A Florida home is struggling to find a buyer despite multiple price reductions, remaining on the market for over 200 days in a cooling real estate environment.

A luxurious Florida home located in the Sunshine State is facing an uphill battle in attracting a buyer, even after undergoing a series of price cuts. The property has lingered on the market for more than 200 days, a sign of shifting dynamics in the real estate sector. This extended period highlights a cooling trend and a potential recalibration of seller expectations amidst evolving market conditions.

The house, initially listed at a higher price point, has seen gradual reductions aimed at enticing prospective buyers. The fact that it remains unsold after such a prolonged period suggests a variety of factors at play, including but not limited to pricing strategy, buyer demand, and broader economic conditions impacting the housing market.

“The market is definitely shifting,” says local real estate analyst John Miller. “Properties that were once scooped up within days are now sitting for weeks, sometimes months. Sellers need to be more realistic about pricing.”

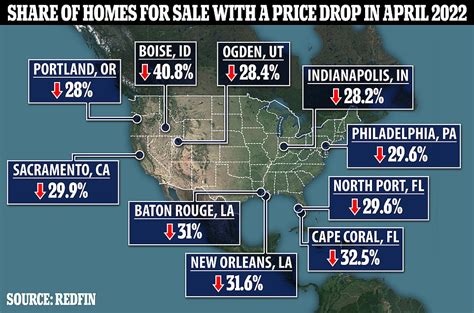

The situation with this Florida home underscores a wider trend observed across the nation. The rapid pace of home sales experienced during the pandemic has slowed considerably, with rising interest rates, inflation, and a general sense of economic uncertainty contributing to a more cautious buyer sentiment.

The listing, initially generating considerable buzz due to its high-end amenities and prime location, has now become a case study in the challenges sellers face when navigating a transitioning real estate landscape. Real estate experts suggest that sellers need to carefully assess market conditions and price their properties competitively to attract buyers in the current environment.

The protracted sales period also has implications for the local real estate market, potentially influencing pricing strategies for comparable properties. Agents and sellers alike are closely watching the outcome of this listing to gauge the true temperature of the market and adjust their approaches accordingly.

The house in question, located in a desirable neighborhood, boasts a range of features that would typically make it an attractive prospect. However, the current market dynamics appear to be outweighing these positives, leading to a prolonged period of market exposure without a successful sale.

As the property continues to sit unsold, both the seller and real estate professionals involved are faced with the challenge of recalibrating their strategy. Further price reductions, enhanced marketing efforts, or a combination of both may be necessary to finally secure a buyer for this Florida home. The case serves as a stark reminder of the complexities involved in selling real estate in a constantly evolving market.

Delving Deeper into the Florida Housing Market

The current situation with the Florida home, lingering on the market for over 200 days despite price cuts, is not an isolated incident. It’s indicative of broader trends affecting the Florida housing market and the real estate landscape nationwide. Several factors contribute to this shift, which requires a nuanced understanding to navigate effectively.

The Pandemic-Fueled Boom and Its Aftermath

The COVID-19 pandemic triggered an unprecedented surge in housing demand. Low interest rates, coupled with the desire for more space and the rise of remote work, fueled a buying frenzy. Florida, in particular, benefited from this trend due to its attractive lifestyle, favorable tax environment, and warm climate.

However, this boom was unsustainable. As the pandemic eased, interest rates began to rise, driven by the Federal Reserve’s efforts to combat inflation. This increase in borrowing costs significantly impacted housing affordability, cooling down the market. The rapid pace of price appreciation that characterized the pandemic era has decelerated, leading to a more balanced market where buyers have greater negotiating power.

Rising Interest Rates and Inflation

The most significant factor impacting the housing market is the rise in interest rates. Higher mortgage rates directly translate to increased monthly payments for homebuyers, reducing their purchasing power. This has led to a decrease in demand, as potential buyers either postpone their purchase or opt for less expensive properties.

Inflation, which has affected various sectors of the economy, also plays a crucial role. Rising prices for essential goods and services leave less disposable income for housing, further dampening demand. The combination of high interest rates and inflation creates a challenging environment for both buyers and sellers.

Inventory Levels and Supply Chain Issues

While inventory levels are still relatively low compared to historical averages, they have been steadily increasing in recent months. This increase in supply gives buyers more options and reduces the pressure to make hasty decisions.

Supply chain disruptions, which plagued the construction industry during the pandemic, have also contributed to the housing market’s complexities. Delays in obtaining building materials and skilled labor shortages have slowed down the pace of new construction, limiting the overall supply of homes.

Regional Variations Within Florida

It’s important to note that the Florida housing market is not monolithic. Different regions within the state experience varying levels of demand and price fluctuations. Coastal areas, particularly those popular with retirees and second-home buyers, tend to be more resilient, while inland areas may see a more pronounced slowdown.

Factors such as local job growth, population trends, and the availability of amenities also influence regional variations. Understanding these nuances is crucial for both buyers and sellers operating in specific Florida markets.

The Impact on Sellers and Buyers

The changing market dynamics have significant implications for both sellers and buyers. Sellers who were accustomed to receiving multiple offers above asking price now need to adjust their expectations. Pricing their properties competitively and being willing to negotiate are essential for attracting buyers in the current environment.

Buyers, on the other hand, have more leverage than they did during the pandemic. They can take their time to shop around, negotiate prices, and conduct thorough inspections. However, they also need to be mindful of rising interest rates and the potential for further increases.

Strategies for Navigating the Current Market

In this evolving real estate landscape, strategic decision-making is crucial for both buyers and sellers. Here are some tips for navigating the current market:

For Sellers:

- Price Competitively: Conduct a thorough market analysis to determine the fair market value of your property. Be realistic about pricing and be prepared to adjust your expectations if necessary.

- Enhance Curb Appeal: Make sure your property is well-maintained and visually appealing. First impressions matter, so focus on improving curb appeal.

- Consider Staging: Staging your home can help potential buyers visualize themselves living in the space. It can also highlight the property’s best features.

- Be Flexible with Negotiations: Be open to negotiating with buyers on price, contingencies, and closing dates.

- Work with an Experienced Real Estate Agent: A knowledgeable real estate agent can provide valuable guidance and expertise in navigating the complexities of the current market.

For Buyers:

- Get Pre-Approved for a Mortgage: Getting pre-approved for a mortgage will give you a clear understanding of your budget and demonstrate to sellers that you are a serious buyer.

- Shop Around for the Best Mortgage Rates: Compare mortgage rates from multiple lenders to find the best deal.

- Don’t Be Afraid to Negotiate: Don’t be afraid to make offers below the asking price, especially if the property has been on the market for a while.

- Conduct Thorough Inspections: Conduct thorough inspections to identify any potential problems with the property before making an offer.

- Be Patient: The current market gives buyers more time to shop around and make informed decisions. Be patient and don’t feel pressured to rush into a purchase.

The Future Outlook

The outlook for the Florida housing market remains uncertain, but most experts predict a continued slowdown in the near term. Interest rates are expected to remain elevated, which will continue to put downward pressure on demand. However, long-term fundamentals, such as population growth and a strong economy, should support the market over the long term.

The market is likely to remain more balanced, with buyers having greater negotiating power. Sellers will need to adjust their expectations and pricing strategies to attract buyers in this new environment.

The Psychological Impact of a Lingering Listing

Beyond the financial and logistical implications, a property sitting on the market for an extended period can take a toll on the seller’s emotions. The initial excitement and optimism surrounding the listing can gradually give way to frustration, anxiety, and even a sense of personal rejection.

The constant need to keep the property in pristine condition for showings, the uncertainty of not knowing when an offer will come, and the pressure to make difficult decisions about price reductions can all contribute to a stressful experience.

Real estate agents play a crucial role in managing the seller’s expectations and providing emotional support during this challenging time. They can offer objective advice, help the seller understand market dynamics, and provide encouragement to stay the course.

The Importance of Transparency and Communication

Open and honest communication between the seller and the real estate agent is essential for navigating a difficult market. The agent should provide regular updates on market conditions, feedback from showings, and advice on pricing strategies.

The seller, in turn, should be transparent with the agent about their financial situation, their motivations for selling, and their willingness to negotiate. This collaborative approach can help to ensure that everyone is on the same page and working towards the same goal.

Alternative Strategies for Selling

If a property is not selling through traditional methods, there are alternative strategies that sellers can consider. These include:

- Offering Incentives: Offering incentives such as paying for closing costs, providing a home warranty, or including furniture can make the property more attractive to buyers.

- Lease Option: A lease option allows a potential buyer to lease the property for a set period of time with the option to purchase it at a later date. This can be a good option for buyers who are not yet ready to commit to a purchase.

- Auction: An auction can be a quick way to sell a property, but it also carries the risk of selling for less than the desired price.

- Taking the Property Off the Market: Sometimes, taking the property off the market for a period of time and then relisting it with a new marketing strategy can generate renewed interest.

The Role of Marketing and Presentation

In a competitive market, effective marketing and presentation are essential for attracting buyers. High-quality photos, virtual tours, and detailed property descriptions can help to showcase the property’s best features.

Social media marketing, targeted advertising, and open houses can also be effective ways to reach potential buyers. The goal is to create a compelling narrative that highlights the property’s unique selling points and differentiates it from the competition.

The Long-Term Perspective

While the current market conditions may be challenging, it’s important to remember that real estate is a long-term investment. The market is cyclical, and prices fluctuate over time.

Sellers who are not in a rush to sell may choose to wait for market conditions to improve. Buyers who are looking to purchase a home for the long term may find that the current market presents opportunities to negotiate favorable deals.

The Importance of Professional Advice

Navigating the complexities of the real estate market requires professional advice. Real estate agents, mortgage lenders, and financial advisors can provide valuable guidance and expertise to help buyers and sellers make informed decisions.

Working with a team of trusted professionals can help to ensure a smooth and successful real estate transaction.

FAQ: Florida Home Lingers – Price Cuts Fail to Sell After 200+ Days!

Q1: Why is this Florida home not selling despite price cuts?

A: Several factors contribute to a home lingering on the market. The most prominent is the shifting real estate market, moving away from the pandemic-induced buying frenzy. Rising interest rates make mortgages more expensive, reducing buyer affordability. Inflation also strains household budgets, leaving less money for housing. Overpricing initially can also deter buyers, even after reductions. The specific features and location of the home, compared to buyer preferences and other available properties, play a role. Finally, marketing and presentation effectiveness are key; if the property isn’t showcased well, it might not attract the right attention.

Q2: How do rising interest rates affect the Florida housing market?

A: Rising interest rates directly increase the cost of borrowing money for mortgages. This makes homes less affordable for potential buyers, reducing demand. As demand decreases, price growth slows or even declines. This also gives buyers more negotiating power, as there is less competition for each property. Higher rates can also discourage some people from entering the market altogether, further cooling the market.

Q3: What can sellers do to sell their homes in a slowing market?

A: Sellers need to adapt their strategies. The most crucial is pricing the home competitively based on current market conditions, not past trends. Enhancing curb appeal and staging the home can make it more attractive. Being flexible with negotiations, offering incentives like covering closing costs, and working with an experienced real estate agent are also essential. High-quality marketing with professional photos and virtual tours is crucial to reach potential buyers. Transparency and communication with the agent are key to adjusting strategy as needed.

Q4: What are the benefits of buying a home in Florida in the current market?

A: The current market offers benefits for buyers. Reduced competition means less pressure and more time to make decisions. Buyers have increased negotiating power and can potentially secure a better price. The increase in inventory provides more options to choose from. Although interest rates are higher, they may stabilize or even decrease in the future. Buying now could position buyers to benefit from any future market appreciation.

Q5: What is the long-term outlook for the Florida housing market?

A: The long-term outlook remains somewhat uncertain, but fundamentally positive. While a continued slowdown is expected in the near term due to elevated interest rates, Florida’s strong population growth, attractive lifestyle, and overall economic strength support long-term stability and growth. The market is likely to become more balanced, with moderate price appreciation rather than the rapid increases seen during the pandemic. Long-term, real estate remains a solid investment in Florida, despite short-term fluctuations.

Conclusion

The case of the Florida home lingering on the market for over 200 days, despite price reductions, is a microcosm of the broader challenges and opportunities present in the current real estate landscape. It underscores the importance of adapting to changing market dynamics, employing strategic decision-making, and seeking professional guidance. While the road to selling or buying a home may be more complex than it was during the peak of the pandemic-fueled boom, a well-informed and proactive approach can lead to successful outcomes for both sellers and buyers. The future of the Florida housing market, while uncertain in the short term, is underpinned by strong fundamentals that suggest long-term stability and growth.