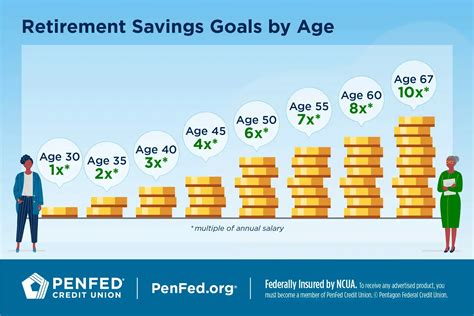

Many Americans are falling short of recommended retirement savings benchmarks at ages 30, 50, and 60, raising concerns about their long-term financial security. Financial experts suggest accumulating approximately one year’s salary by age 30, three times salary by age 40, six times by age 50, and eight times by age 60 to maintain a comparable lifestyle in retirement. However, achieving these milestones proves challenging for many due to factors like student loan debt, stagnant wages, and the rising cost of living.

Retirement Savings: Are You on Track?

Saving for retirement is a marathon, not a sprint, yet many Americans find themselves behind the pace, struggling to meet recommended savings targets at various stages of their working lives. While individual circumstances vary significantly, financial advisors generally recommend specific savings benchmarks to ensure a comfortable retirement. These targets, expressed as multiples of annual salary, offer a guideline for gauging retirement readiness at different ages.

The general rule of thumb suggests having saved approximately one year’s salary by age 30. This benchmark serves as a foundation for future savings and allows individuals to take advantage of the power of compounding over the long term. By age 40, the recommended savings target increases to three times one’s annual salary. This reflects the need to accelerate savings during the peak earning years to compensate for potential early-career setbacks. By age 50, the target jumps to six times salary, a critical juncture as retirement draws closer. Finally, by age 60, individuals should aim to have saved eight times their annual salary to ensure a secure and comfortable retirement.

However, these targets are aspirational and many find them difficult to achieve. A significant portion of the population is behind on their retirement savings, according to various surveys and studies. Contributing factors include a multitude of economic and personal challenges.

Challenges to Reaching Retirement Savings Goals

Several factors contribute to the difficulty many individuals face in meeting recommended retirement savings targets. These challenges range from macroeconomic trends to personal financial circumstances.

-

Student Loan Debt: The burden of student loan debt has become a significant impediment to retirement savings for younger generations. “Many young professionals are saddled with substantial student loan debt, which limits their ability to save for retirement in their 20s and 30s,” explains a financial advisor. Paying off student loans often takes precedence over retirement contributions, delaying the start of the savings journey.

-

Stagnant Wages: Wage growth has lagged behind inflation for decades, making it harder for workers to save a sufficient portion of their income. While the cost of living continues to rise, many individuals have not seen corresponding increases in their earnings. This creates a situation where essential expenses consume a larger share of income, leaving less available for retirement savings.

-

Rising Cost of Living: The increasing cost of housing, healthcare, education, and other essential goods and services puts a strain on household budgets. As expenses climb, individuals may find it challenging to allocate funds towards retirement savings. Unexpected expenses, such as medical bills or home repairs, can further derail savings plans.

-

Lack of Financial Literacy: A lack of financial literacy can also contribute to inadequate retirement savings. Many individuals lack a basic understanding of investment principles, retirement planning strategies, and the importance of starting early. Without this knowledge, they may be less likely to prioritize retirement savings or make informed investment decisions.

-

Job Insecurity and Career Interruptions: Job losses and career interruptions can significantly impact retirement savings. Periods of unemployment can deplete savings and disrupt contribution patterns. Women, in particular, may experience career interruptions due to caregiving responsibilities, which can negatively affect their retirement savings.

-

Unexpected Expenses: Life is full of surprises, and unexpected expenses can derail even the most carefully crafted retirement plans. Medical emergencies, car repairs, or home renovations can quickly deplete savings and make it difficult to stay on track.

Strategies for Catching Up

While the challenges to retirement savings are significant, individuals who find themselves behind can take steps to improve their financial outlook. Several strategies can help individuals catch up and increase their chances of a comfortable retirement.

-

Increase Savings Rate: One of the most effective ways to boost retirement savings is to increase the savings rate. Even small increases in contributions can make a significant difference over time. Consider automating contributions to ensure consistency and avoid the temptation to skip payments.

-

Take Advantage of Employer Matching: Many employers offer matching contributions to retirement plans, such as 401(k)s. This is essentially “free money” and should be taken advantage of whenever possible. Contributing enough to receive the full employer match can significantly boost retirement savings.

-

Reduce Debt: Paying down high-interest debt, such as credit card balances, can free up cash flow for retirement savings. Consider strategies like the debt snowball or debt avalanche to accelerate debt repayment. Reducing debt can also improve credit scores, making it easier to qualify for lower interest rates on loans.

-

Seek Professional Financial Advice: A qualified financial advisor can help individuals assess their retirement savings needs, develop a personalized savings plan, and make informed investment decisions. A financial advisor can also provide guidance on tax planning, estate planning, and other financial matters.

-

Delay Retirement (If Possible): Working a few extra years can significantly boost retirement savings. It allows individuals to continue contributing to retirement accounts, delay drawing on existing savings, and potentially increase Social Security benefits.

-

Consider Downsizing or Reducing Expenses: Reducing expenses can free up more money for retirement savings. Consider downsizing to a smaller home, cutting back on discretionary spending, or finding ways to lower essential expenses.

-

Explore Alternative Income Streams: Generating additional income through a side hustle or part-time job can provide a boost to retirement savings. The extra income can be used to pay down debt, increase retirement contributions, or invest in other assets.

-

Invest Wisely: Choosing the right investments is crucial for maximizing retirement savings. Consider diversifying investments across different asset classes, such as stocks, bonds, and real estate. Seek professional advice on asset allocation and investment strategies.

The Importance of Starting Early

The power of compounding makes starting early the single most important factor in retirement savings. Compounding refers to the process of earning returns on both the initial investment and the accumulated interest. The earlier one starts saving, the more time compounding has to work its magic.

Consider two individuals, Alex and Ben. Alex starts saving \$5,000 per year at age 25, while Ben starts saving the same amount at age 35. Assuming an average annual return of 7%, Alex will have significantly more saved by retirement age than Ben, even though they contributed the same total amount. This is because Alex’s investments had an extra 10 years to grow through the power of compounding.

Addressing the Retirement Savings Crisis

The retirement savings shortfall is a growing concern that requires attention from policymakers, employers, and individuals. Addressing the crisis will require a multi-faceted approach that includes:

-

Promoting Financial Literacy: Improving financial literacy among young people and adults can empower them to make informed financial decisions and prioritize retirement savings.

-

Expanding Access to Retirement Plans: Expanding access to workplace retirement plans, particularly for small business employees and gig workers, can help more individuals save for retirement.

-

Strengthening Social Security: Social Security is a vital source of retirement income for many Americans. Strengthening Social Security can provide a safety net for those who have not been able to save enough on their own.

-

Addressing Wage Stagnation: Addressing wage stagnation can help workers save a larger portion of their income for retirement.

-

Reducing Student Loan Debt: Reducing the burden of student loan debt can free up more money for retirement savings.

-

Encouraging Automatic Enrollment in Retirement Plans: Automatic enrollment in workplace retirement plans can increase participation rates and encourage employees to start saving early.

The Role of Government Policy

Government policies play a crucial role in shaping the retirement landscape. Policies that encourage savings, promote financial literacy, and provide a safety net for retirees can help address the retirement savings crisis.

-

Tax Incentives for Retirement Savings: Tax incentives, such as tax-deferred retirement accounts and employer matching contributions, can encourage individuals to save for retirement.

-

Regulations on Financial Institutions: Regulations on financial institutions can protect consumers from predatory lending practices and ensure that they receive sound financial advice.

-

Social Security Reform: Social Security reform is necessary to ensure the long-term solvency of the program and provide adequate benefits for future retirees.

-

Healthcare Reform: Healthcare reform can help control healthcare costs and reduce the financial burden on retirees.

The Importance of Planning and Preparation

Retirement planning is an ongoing process that requires careful planning and preparation. It is never too early or too late to start planning for retirement. By setting clear goals, developing a savings plan, and making informed investment decisions, individuals can increase their chances of a secure and comfortable retirement.

-

Set Retirement Goals: Determine how much income will be needed in retirement to maintain a desired lifestyle. Consider factors such as housing costs, healthcare expenses, and leisure activities.

-

Develop a Savings Plan: Create a realistic savings plan that takes into account income, expenses, and time horizon. Set specific savings goals and track progress regularly.

-

Make Informed Investment Decisions: Choose investments that align with risk tolerance and time horizon. Diversify investments across different asset classes to reduce risk.

-

Review and Adjust Plan Regularly: Regularly review retirement plan and make adjustments as needed to reflect changes in circumstances, such as income, expenses, or market conditions.

Real-Life Examples

Consider the following examples to illustrate the challenges and opportunities of retirement savings:

-

Maria: Maria is a 35-year-old single mother who works as a teacher. She has \$20,000 in student loan debt and earns \$50,000 per year. She is currently contributing 5% of her salary to her 403(b) account, and her employer matches 50% of her contributions up to 6% of her salary. Maria is behind on her retirement savings goals, but she is committed to improving her financial situation. She plans to increase her contribution rate to 10% of her salary, pay down her student loan debt, and seek professional financial advice.

-

John and Susan: John and Susan are a married couple in their early 50s. John works as an engineer and Susan works as a nurse. They have no debt and earn a combined income of \$150,000 per year. They have saved \$500,000 in their retirement accounts. John and Susan are on track to meet their retirement savings goals, but they are concerned about the rising cost of healthcare. They plan to continue saving aggressively and explore options for long-term care insurance.

-

Robert: Robert is a 62-year-old retired teacher. He receives Social Security benefits and a pension from his former employer. He has saved \$300,000 in his retirement accounts. Robert is able to cover his basic expenses, but he is concerned about the possibility of unexpected medical expenses. He plans to live frugally and explore options for supplemental income.

These examples illustrate the diverse financial situations of individuals and the importance of personalized retirement planning.

The Impact of Inflation

Inflation erodes the purchasing power of savings over time, making it crucial to factor inflation into retirement planning. A retirement income that seems adequate today may not be sufficient in the future due to rising prices.

To account for inflation, financial advisors recommend using a real rate of return when projecting retirement savings. The real rate of return is the nominal rate of return minus the inflation rate. For example, if the nominal rate of return is 7% and the inflation rate is 3%, the real rate of return is 4%.

It is also important to consider the potential for inflation to accelerate in the future. Unexpected surges in inflation can significantly impact retirement savings and require adjustments to spending plans.

The Role of Social Security

Social Security is a vital source of retirement income for many Americans, particularly those with limited savings. However, Social Security benefits are not designed to replace all pre-retirement income. They are intended to supplement retirement savings and provide a basic level of income security.

The amount of Social Security benefits an individual receives depends on their earnings history and the age at which they claim benefits. Claiming benefits early, at age 62, results in a reduced monthly benefit. Delaying benefits until age 70 results in a higher monthly benefit.

It is important to understand how Social Security benefits work and how they fit into overall retirement plan. The Social Security Administration provides resources and tools to help individuals estimate their future benefits.

The Importance of Staying Informed

The retirement landscape is constantly evolving, with changes in tax laws, investment options, and Social Security regulations. Staying informed about these changes is crucial for making sound financial decisions.

Subscribe to financial newsletters, read financial publications, and attend financial seminars to stay up-to-date on the latest developments. Consult with a qualified financial advisor to get personalized advice and guidance.

Conclusion

Saving for retirement is a challenging but essential endeavor. While many Americans are behind on their savings goals, it is never too late to take action and improve their financial outlook. By increasing savings rates, reducing debt, seeking professional advice, and making informed investment decisions, individuals can increase their chances of a secure and comfortable retirement. Government policies that promote savings, expand access to retirement plans, and strengthen Social Security can also help address the retirement savings crisis. The key is to start early, plan carefully, and stay informed.

Frequently Asked Questions (FAQ)

Q1: How much should I have saved for retirement by age 30?

A: Financial experts generally recommend having saved approximately one year’s salary by age 30. This serves as a foundation for future savings and allows you to take advantage of the power of compounding.

Q2: What if I am behind on my retirement savings goals?

A: If you are behind on your retirement savings goals, don’t panic. There are several steps you can take to catch up, including increasing your savings rate, taking advantage of employer matching, reducing debt, and seeking professional financial advice.

Q3: What is the biggest obstacle to saving for retirement?

A: There are many obstacles, but some of the most common include student loan debt, stagnant wages, the rising cost of living, and a lack of financial literacy.

Q4: Is it too late to start saving for retirement if I am already in my 50s?

A: No, it is never too late to start saving for retirement. While it may be more challenging to catch up, there are still steps you can take to improve your financial outlook. Consider working longer, increasing your savings rate, and seeking professional financial advice.

Q5: How does Social Security fit into my retirement plan?

A: Social Security is a vital source of retirement income for many Americans. However, it is not designed to replace all pre-retirement income. It is intended to supplement retirement savings and provide a basic level of income security. Understand how Social Security benefits work and how they fit into your overall retirement plan.