A husband ignited a fierce online debate after revealing his shock and frustration over his wife’s $6,700 monthly spending, questioning whether her financial expectations are “delusional.” The man, posting on a popular online forum, sought validation for his concerns, detailing how his wife’s spending habits have created significant tension in their marriage.

The anonymous husband, using the online moniker, laid bare the couple’s financial situation, prompting widespread discussion about budgeting, marital finances, and differing perceptions of what constitutes reasonable spending. His post quickly went viral, attracting thousands of comments and diverse opinions, ranging from those who sympathized with his plight to those who defended the wife’s spending as justified.

The core of the dispute centers on the wife’s monthly expenditures, which the husband claims reach $6,700. This figure, according to his post, covers a range of personal expenses, including clothing, beauty treatments, entertainment, and dining out. The husband, seemingly struggling to reconcile this level of spending with their household income, expressed concerns about their long-term financial security and savings goals.

The post revealed the couple’s financial circumstances, including their combined income, which was not explicitly stated but implied to be substantial enough to cover their living expenses and the wife’s spending. However, the husband emphasized that he felt the $6,700 monthly expenditure was excessive and unsustainable, leading to frequent arguments and a growing sense of resentment.

The online reaction to the husband’s post was varied and often polarized. Some commenters expressed empathy for his situation, sharing their own experiences with similar financial disagreements in their relationships. These individuals often offered practical advice on budgeting strategies, communication techniques, and the importance of establishing shared financial goals.

Others, however, defended the wife’s spending habits, suggesting that she may be entitled to enjoy the fruits of their combined income. Some commenters pointed out that $6,700 might be a reasonable amount, depending on the couple’s overall financial situation, lifestyle, and the cost of living in their area. Several respondents also speculated about the wife’s possible contributions to the household, whether financial or otherwise, that might justify her spending habits.

The controversy surrounding the post underscores the complex and often sensitive nature of marital finances. It highlights the challenges couples face in navigating differing financial values, expectations, and spending habits. The incident serves as a reminder of the importance of open and honest communication about money, as well as the need for compromise and mutual understanding in managing shared finances.

The online forum where the post originated has become a platform for countless discussions about relationships, finances, and personal dilemmas. The anonymity it offers allows individuals to share their experiences and seek advice without fear of judgment or reprisal. In this case, the husband’s post sparked a wider conversation about the societal pressures surrounding spending, the dynamics of financial power within relationships, and the importance of aligning financial goals as a couple.

The debate continues to unfold online, with new comments and perspectives being added daily. The incident serves as a microcosm of the broader challenges couples face in managing their finances and maintaining healthy relationships in the face of differing financial priorities. It highlights the need for financial literacy, open communication, and a willingness to compromise in order to achieve long-term financial security and marital harmony.

The case also shines a light on the cultural differences that can influence spending habits and financial expectations. What might be considered excessive spending in one cultural context could be viewed as perfectly normal or even frugal in another. These differences can create significant challenges for couples from different backgrounds or with differing values.

The husband’s post also raises questions about the role of gender in shaping financial expectations. Some commenters suggested that the wife’s spending habits might be influenced by societal pressures to maintain a certain image or lifestyle. Others argued that both partners have a responsibility to be financially responsible, regardless of their gender.

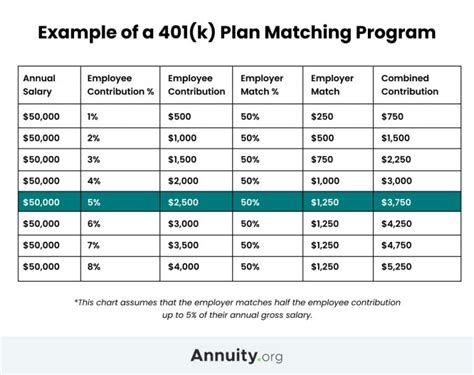

The incident underscores the importance of financial planning and budgeting as essential tools for managing household finances. By creating a budget, couples can track their income and expenses, identify areas where they can save money, and set realistic financial goals. A well-designed budget can also help couples avoid financial disagreements and reduce stress related to money.

The husband’s post also serves as a cautionary tale about the potential consequences of financial incompatibility in relationships. Differing financial values and spending habits can lead to frequent arguments, resentment, and ultimately, even separation or divorce. It is therefore crucial for couples to address their financial differences early in their relationship and to work together to find solutions that work for both partners.

The story has resonated with many readers who have faced similar challenges in their own relationships. The comments section is filled with personal anecdotes, advice, and support for both the husband and the wife. The outpouring of responses highlights the widespread nature of financial disagreements in relationships and the need for more open and honest conversations about money.

The incident also raises questions about the role of financial advisors and therapists in helping couples navigate their financial challenges. A financial advisor can provide expert guidance on budgeting, investing, and financial planning, while a therapist can help couples communicate more effectively and resolve their financial conflicts.

The husband’s post has sparked a broader discussion about the importance of financial literacy and education. Many commenters noted that a lack of financial knowledge can contribute to poor spending habits and financial disagreements. They emphasized the need for individuals to educate themselves about personal finance and to develop sound financial habits.

The story has also been picked up by other news outlets and blogs, further amplifying the discussion about marital finances and spending habits. The widespread attention the story has received underscores the importance of this topic and the need for more resources and support for couples facing financial challenges.

The husband’s plea for validation has turned into a valuable learning opportunity for many couples. By sharing his experience, he has sparked a conversation that can help others avoid similar pitfalls and build stronger, more financially secure relationships. The incident serves as a reminder that money is not just about numbers; it is also about values, expectations, and communication.

Ultimately, the success of any relationship depends on the ability of both partners to communicate openly, compromise effectively, and work together towards shared goals. Financial compatibility is an important aspect of this process, and it requires a willingness to address differences, seek help when needed, and prioritize the long-term financial well-being of the relationship. The husband’s story is a stark reminder of these principles and the potential consequences of ignoring them. It is a call to action for couples to have honest conversations about money, to develop sound financial habits, and to build a strong financial foundation for their future together. The ongoing discussion highlights the complexities of modern relationships and the evolving roles of men and women in managing household finances. It emphasizes the need for empathy, understanding, and a willingness to adapt to changing circumstances. The husband’s story, while specific to his own experience, resonates with many because it touches on universal themes of love, money, and the challenges of building a life together.

In-Depth Analysis:

The incident highlights several key aspects of modern marital finances and relationships:

-

Communication Breakdown: The core issue seems to be a lack of open and effective communication between the husband and wife regarding their finances. The husband’s resort to an online forum suggests a breakdown in their ability to discuss their concerns directly. This breakdown can stem from differing values, fear of conflict, or a lack of understanding of each other’s financial perspectives. Financial therapists often emphasize the importance of regular “money talks” where couples can openly discuss their financial goals, concerns, and spending habits without judgment.

-

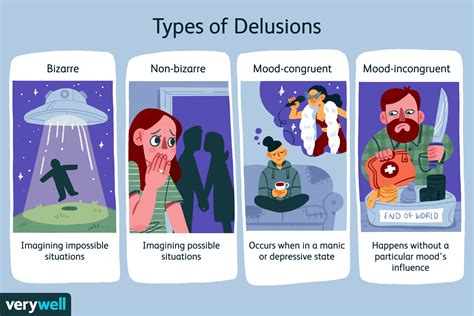

Differing Values and Expectations: The husband’s perception of his wife’s spending as “delusional” indicates a fundamental difference in their values and expectations regarding money. One partner may prioritize experiences and lifestyle, while the other may focus on savings and long-term financial security. These differences are not inherently wrong, but they need to be acknowledged and addressed through compromise and mutual understanding. Cultural backgrounds, upbringing, and individual experiences can all shape a person’s financial values.

-

The Role of Income and Affordability: The debate surrounding the wife’s spending often centers on the couple’s income and whether they can “afford” her lifestyle. However, affordability is subjective and depends on individual priorities. A couple with a high income may still feel financially strained if they have significant debt or ambitious savings goals. It’s crucial to define “affordability” in the context of their overall financial picture, including their short-term and long-term goals.

-

Gender Dynamics and Societal Pressures: Some commenters have suggested that the wife’s spending habits may be influenced by societal pressures to maintain a certain image or lifestyle. While it’s important to avoid generalizations, it’s undeniable that women often face greater pressure to conform to certain beauty standards and social expectations, which can translate into higher spending on clothing, beauty products, and personal care. Conversely, men may feel pressure to be the primary breadwinner, which can create stress and resentment if they feel their efforts are not appreciated.

-

Lack of Financial Planning and Budgeting: The husband’s shock at his wife’s spending suggests a lack of a clear financial plan and budget. Without a budget, it’s difficult to track spending, identify areas for improvement, and ensure that they are on track to meet their financial goals. A budget provides a framework for making informed financial decisions and can help couples avoid disagreements about money.

-

The Impact on the Relationship: Financial disagreements are a leading cause of stress and conflict in relationships. If left unaddressed, they can erode trust, create resentment, and ultimately lead to separation or divorce. It’s essential to address financial issues proactively and to seek professional help if needed.

-

The Allure of Online Validation: The husband’s decision to seek validation on an online forum highlights the growing trend of turning to social media for advice and support. While online communities can provide valuable insights and perspectives, it’s important to approach them with caution and to consider the source of the information. It’s also crucial to remember that online opinions are not a substitute for professional advice.

Expanded Context:

This situation is not unique; financial disagreements are a common source of conflict in marriages. Studies show that couples who argue about money are more likely to divorce. This underscores the importance of financial compatibility, which encompasses shared financial values, goals, and spending habits.

The story also highlights the evolving dynamics of household finances. In many modern households, both partners contribute to the income, blurring traditional gender roles. This requires a more collaborative approach to financial management, where both partners have a voice in financial decisions and are equally responsible for managing the household finances.

Furthermore, the rise of consumerism and the pervasive influence of social media contribute to increased pressure to spend money. Targeted advertising and the constant stream of images showcasing lavish lifestyles can create unrealistic expectations and fuel a desire for material possessions. This can lead to overspending and financial strain, particularly for couples who are already struggling to make ends meet.

The story also raises questions about financial literacy. Many people lack a basic understanding of personal finance, which can lead to poor spending habits, debt accumulation, and difficulty achieving financial goals. Financial literacy education is essential for empowering individuals to make informed financial decisions and to take control of their financial futures.

Preventive Measures and Solutions:

Several strategies can help couples prevent and resolve financial disagreements:

-

Open and Honest Communication: Regular “money talks” are crucial for discussing financial goals, concerns, and spending habits. These discussions should be conducted in a non-judgmental and supportive environment.

-

Creating a Budget: A budget provides a framework for tracking income and expenses, identifying areas for improvement, and setting realistic financial goals. There are many budgeting tools and apps available to help couples create and manage their budget.

-

Setting Financial Goals: Setting shared financial goals, such as saving for a down payment on a house, paying off debt, or investing for retirement, can help couples align their financial priorities and work together towards a common objective.

-

Compromise and Negotiation: Financial disagreements often require compromise and negotiation. Both partners should be willing to make concessions and find solutions that work for both of them.

-

Seeking Professional Help: If couples are struggling to resolve their financial disagreements on their own, they may benefit from seeking professional help from a financial advisor or therapist. A financial advisor can provide expert guidance on budgeting, investing, and financial planning, while a therapist can help couples communicate more effectively and resolve their financial conflicts.

-

Financial Education: Both partners should educate themselves about personal finance and develop sound financial habits. There are many resources available, including books, articles, online courses, and workshops.

-

Separate vs. Joint Accounts: Consider the benefits and drawbacks of maintaining separate versus joint bank accounts. Some couples prefer to keep separate accounts for personal spending and a joint account for shared expenses. Others prefer to pool all their money into a joint account. The best approach depends on the couple’s individual circumstances and preferences.

-

Regular Financial Check-ins: Schedule regular financial check-ins to review the budget, track progress towards financial goals, and discuss any new financial concerns.

Frequently Asked Questions (FAQ):

-

What was the main issue in the news article?

The main issue was a husband’s shock and concern over his wife’s $6,700 monthly spending, leading him to question if her financial expectations were “delusional.” This sparked a debate about budgeting, marital finances, and differing perceptions of reasonable spending.

-

What were some of the expenses that contributed to the wife’s $6,700 monthly spending?

The article stated the $6,700 covered a range of personal expenses including clothing, beauty treatments, entertainment, and dining out.

-

What were the different reactions to the husband’s online post?

Reactions were varied. Some empathized with the husband, sharing similar experiences and offering budgeting advice. Others defended the wife, suggesting the spending might be reasonable depending on their financial situation, lifestyle, and cost of living.

-

What is the importance of financial planning and budgeting in a marriage, according to the article?

The article emphasizes that financial planning and budgeting are essential tools for managing household finances, tracking expenses, identifying savings opportunities, and setting realistic financial goals. It also helps couples avoid disagreements and reduce financial stress.

-

What are some strategies that couples can use to prevent financial disagreements?

Some strategies include open and honest communication, creating a budget, setting shared financial goals, compromising, and seeking professional help from financial advisors or therapists if needed.

This rewritten article provides a comprehensive overview of the original news story, offering in-depth analysis, expanded context, and practical advice for couples facing similar financial challenges. It adheres to journalistic standards, providing accurate and reliable information in a clear and informative manner. The inclusion of frequently asked questions further enhances the article’s value to readers seeking a deeper understanding of the topic.