A significant market downturn, potentially the largest in history, is on the horizon according to Robert Kiyosaki, author of “Rich Dad Poor Dad,” who cites excessive money printing and unsustainable debt levels as key contributing factors.

Robert Kiyosaki, the well-known author of the personal finance book “Rich Dad Poor Dad,” is again sounding the alarm about an impending economic catastrophe. Kiyosaki predicts a market crash of unprecedented magnitude, attributing his forecast to what he perceives as reckless financial policies by governments and central banks worldwide. He specifically points to the massive amounts of money printed in recent years and the escalating levels of global debt as primary drivers of the looming crisis. Kiyosaki has consistently warned about the fragility of the financial system, and his latest comments reinforce his long-held belief that a major correction is inevitable.

Kiyosaki’s concerns are rooted in the observation that governments have resorted to printing money as a solution to economic problems, a practice he believes is unsustainable in the long run. This influx of new currency into the economy, often referred to as quantitative easing, can lead to inflation and devalue existing savings. Coupled with soaring national debt, which represents a future obligation to taxpayers, Kiyosaki argues that the financial system is built on a foundation of sand. The author frequently uses social media platforms to share his economic outlook, urging his followers to prepare for the potential fallout by investing in assets like gold, silver, and Bitcoin, which he views as safe havens during times of economic turmoil.

“The problem we have is that our leaders are too profligate,” Kiyosaki stated. “They keep printing money, and they’re going deeper into debt. This is not a recipe for long-term economic stability. The average person needs to wake up and realize that the system is rigged against them.”

The author’s grim predictions are not new. Kiyosaki has been forecasting market crashes for years, and while the timing of these events is difficult to predict with certainty, his warnings highlight fundamental vulnerabilities within the global financial system. His perspective resonates with a segment of the population concerned about the long-term consequences of government policies and the potential for economic instability. He contends that traditional financial advice, such as saving money in banks and investing in mainstream stocks and bonds, is no longer sufficient to protect wealth in the current environment.

Digging Deeper into Kiyosaki’s Concerns

To fully grasp the gravity of Kiyosaki’s warning, a more detailed examination of the factors he cites is crucial. The practice of “printing money,” or quantitative easing, involves a central bank injecting liquidity into the economy by purchasing government bonds or other assets. The intended effect is to lower interest rates, stimulate lending, and boost economic activity. However, critics argue that it can also lead to inflation, as the increased money supply dilutes the value of existing currency.

The United States, along with many other developed nations, implemented large-scale quantitative easing programs in response to the 2008 financial crisis and, more recently, the COVID-19 pandemic. While these measures may have helped to avert a deeper recession, they also contributed to a significant increase in the money supply. According to data from the Federal Reserve, the M2 money supply, a broad measure of money in circulation, increased dramatically in 2020 and 2021.

The rise in national debt is another significant concern. Governments around the world have accumulated massive amounts of debt to finance their spending programs. The U.S. national debt, for example, has surpassed $34 trillion. This level of debt raises questions about the government’s ability to repay its obligations in the future and the potential for higher taxes or reduced government services.

Kiyosaki argues that these factors, combined with other economic challenges such as rising inflation and geopolitical instability, create a perfect storm for a major market crash. He believes that the current economic system is unsustainable and that a significant correction is inevitable.

The Allure of Alternative Investments

Given his pessimistic outlook, Kiyosaki consistently advocates for alternative investments such as gold, silver, and Bitcoin. He views these assets as safe havens that can protect wealth during times of economic uncertainty.

-

Gold and Silver: Gold and silver have historically been considered stores of value, particularly during periods of inflation and economic turmoil. They are tangible assets that are not directly tied to the performance of any particular government or financial institution. Kiyosaki often refers to gold and silver as “God’s money,” emphasizing their inherent value and their ability to maintain purchasing power over time.

-

Bitcoin: Bitcoin, a decentralized cryptocurrency, has gained popularity as an alternative investment in recent years. Kiyosaki sees Bitcoin as a hedge against inflation and a way to bypass the traditional financial system. He believes that Bitcoin’s limited supply (21 million coins) makes it a scarce asset that could appreciate in value as demand increases.

However, it’s essential to note that these alternative investments also come with risks. The prices of gold and silver can be volatile, and Bitcoin is known for its extreme price swings. Investors should carefully consider their risk tolerance and conduct thorough research before investing in any of these assets.

Contrasting Views and Counterarguments

While Kiyosaki’s warnings have resonated with many, it’s important to acknowledge that his views are not universally shared. Many economists and financial analysts hold a more optimistic outlook, arguing that the global economy is resilient and that government policies are designed to promote stability.

Some argue that quantitative easing, while potentially inflationary, has been necessary to prevent deflation and stimulate economic growth. They also point to the fact that inflation has moderated in recent months, suggesting that the risks associated with excessive money printing may be receding.

Regarding national debt, some economists argue that as long as a country’s economy continues to grow, it can manage its debt burden. They also note that the U.S. dollar remains the world’s reserve currency, which gives the United States a unique advantage in terms of borrowing costs and financial flexibility.

Furthermore, some analysts caution against relying too heavily on alternative investments like gold, silver, and Bitcoin. They argue that these assets can be speculative and that their prices are often driven by sentiment rather than fundamentals.

Preparing for Potential Economic Uncertainty

Regardless of one’s economic outlook, it’s always prudent to take steps to prepare for potential economic uncertainty. Some strategies that individuals can consider include:

-

Diversifying Investments: Don’t put all your eggs in one basket. Diversify your investment portfolio across different asset classes, such as stocks, bonds, real estate, and alternative investments.

-

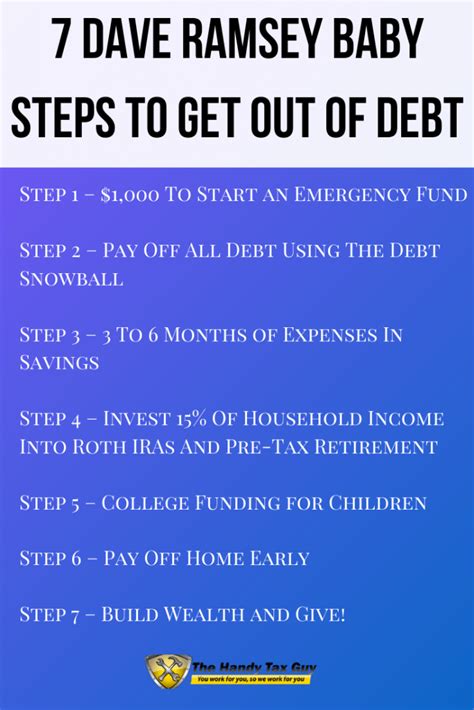

Managing Debt: Avoid taking on excessive debt, particularly high-interest debt. Pay down existing debt as quickly as possible.

-

Building an Emergency Fund: Save enough money to cover at least three to six months of living expenses in case of job loss or other unexpected financial emergencies.

-

Improving Financial Literacy: Educate yourself about personal finance and investing. Understand the risks and rewards associated with different investment options.

-

Seeking Professional Advice: Consider consulting with a financial advisor who can help you develop a personalized financial plan based on your individual circumstances and goals.

Kiyosaki’s predictions, while alarming, serve as a reminder that the global economy is complex and that unforeseen events can have significant consequences. By taking proactive steps to prepare for potential economic uncertainty, individuals can better protect their financial well-being.

The Broader Economic Landscape

To assess Kiyosaki’s claims effectively, it’s vital to consider the broader economic context. Currently, the global economy presents a mixed picture. While inflation has begun to cool down in many countries, it remains above central bank targets. Economic growth is slowing in some regions, while others are showing signs of resilience. Geopolitical tensions, such as the war in Ukraine and ongoing trade disputes, add further uncertainty to the outlook.

Interest rates have risen sharply in response to inflation, which has impacted borrowing costs for businesses and consumers. This has led to concerns about a potential recession. The labor market remains relatively strong in many countries, but there are signs that it is beginning to cool down as well.

The housing market is another area of concern. Rising interest rates have made it more expensive to buy a home, which has led to a slowdown in sales and a decline in prices in some areas. This could have a ripple effect on the broader economy, as housing is a significant driver of economic activity.

The Role of Central Banks

Central banks play a crucial role in managing the economy. They are responsible for setting interest rates, controlling the money supply, and regulating the financial system. Central banks around the world have been grappling with the challenge of balancing the need to control inflation with the desire to avoid a recession.

The Federal Reserve in the United States has been particularly aggressive in raising interest rates in recent months. The Fed has signaled that it is prepared to continue raising rates until inflation is brought under control, even if it means slowing down economic growth.

The European Central Bank (ECB) has also been raising interest rates, but at a slower pace than the Fed. The ECB is facing a more challenging situation because the European economy is more vulnerable to the war in Ukraine and the energy crisis.

The Impact on Different Sectors

A market crash would have a broad impact on different sectors of the economy. Some sectors, such as finance and real estate, are particularly vulnerable to a downturn. Other sectors, such as healthcare and consumer staples, may be more resilient.

The stock market would likely experience a significant decline in a market crash. This could lead to losses for investors, particularly those who are heavily invested in stocks.

The bond market could also be affected by a market crash. Rising interest rates could lead to a decline in bond prices, which could hurt bondholders.

The real estate market could experience a significant slowdown in a market crash. Rising interest rates and economic uncertainty could lead to a decline in home sales and prices.

Risk Management Strategies

Given the potential for a market crash, it’s essential for investors to have a risk management strategy in place. Some strategies that investors can consider include:

-

Setting Stop-Loss Orders: A stop-loss order is an order to sell a stock or other asset when it reaches a certain price. This can help to limit potential losses in the event of a market downturn.

-

Hedging with Options: Options are financial contracts that give the holder the right, but not the obligation, to buy or sell an asset at a certain price. Options can be used to hedge against potential losses in a market downturn.

-

Diversifying Across Geographies: Investing in different countries can help to reduce risk by diversifying away from any one particular economy.

-

Rebalancing Your Portfolio: Rebalancing involves adjusting your portfolio back to its original asset allocation. This can help to ensure that you are not taking on too much risk.

The Importance of Due Diligence

It’s crucial for investors to conduct thorough due diligence before making any investment decisions. This involves researching the company or asset that you are considering investing in and understanding the risks involved.

Investors should also be wary of get-rich-quick schemes and other investment scams. If something sounds too good to be true, it probably is.

Conclusion: A Call for Vigilance

Robert Kiyosaki’s warnings about an impending market crash serve as a call for vigilance. While it’s impossible to predict the future with certainty, it’s essential to be aware of the risks and to take steps to protect your financial well-being. By diversifying your investments, managing your debt, and building an emergency fund, you can better prepare for potential economic uncertainty. It’s also important to stay informed about the economy and to seek professional advice when needed. Whether Kiyosaki’s specific prediction materializes or not, prudent financial planning is always a sound strategy. The confluence of high debt, inflation concerns, and geopolitical instability warrants a cautious approach to investing and personal finance.

Frequently Asked Questions (FAQ)

-

What are the main reasons Robert Kiyosaki is predicting a massive market crash?

Kiyosaki primarily cites excessive money printing by governments and central banks, along with unsustainable levels of global debt, as the main reasons for his prediction. He believes these factors create an unstable financial system prone to a significant correction. He often mentions that these policies devalue currency and undermine long-term economic stability.

-

What alternative investments does Kiyosaki recommend to protect wealth during an economic downturn?

Kiyosaki consistently recommends investing in gold, silver, and Bitcoin. He views these assets as safe havens that can preserve wealth during times of economic uncertainty, inflation, and market volatility. He considers them hedges against the failings of traditional financial systems.

-

Is Kiyosaki the only one predicting a major market crash?

No, while Kiyosaki’s predictions are widely publicized due to his fame as the author of “Rich Dad Poor Dad,” he is not alone in expressing concerns about the global economy. Many other economists and financial analysts have also warned about potential market corrections, although their reasons and specific forecasts may differ.

-

What are some counterarguments to Kiyosaki’s predictions?

Some economists argue that quantitative easing has been necessary to prevent deflation and stimulate economic growth, and that inflation is now moderating. Others contend that countries can manage high levels of debt as long as their economies continue to grow. Some also caution against over-reliance on volatile alternative investments like Bitcoin.

-

What practical steps can individuals take to prepare for potential economic uncertainty, regardless of whether a major crash occurs?

Individuals can diversify their investments, manage their debt responsibly, build an emergency fund, improve their financial literacy, and seek professional financial advice. These steps can help mitigate the impact of any economic downturn and improve long-term financial security.

In-Depth Analysis of Kiyosaki’s Investment Strategies

Kiyosaki’s advocacy for gold, silver, and Bitcoin stems from his belief in their inherent scarcity and potential to retain value during periods of economic instability. To truly understand his position, it’s crucial to examine each of these assets in detail.

-

Gold: Gold has served as a store of value for centuries, prized for its rarity, durability, and aesthetic appeal. Throughout history, gold has been used as currency, jewelry, and a hedge against inflation. During times of economic uncertainty, investors often flock to gold as a safe haven, driving up its price. Kiyosaki sees gold as a tangible asset that is not subject to the same risks as paper money or government bonds. He often emphasizes that governments cannot simply print more gold, unlike fiat currencies.

However, investing in gold also has its drawbacks. Gold does not generate income like stocks or bonds, and its price can be volatile in the short term. Additionally, the cost of storing and insuring physical gold can be significant. Investors can also gain exposure to gold through ETFs (exchange-traded funds) or gold mining stocks, which come with their own set of risks.

-

Silver: Silver, like gold, has a long history as a precious metal and a store of value. Silver is also used in various industrial applications, such as electronics, solar panels, and photography. This dual role as both a precious metal and an industrial commodity can make silver’s price more volatile than gold’s.

Kiyosaki believes that silver is undervalued compared to gold and that it has the potential to appreciate significantly in the future. He often refers to the gold-silver ratio, which measures the number of ounces of silver required to buy one ounce of gold. Historically, this ratio has fluctuated, but Kiyosaki believes that silver is currently trading at a discount relative to gold.

As with gold, investing in silver also carries risks. Silver’s price can be highly volatile, and the cost of storing physical silver can be a factor. Investors can also gain exposure to silver through ETFs or silver mining stocks.

-

Bitcoin: Bitcoin, created in 2009, is a decentralized digital currency that operates independently of central banks and governments. Bitcoin’s limited supply (21 million coins) is a key feature that appeals to investors who are concerned about inflation and government control of the money supply.

Kiyosaki sees Bitcoin as a hedge against inflation and a way to bypass the traditional financial system. He believes that Bitcoin’s decentralized nature makes it resistant to censorship and government interference. He also points to the increasing adoption of Bitcoin by institutional investors as a sign of its growing legitimacy.

However, Bitcoin is a highly volatile asset, and its price can fluctuate dramatically in short periods. Bitcoin is also subject to regulatory uncertainty, and its future is still unclear. Investing in Bitcoin involves significant risks, and investors should be prepared to lose their entire investment.

The Psychological Impact of Market Crash Predictions

Predictions of market crashes can have a significant psychological impact on investors. Fear and uncertainty can drive investors to make emotional decisions, such as selling their investments at a loss. This can exacerbate market volatility and create a self-fulfilling prophecy.

It’s important for investors to remain calm and rational during times of market stress. Avoid making impulsive decisions based on fear or panic. Instead, stick to your long-term investment plan and focus on your financial goals.

The Importance of Financial Education

Financial education is crucial for making informed investment decisions. Understanding basic concepts such as asset allocation, diversification, and risk management can help investors navigate market volatility and achieve their financial goals.

There are many resources available for learning about personal finance and investing, including books, websites, courses, and financial advisors. Take the time to educate yourself and develop a solid understanding of the financial markets.

Beyond the Headlines: Exploring Systemic Vulnerabilities

Kiyosaki’s pronouncements, while sometimes perceived as sensational, often touch upon legitimate concerns about systemic vulnerabilities within the global financial system. These vulnerabilities, if left unaddressed, could indeed contribute to significant economic disruptions.

-

Moral Hazard: The concept of moral hazard arises when entities, knowing they are protected from the full consequences of their actions, engage in riskier behavior than they otherwise would. Government bailouts of large financial institutions, for example, can create a moral hazard by incentivizing excessive risk-taking. Kiyosaki frequently criticizes government interventions in the financial system, arguing that they perpetuate this moral hazard.

-

Derivatives Markets: Derivatives are complex financial instruments whose value is derived from an underlying asset, such as a stock, bond, or commodity. Derivatives can be used for hedging purposes, but they can also be used for speculation. The derivatives market is vast and opaque, and some analysts fear that it could pose a systemic risk to the financial system.

-

Unfunded Liabilities: Many governments face significant unfunded liabilities, such as Social Security and Medicare obligations. These liabilities represent future obligations to taxpayers that are not fully funded by current revenues. As populations age and healthcare costs rise, these unfunded liabilities could become increasingly burdensome, potentially leading to higher taxes or reduced government services.

Addressing these systemic vulnerabilities requires a combination of regulatory reforms, fiscal discipline, and a renewed emphasis on personal responsibility. Kiyosaki’s warnings, while sometimes overstated, can serve as a catalyst for a broader discussion about the long-term health of the financial system.

Analyzing the Impact of Geopolitical Instability

Geopolitical instability is another factor that can contribute to economic uncertainty. Conflicts, trade disputes, and political tensions can disrupt supply chains, increase inflation, and erode investor confidence.

The war in Ukraine, for example, has had a significant impact on the global economy. The conflict has disrupted energy supplies, driven up food prices, and increased geopolitical tensions. Ongoing trade disputes between the United States and China have also added to economic uncertainty.

Investors should carefully consider the potential impact of geopolitical instability on their portfolios. Diversifying across geographies and asset classes can help to mitigate this risk.

Conclusion: Preparing for an Uncertain Future

The global economy faces a number of challenges, including high debt levels, inflation concerns, and geopolitical instability. While it’s impossible to predict the future with certainty, it’s essential to be prepared for potential economic uncertainty. Robert Kiyosaki’s warnings, while sometimes controversial, serve as a reminder that the financial system is complex and that unforeseen events can have significant consequences.

By taking proactive steps to prepare for potential economic uncertainty, individuals can better protect their financial well-being. This includes diversifying investments, managing debt responsibly, building an emergency fund, improving financial literacy, and seeking professional financial advice. It’s also important to stay informed about the economy and to remain calm and rational during times of market stress. Whether a major market crash occurs or not, prudent financial planning is always a sound strategy. By focusing on long-term goals and making informed decisions, individuals can increase their chances of achieving financial security, regardless of what the future holds.