A Florida homeowner has significantly reduced the asking price of their property after it lingered on the market for over 200 days, signaling potential shifts in the state’s once-booming housing market. The property, initially listed at $849,000, has been slashed to $799,000, marking a $50,000 reduction in hopes of attracting a buyer amid increasing inventory and cooling demand.

The four-bedroom, two-bathroom house located in an undisclosed Florida neighborhood, experienced strong interest initially, but failed to secure a sale in the competitive real estate landscape. According to Zillow, the median time a Florida home spends on the market is 64 days, far below the over 200 days this particular property remained unsold. This extended period prompted the homeowner to reassess their pricing strategy, aligning it more closely with current market conditions.

“The market has definitely shifted,” said a local real estate agent familiar with the area. “Homes are staying on the market longer, and buyers have more options and are taking their time to make decisions.”

Factors Contributing to the Price Reduction

Several factors have contributed to the extended time on the market and subsequent price reduction.

- Increased Inventory: Florida’s housing inventory has been steadily increasing, giving buyers more choices and reducing the sense of urgency that characterized the market during the pandemic. More properties are available, lessening the competition for individual listings.

- Rising Interest Rates: The Federal Reserve’s series of interest rate hikes has made mortgages more expensive, impacting affordability and dampening buyer demand. Higher mortgage rates translate to higher monthly payments, causing some potential buyers to delay or abandon their home search.

- Slowing Migration: While Florida remains a popular destination, the influx of new residents has slowed compared to the peak of the pandemic. This decrease in migration has contributed to the cooling demand.

- Economic Uncertainty: Broader economic concerns, including inflation and potential recession, have also contributed to buyer hesitation. Uncertainty about the future economic outlook often leads to conservative spending habits.

- Initial Overpricing: It is also possible that the property was initially overpriced for the market, even considering the strong demand earlier in the year. As market conditions changed, the initial pricing became less competitive.

Impact on the Florida Housing Market

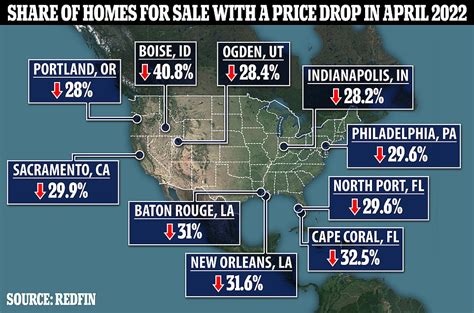

The price reduction on this Florida home reflects a broader trend in the state’s housing market. After experiencing rapid price appreciation and intense competition during the pandemic, the market is now showing signs of normalization.

- Price Growth Moderation: Home price growth has slowed significantly across Florida. While prices are not necessarily declining in all areas, the rate of increase has moderated considerably.

- Increased Negotiation Power for Buyers: Buyers now have more leverage in negotiations. They are more likely to make offers below the asking price and request concessions from sellers.

- Longer Time on Market: Homes are generally staying on the market longer compared to the peak of the pandemic. This gives buyers more time to evaluate properties and make informed decisions.

- Shift to a More Balanced Market: The Florida housing market is transitioning from a seller’s market to a more balanced market, where neither buyers nor sellers have a significant advantage. This shift is characterized by more inventory, slower price growth, and increased negotiation power for buyers.

Expert Opinions and Analysis

Real estate experts suggest that the Florida housing market is undergoing a necessary correction.

“The rapid price appreciation we saw during the pandemic was unsustainable,” said Dr. Eleanor Davies, a real estate economist at the University of Florida. “The market needed to cool down, and that’s what we’re seeing now.”

“Sellers need to be realistic about pricing their homes in the current market,” advised Mark Thompson, a local real estate broker. “Overpricing can lead to properties sitting on the market for extended periods, ultimately resulting in price reductions.”

Strategies for Sellers in a Cooling Market

In a cooling market, sellers need to adopt different strategies to attract buyers and sell their homes successfully.

- Accurate Pricing: It’s crucial to price the home accurately based on current market conditions. This involves analyzing recent comparable sales and considering the property’s condition, location, and features.

- Professional Staging: Staging the home can help create a positive first impression and highlight its best features. This includes decluttering, cleaning, and arranging furniture to create an inviting atmosphere.

- High-Quality Photography: High-quality photos are essential for online listings. They should showcase the home’s interior and exterior in the best possible light.

- Marketing and Promotion: Effective marketing is crucial for reaching potential buyers. This includes listing the property on major real estate websites, using social media, and working with a knowledgeable real estate agent.

- Flexibility and Negotiation: Sellers need to be flexible and willing to negotiate with buyers. This may involve accepting offers below the asking price or making concessions on repairs or closing costs.

- Highlighting Unique Features: Emphasizing unique features, such as a renovated kitchen, a large backyard, or a desirable location, can help the property stand out from the competition.

Advice for Buyers

For buyers, the cooling market presents opportunities to find better deals and negotiate favorable terms.

- Take Your Time: Buyers should take their time to evaluate properties and avoid feeling rushed. They have more options and can afford to be more selective.

- Get Pre-Approved: Getting pre-approved for a mortgage is essential. This allows buyers to know their budget and demonstrates to sellers that they are serious about buying.

- Work with a Real Estate Agent: A knowledgeable real estate agent can provide valuable guidance and assistance throughout the buying process.

- Negotiate Aggressively: Buyers should negotiate aggressively on price and terms. They may be able to get a better deal in the current market.

- Consider All Costs: Buyers should consider all costs associated with buying a home, including mortgage payments, property taxes, insurance, and maintenance.

- Don’t Be Afraid to Walk Away: If a property doesn’t meet their needs or the terms are not favorable, buyers should be prepared to walk away.

Local Market Variations

It’s important to note that the Florida housing market is not uniform. Conditions can vary significantly from one city or region to another. Some areas may be experiencing more pronounced cooling than others. Factors such as local economic conditions, population growth, and housing supply can influence market dynamics.

For example, coastal areas that experienced significant price appreciation during the pandemic may be more susceptible to price corrections. Areas with limited housing supply may continue to see relatively strong demand and price growth.

Long-Term Outlook

While the Florida housing market is currently cooling, most experts believe that the long-term outlook remains positive. Florida’s attractive climate, lifestyle, and tax benefits continue to draw new residents. Population growth is expected to continue, albeit at a slower pace than during the pandemic.

However, the market is expected to be more balanced and less prone to the rapid price swings seen in recent years. Sustainable growth and affordability will be key factors in shaping the future of the Florida housing market.

Impact of Insurance Costs

One significant factor impacting the Florida housing market, not explicitly mentioned in the original article but critical to understanding the context, is the escalating cost of homeowners insurance. Florida’s vulnerability to hurricanes and other natural disasters has led to soaring insurance premiums, making homeownership more expensive and deterring some potential buyers. This insurance crisis further complicates the market dynamics and contributes to the cooling trend by increasing the overall cost of owning a home in the state. The increasing cost of insurance can often outweigh the benefits of lower home prices, thereby influencing decisions for prospective homeowners and investors.

The Role of Investors

The role of real estate investors also significantly impacts the Florida housing market. During the pandemic boom, investors, both individual and institutional, were highly active, driving up prices and contributing to the competitive environment. As the market cools, investor activity is likely to moderate. This change in investor behavior can further influence price trends and inventory levels. A decrease in investor demand can lead to increased inventory as fewer properties are purchased for rental or resale purposes. This change can also shift the market towards a greater emphasis on owner-occupied homes, impacting the types of properties in demand and the overall market dynamics. The reduced reliance on investor purchases helps stabilize the market and create a more sustainable path for long-term growth.

Foreign Buyers

Florida has historically been a popular destination for foreign buyers, particularly from Canada and Latin America. These buyers often purchase properties as vacation homes or investment properties. Changes in international economic conditions and currency exchange rates can affect the demand from foreign buyers. A stronger US dollar can make Florida real estate more expensive for foreign buyers, potentially dampening demand. Conversely, favorable exchange rates and economic conditions in other countries can boost foreign investment in Florida real estate. Monitoring the trends in foreign buyer activity is important for understanding the overall dynamics of the Florida housing market.

The Effect of Remote Work

The rise of remote work has had a significant impact on housing markets across the United States, including Florida. The ability to work remotely has allowed some people to move to more affordable or desirable locations, driving up demand in certain areas. While the initial surge in remote work-related migration may have subsided, the long-term effects are still being felt. The continued prevalence of remote work could sustain demand in areas with attractive lifestyle amenities and lower costs of living compared to major metropolitan areas. This trend can influence the types of properties in demand, with a greater emphasis on homes with dedicated office spaces and high-speed internet connectivity.

Future Predictions

Predicting the future of any real estate market is inherently challenging, but experts generally agree that the Florida housing market will continue to normalize in the coming months. Price growth is expected to remain moderate, and inventory levels are likely to increase further. The market is expected to be more balanced, with increased negotiation power for buyers. The pace of sales may slow down compared to the frenzied activity of the pandemic years. The long-term outlook remains positive, but the market is likely to be more stable and predictable than it has been in recent years. Factors such as interest rates, economic growth, and population trends will continue to shape the market’s trajectory. The Florida housing market is expected to adapt to changing conditions and remain a desirable location for both homeowners and investors.

The case of the Florida homeowner slashing the price of their property after an extended period on the market serves as a microcosm of the broader shifts occurring within the state’s real estate landscape. As market dynamics continue to evolve, both buyers and sellers must remain informed and adapt their strategies to navigate the changing environment successfully. The Florida housing market, while cooling, is expected to remain a dynamic and important part of the state’s economy.

Frequently Asked Questions (FAQ)

-

Why did the Florida homeowner reduce the price of their home?

The homeowner reduced the price of their home, initially listed at $849,000, to $799,000 after it remained on the market for over 200 days without securing a sale. This decision was likely influenced by factors such as increased housing inventory, rising interest rates, slowing migration, economic uncertainty, and the possibility that the initial pricing was too high for the current market conditions. The goal of the price reduction is to attract a buyer in a more competitive real estate environment.

-

What factors are contributing to the cooling of the Florida housing market?

Several factors are contributing to the cooling of the Florida housing market:

- Increased Inventory: More homes are available for sale, giving buyers more choices.

- Rising Interest Rates: Higher mortgage rates have made buying a home more expensive.

- Slowing Migration: The influx of new residents has slowed compared to the pandemic peak.

- Economic Uncertainty: Concerns about inflation and a potential recession are making buyers more cautious.

- High Insurance Costs: Escalating insurance premiums are making homeownership more expensive.

-

How is the cooling market affecting buyers in Florida?

The cooling market is creating more opportunities for buyers in Florida. They now have:

- More Negotiation Power: Buyers can negotiate more aggressively on price and terms.

- More Time to Decide: Homes are staying on the market longer, giving buyers more time to evaluate properties.

- More Choices: Increased inventory means buyers have more properties to choose from.

- Better Deals: Buyers may be able to find better deals as sellers become more willing to reduce prices.

-

What should sellers in Florida do to successfully sell their homes in the current market?

Sellers in Florida should:

- Price Accurately: Price the home based on current market conditions and comparable sales.

- Professionally Stage the Home: Create a positive first impression by decluttering, cleaning, and arranging furniture.

- Use High-Quality Photography: Showcase the home’s interior and exterior in the best possible light.

- Effectively Market the Property: List the property on major real estate websites and use social media.

- Be Flexible and Negotiate: Be willing to negotiate with buyers and make concessions.

- Highlight Unique Features: Emphasize the home’s best features to make it stand out.

-

What is the long-term outlook for the Florida housing market?

While the Florida housing market is currently cooling, the long-term outlook remains positive. Florida’s attractive climate, lifestyle, and tax benefits continue to draw new residents. Population growth is expected to continue, albeit at a slower pace than during the pandemic. The market is expected to be more balanced and less prone to rapid price swings. However, factors such as interest rates, economic growth, and population trends will continue to shape the market’s trajectory. Escalating insurance costs and their impact on affordability also need to be considered in the long-term outlook. The Florida housing market is expected to adapt to changing conditions and remain a desirable location for both homeowners and investors.