions of other automakers and impact the overall transition to electric vehicles.

However, it is also possible that Tesla’s decline will create opportunities for other EV brands to gain market share. As the EV market becomes more competitive, consumers will have more choices, which could accelerate the transition to electric vehicles.

Conclusion

Tesla’s significant sales drop in Germany is undoubtedly a cause for concern and warrants close attention. While it is premature to declare it a definitive “watershed moment,” the decline highlights critical challenges Tesla faces in a key European market. Increased competition, changing government incentives, and potential saturation require Tesla to adapt and innovate to maintain its leading position. The coming months will be crucial in determining whether this dip is a temporary setback or a sign of a more significant shift in the EV landscape. The performance in Germany will be closely watched by industry analysts, investors, and competitors alike, as it provides valuable insights into the evolving dynamics of the global electric vehicle market. Tesla’s response and strategic adjustments will ultimately determine its long-term success in Germany and its broader impact on the global EV industry. The situation underscores the importance of continuous innovation, competitive pricing, and effective market strategies in the rapidly evolving electric vehicle sector.

Frequently Asked Questions (FAQ)

-

What caused Tesla’s sales to drop significantly in Germany in March?

- The sales drop is attributed to a combination of factors including increased competition from traditional automakers and new EV brands, changes in government incentives reducing subsidies for EVs, potential saturation among early adopters, and possible supply chain constraints impacting production and delivery. The macroeconomic environment could also be a contributing factor.

-

How much did Tesla’s sales decline in Germany compared to last year?

- Tesla’s sales in Germany declined by approximately 65.6% in March compared to the same month last year. Registrations fell from around 8,434 vehicles in March of the previous year to approximately 2,904 vehicles in March of this year.

-

What are the main competitors Tesla faces in the German EV market?

- Tesla faces strong competition from established German automakers such as Volkswagen (with its ID series), BMW (with models like the i4 and iX), and Mercedes-Benz (with its EQE). Additionally, emerging EV brands like Polestar, Nio, and BYD are also entering and gaining traction in the German market.

-

How have changes in government incentives affected Tesla’s sales in Germany?

- The German government reduced subsidies for electric vehicles, particularly for higher-priced models like Tesla’s. This reduction made EVs less affordable and likely contributed to a decrease in sales. Uncertainty regarding the future of these incentives has also made some potential buyers hesitant.

-

What is Tesla doing to address the challenges it faces in the German market?

- Tesla is investing in its Gigafactory Berlin-Brandenburg to increase local production capacity, aiming to reduce delivery times. The company is also working on improving its customer service, addressing build quality concerns, and planning to launch new, more affordable electric vehicle models to attract a wider range of consumers.

-

What impact does this sales decline have on Tesla’s overall global strategy?

- While Tesla’s global sales have been growing rapidly, the decline in a major market like Germany raises concerns about the sustainability of its growth trajectory and highlights the need for adaptive strategies. Tesla’s global strategy is to become a mass-market automaker by producing affordable electric vehicles and expanding its charging infrastructure. The company is also investing in new technologies, such as autonomous driving and battery technology, to maintain its competitive edge.

-

Are there other factors, aside from competition and government incentives, that might be affecting Tesla’s sales?

- Yes, macroeconomic conditions, such as inflationary pressures and economic uncertainty related to geopolitical events, can impact consumer spending and potentially contribute to a slowdown in automotive sales. Supply chain disruptions, particularly concerning semiconductors and battery components, can also lead to production delays and longer delivery times.

-

What does “watershed moment” signify in the context of the article?

- “Watershed moment” implies a significant turning point or inflection point. In this context, it suggests that the sales decline could be a sign of more fundamental challenges for Tesla in the German market, requiring significant adaptation to maintain its competitive edge.

-

How is Tesla working to improve its customer service and address build quality concerns?

- Tesla is expanding its service center network, training its staff to improve responsiveness, and implementing stricter quality control measures at its factories to address concerns about build quality.

-

What are some of the newer EV models that are competing with Tesla in Germany?

- New EV models include those from Volkswagen (ID.4, ID.5), BMW (i4, iX), Mercedes-Benz (EQE), and emerging brands like Polestar, Nio, and BYD, which offer various features, designs, and price points to attract consumers.

-

How important is the German market to Tesla’s overall global strategy?

- The German market is very important because it is one of the largest automotive markets in Europe, with discerning consumers and a strong automotive industry.

-

What are some examples of specific supply chain issues that Tesla has faced recently?

- The ongoing shortage of semiconductors, which are essential for vehicle systems, has been a major obstacle. Battery components, particularly lithium-ion cells, have also been in short supply.

-

What is Tesla’s Gigafactory Berlin-Brandenburg, and how does it fit into Tesla’s plans for the German market?

- Tesla’s Gigafactory Berlin-Brandenburg, located near Berlin, is a key part of its strategy to increase production capacity in Europe. The factory is currently producing the Model Y and is expected to ramp up production in the coming months.

-

What are some potential criticisms of Tesla’s brand perception that might be affecting sales?

- Consumer concerns may include build quality issues (panel gaps, paint defects, software glitches), reliability issues, and criticisms of customer service responsiveness.

-

What implications could Tesla’s decline have for the wider EV market in Europe and globally?

- It could potentially signal a slowdown in EV adoption in Europe. However, it could also create opportunities for other EV brands to gain market share.

-

What new technologies is Tesla investing in to stay competitive?

- Tesla is investing in new technologies, such as autonomous driving and battery technology.

-

What are some regulatory hurdles that Tesla might be facing in Germany or Europe?

- Tesla might face regulatory hurdles related to safety standards, emissions regulations, and other automotive regulations.

-

What specific steps is Tesla taking to regain market share in Germany?

- Besides increasing local production, Tesla might also be engaging in marketing campaigns, offering promotions or discounts, and working to enhance its brand image.

-

How could consumer confidence in the broader automotive market be affecting Tesla’s sales?

- Economic uncertainty and concerns about the overall economy can lead to lower consumer confidence, causing people to postpone large purchases like cars.

-

What role do charging infrastructure and availability play in Tesla sales in Germany?

- The availability of charging infrastructure and its reliability can influence consumer decisions. If there are perceived limitations in charging infrastructure, it can discourage potential EV buyers.