Dave Ramsey’s long-held advice to opt for a 15-year mortgage and avoid longer terms is facing renewed scrutiny in today’s economic climate, with critics arguing that it may be outdated and unsuitable for many homebuyers.

Personal finance guru Dave Ramsey’s staunch advocacy for 15-year mortgages is under fire as financial experts question whether the advice remains relevant in the face of rising home prices, fluctuating interest rates, and evolving financial landscapes. Ramsey’s core philosophy centers around aggressive debt elimination, and the 15-year mortgage is a cornerstone of that approach, designed to help homeowners build equity quickly and become debt-free faster. However, critics argue that this strategy can put undue financial strain on families and may not be the best option for everyone.

Ramsey’s recommendation is simple: take out a 15-year fixed-rate mortgage, even if it means buying a less expensive home, and avoid all other forms of debt. He believes this approach builds wealth rapidly and provides financial security. “The best way to buy a home is to get a 15-year, fixed-rate mortgage. If you can’t afford the payments on a 15-year mortgage, then you can’t afford the home,” Ramsey has stated. He argues that the long-term interest savings and quicker equity buildup outweigh the higher monthly payments.

The primary argument against Ramsey’s advice centers on the opportunity cost and financial flexibility. A 15-year mortgage requires significantly higher monthly payments compared to a 30-year mortgage for the same loan amount. This can strain a household’s budget, leaving less room for other financial goals like retirement savings, investments, or emergency funds. Critics contend that tying up a large portion of income in mortgage payments can make families vulnerable to unexpected expenses or economic downturns.

One major consideration is the potential for investment returns. Critics argue that individuals who opt for a 30-year mortgage and invest the difference between the monthly payments of a 15-year mortgage could potentially earn a higher return than the interest saved by the shorter loan term. This strategy allows homeowners to leverage the power of compound interest and build wealth more effectively over the long term.

Furthermore, tax deductions associated with mortgage interest can also play a role in the decision. While paying off a mortgage quickly reduces overall interest paid, it also reduces the amount of deductible interest each year. For some homeowners, the tax benefits of a larger mortgage interest deduction may offset some of the costs of a longer loan term.

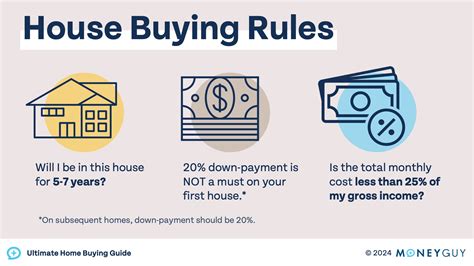

The current economic environment presents additional challenges to Ramsey’s approach. Rising home prices have made it increasingly difficult for first-time homebuyers to enter the market, even with a 30-year mortgage. Forcing them to take on a 15-year mortgage could price many out of homeownership altogether. In addition, fluctuating interest rates add another layer of complexity. While Ramsey advocates for fixed-rate mortgages, the overall interest rate environment can significantly impact the affordability of a home.

Another point of contention revolves around the concept of financial flexibility. A 30-year mortgage provides homeowners with lower monthly payments, freeing up cash flow for other purposes. This flexibility can be particularly valuable during periods of economic uncertainty or when unexpected expenses arise. Homeowners can choose to make extra payments on their mortgage when they have the means to do so, effectively shortening the loan term without being locked into a higher monthly payment.

Opponents of Ramsey’s advice also emphasize the importance of considering individual financial circumstances. A one-size-fits-all approach may not be suitable for everyone. Factors such as income stability, job security, risk tolerance, and long-term financial goals should all be taken into account when deciding on the appropriate mortgage term. For example, self-employed individuals with fluctuating incomes may prefer the lower monthly payments of a 30-year mortgage to provide a buffer during lean months.

Despite the criticisms, Ramsey’s supporters maintain that his advice is sound, particularly for those who prioritize debt elimination and financial security. They argue that the long-term interest savings and quicker equity buildup outweigh the higher monthly payments. Ramsey emphasizes the importance of avoiding debt and building wealth through disciplined financial habits. His followers believe that the 15-year mortgage is a powerful tool for achieving these goals.

Moreover, Ramsey’s approach can be particularly appealing to individuals who are risk-averse and prefer the certainty of paying off their mortgage quickly. For those who are uncomfortable with the idea of carrying debt for an extended period, the 15-year mortgage provides a sense of security and peace of mind.

The debate over the 15-year versus 30-year mortgage highlights the importance of making informed financial decisions based on individual circumstances. While Ramsey’s advice may be suitable for some, it is essential to carefully consider the pros and cons of each option and consult with a qualified financial advisor to determine the best course of action. Ultimately, the right mortgage term depends on a variety of factors, including income, expenses, financial goals, and risk tolerance.

The discussion continues as the housing market evolves and individual financial needs change. As interest rates increase, the debate between prioritizing aggressive debt repayment versus maximizing financial flexibility through investments intensifies. Many financial professionals advocate for a more nuanced approach that considers both debt management and wealth accumulation strategies to achieve long-term financial well-being.

In-Depth Analysis

Ramsey’s 15-year mortgage rule stems from his broader philosophy of aggressively eliminating debt and building wealth through disciplined financial habits. This approach is based on the premise that debt is a major obstacle to financial freedom and that paying off a mortgage quickly is a key step towards achieving financial security.

However, the financial landscape has changed significantly since Ramsey first popularized his debt-elimination strategies. Home prices have risen dramatically, making it more challenging for homebuyers to afford a 15-year mortgage. Interest rates have also fluctuated, impacting the affordability of both 15-year and 30-year mortgages.

One of the key arguments against Ramsey’s advice is the concept of opportunity cost. By allocating a larger portion of their income to mortgage payments, homeowners may miss out on opportunities to invest in other assets that could potentially generate higher returns. For example, investing in stocks, bonds, or real estate could potentially yield a higher return than the interest saved by paying off a mortgage quickly.

Another consideration is the impact of inflation. Over time, inflation erodes the value of debt. This means that the real cost of a 30-year mortgage decreases over time, as the payments become less expensive relative to income. In contrast, the real cost of a 15-year mortgage remains relatively constant, as the payments are fixed and do not adjust for inflation.

Furthermore, the tax benefits of mortgage interest can also play a role in the decision. While paying off a mortgage quickly reduces overall interest paid, it also reduces the amount of deductible interest each year. For some homeowners, the tax benefits of a larger mortgage interest deduction may offset some of the costs of a longer loan term.

The decision of whether to opt for a 15-year or 30-year mortgage ultimately depends on individual financial circumstances and priorities. There is no one-size-fits-all answer. Homebuyers should carefully consider their income, expenses, financial goals, and risk tolerance before making a decision.

Expanded Context

The debate over the 15-year versus 30-year mortgage is part of a broader discussion about debt management and wealth accumulation strategies. There are different schools of thought on how to best manage debt and build wealth. Some financial experts advocate for aggressive debt elimination, while others prioritize investment and wealth accumulation.

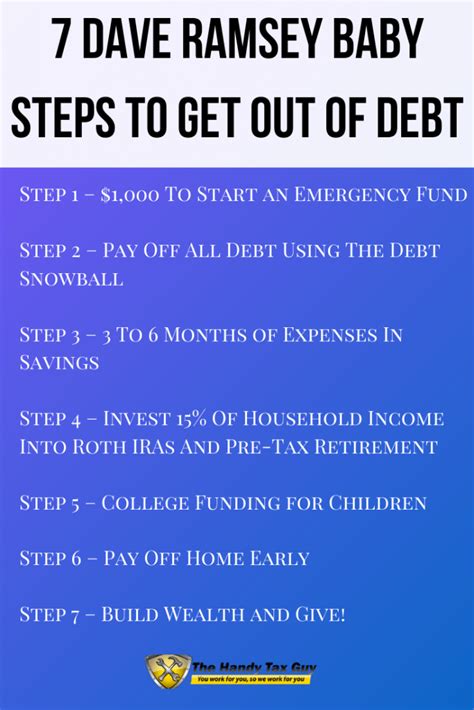

Ramsey’s approach falls into the former category. He believes that debt is a major obstacle to financial freedom and that paying off debt quickly is the best way to build wealth. His followers often embrace his debt snowball method, where they prioritize paying off the smallest debts first to gain momentum and motivation.

However, other financial experts argue that it is more important to focus on investment and wealth accumulation, even if it means carrying some debt. They believe that the potential returns from investments outweigh the cost of interest on debt. This approach often involves strategies such as investing in stocks, bonds, or real estate, and using leverage (debt) to amplify returns.

The choice between these two approaches depends on individual circumstances and priorities. There is no right or wrong answer. Some people may prefer the peace of mind that comes with being debt-free, while others may be more comfortable with carrying some debt in order to pursue investment opportunities.

Deeper Dive into Ramsey’s Philosophy

Dave Ramsey’s financial advice is rooted in a set of core principles that emphasize financial responsibility, discipline, and independence. He advocates for a cash-based lifestyle, avoiding credit cards and other forms of debt whenever possible. His “7 Baby Steps” provide a structured approach to financial planning, starting with building an emergency fund and progressing to debt elimination, saving for retirement, and building wealth.

Ramsey’s philosophy is based on the belief that debt is a major source of stress and anxiety, and that eliminating debt is essential for achieving financial peace. He encourages his followers to take control of their finances, live within their means, and make informed decisions about spending and saving.

While Ramsey’s advice has helped many people get out of debt and build wealth, it is not without its critics. Some argue that his approach is too rigid and inflexible, and that it does not take into account individual circumstances and preferences. Others criticize his aversion to debt, arguing that some forms of debt can be beneficial, such as low-interest mortgages used to purchase appreciating assets.

Alternative Perspectives

Many financial advisors suggest a more balanced approach, where both debt management and wealth accumulation are prioritized. They argue that it is possible to pay off debt while also investing for the future. This approach often involves strategies such as:

- Creating a budget and tracking expenses

- Setting financial goals

- Prioritizing high-interest debt

- Investing in a diversified portfolio

- Making extra payments on debt when possible

This approach recognizes that debt can be a tool for building wealth, but it also emphasizes the importance of managing debt responsibly and avoiding excessive debt.

The Role of Risk Tolerance

Risk tolerance plays a significant role in the decision of whether to opt for a 15-year or 30-year mortgage. Individuals with a high risk tolerance may be more comfortable with carrying a 30-year mortgage and investing the difference between the monthly payments. They may be willing to accept the potential for losses in exchange for the opportunity to earn higher returns.

On the other hand, individuals with a low risk tolerance may prefer the certainty of paying off a mortgage quickly. They may be less comfortable with the idea of investing in volatile assets and may prioritize the peace of mind that comes with being debt-free.

The Importance of Financial Planning

The decision of whether to opt for a 15-year or 30-year mortgage should be part of a comprehensive financial plan. A financial plan should take into account individual income, expenses, financial goals, risk tolerance, and time horizon. It should also include strategies for managing debt, saving for retirement, and investing for the future.

A qualified financial advisor can help individuals develop a financial plan that is tailored to their specific needs and circumstances. A financial advisor can also provide guidance on mortgage options, investment strategies, and debt management techniques.

Impact of Rising Interest Rates

Rising interest rates have a significant impact on the affordability of both 15-year and 30-year mortgages. As interest rates rise, the monthly payments on both types of mortgages increase. This can make it more challenging for homebuyers to afford a home, especially in areas with high home prices.

In a rising interest rate environment, it is even more important to carefully consider the pros and cons of each mortgage option. A 15-year mortgage may become less attractive as interest rates rise, as the higher monthly payments may strain a household’s budget. A 30-year mortgage may become more attractive, as the lower monthly payments provide more financial flexibility.

Long-Term Implications

The decision of whether to opt for a 15-year or 30-year mortgage has long-term implications for financial security. A 15-year mortgage can help homeowners build equity quickly and become debt-free faster, which can provide a sense of security and peace of mind. However, it can also strain a household’s budget and limit investment opportunities.

A 30-year mortgage provides homeowners with lower monthly payments, freeing up cash flow for other purposes. This flexibility can be particularly valuable during periods of economic uncertainty or when unexpected expenses arise. However, it also means that homeowners will pay more interest over the life of the loan and will take longer to build equity.

Conclusion

Dave Ramsey’s 15-year mortgage rule is a controversial topic, with strong arguments on both sides. While his advice may be suitable for some, it is essential to carefully consider the pros and cons of each option and consult with a qualified financial advisor to determine the best course of action. The right mortgage term depends on a variety of factors, including income, expenses, financial goals, and risk tolerance. In the current economic environment, it is more important than ever to make informed financial decisions and to develop a comprehensive financial plan that takes into account individual circumstances and priorities. As market conditions evolve, continuously re-evaluating financial strategies and seeking professional guidance are key to achieving long-term financial success and security. The most appropriate mortgage strategy should align with individual financial objectives, risk tolerance, and broader economic conditions.

Frequently Asked Questions (FAQ)

1. What is Dave Ramsey’s 15-year mortgage rule?

Dave Ramsey advocates for taking out a 15-year fixed-rate mortgage to buy a home, even if it means purchasing a less expensive property. He believes this approach allows homeowners to build equity faster and become debt-free sooner, saving significantly on interest payments over the long term. “If you can’t afford the payments on a 15-year mortgage, then you can’t afford the home,” according to Ramsey.

2. Why are some financial experts criticizing Ramsey’s 15-year mortgage advice?

Critics argue that Ramsey’s advice may be outdated in today’s economic climate, with rising home prices and fluctuating interest rates. They contend that a 15-year mortgage can put undue financial strain on families, limiting their ability to save for retirement, invest, or handle unexpected expenses. They emphasize the opportunity cost, suggesting that investing the difference between a 15-year and 30-year mortgage payment could potentially yield higher returns.

3. What are the potential benefits of choosing a 30-year mortgage over a 15-year mortgage?

A 30-year mortgage typically offers lower monthly payments compared to a 15-year mortgage, providing greater financial flexibility. This can be particularly beneficial for individuals with fluctuating incomes or those who want to allocate funds towards other financial goals, such as retirement savings or investments. The lower payments also act as a buffer during economic downturns.

4. How do rising interest rates affect the decision between a 15-year and 30-year mortgage?

Rising interest rates increase the overall cost of both 15-year and 30-year mortgages. However, the impact can be more pronounced on a 15-year mortgage due to its higher monthly payments. In a rising rate environment, some homebuyers may find a 30-year mortgage more affordable, despite paying more interest over the loan’s lifetime.

5. What factors should individuals consider when deciding between a 15-year and 30-year mortgage?

Individuals should consider their income stability, job security, risk tolerance, and long-term financial goals. Those who prioritize debt elimination and financial security may prefer a 15-year mortgage. Those who value financial flexibility and investment opportunities may opt for a 30-year mortgage. Consulting with a qualified financial advisor is recommended to determine the best course of action based on individual circumstances.