Following Dave Ramsey’s debt payoff advice, a couple eliminated their debt, including student loans, only to find themselves in a $46,000 financial hole after taking out a home equity line of credit (HELOC) to invest in real estate, a move Ramsey advises against.

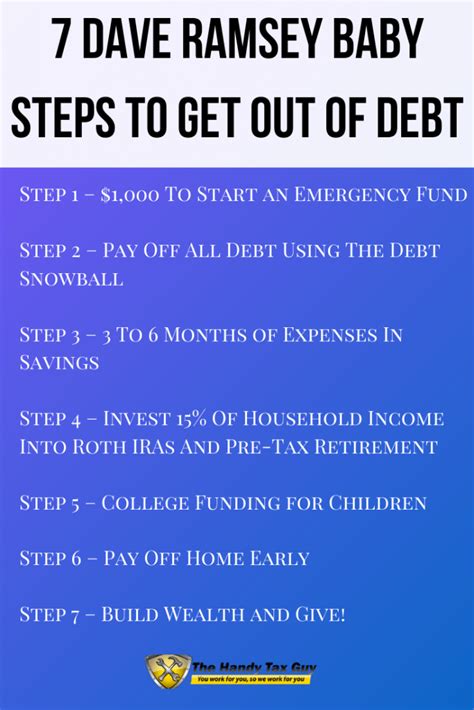

A couple, identified only as Sara and her husband, meticulously followed Dave Ramsey’s financial principles, successfully eradicating their debt, including student loans and car payments. They recounted their experience in a piece published by Business Insider, explaining how they initially achieved debt freedom through Ramsey’s “snowball method,” where they tackled their smallest debts first to gain momentum. However, their financial journey took an unexpected turn when they ventured into real estate investing, a path that ultimately led them to accrue $46,000 in debt despite Ramsey’s warnings against using debt for investments.

The couple’s story highlights a critical juncture where adherence to established financial advice clashed with individual investment decisions. After eliminating their initial debts, Sara and her husband, emboldened by their success and seeking to further grow their wealth, decided to invest in real estate. They secured a home equity line of credit (HELOC) to fund their investments, a move that directly contradicted Ramsey’s staunch opposition to debt-financed investments.

According to the Business Insider article, Sara stated that they had been long-time followers of Ramsey’s advice and had initially found great success in paying off their debts. “We were debt-free, including student loans and car payments,” she said. This initial success instilled confidence in their financial management abilities, leading them to believe they could handle the complexities of real estate investing.

However, their foray into real estate proved more challenging than anticipated. They encountered unexpected expenses, property maintenance issues, and fluctuating market conditions, all of which contributed to the accumulation of debt. The couple acknowledged that their decision to use a HELOC was a departure from Ramsey’s teachings and a risk that ultimately backfired.

This situation serves as a cautionary tale about the importance of thoroughly understanding the risks associated with investments and the potential consequences of deviating from established financial principles. While Ramsey’s debt payoff strategies have helped many individuals achieve financial freedom, his advice is often tailored towards risk-averse individuals seeking to eliminate debt and build a solid financial foundation. Investing in real estate, on the other hand, involves inherent risks and requires a different set of financial skills and risk tolerance.

The article doesn’t specify the exact nature of the real estate investments the couple made, but it implies that the investments did not generate the expected returns, leading to the accumulation of debt. This underscores the importance of conducting thorough due diligence before making any investment decisions, especially when using borrowed money.

Ramsey’s philosophy centers on the idea of building wealth slowly and steadily through debt reduction, disciplined saving, and avoiding high-risk investments. His “snowball method” has gained popularity among individuals seeking a structured approach to debt payoff, providing a sense of accomplishment as each debt is eliminated.

The couple’s experience raises questions about the applicability of blanket financial advice to individual circumstances. While Ramsey’s principles may be suitable for some, others may find that they need to adapt or modify his strategies to align with their specific goals and risk tolerance. It also highlights the importance of seeking professional financial advice before making significant investment decisions, especially when dealing with borrowed funds.

Financial experts often advise individuals to carefully assess their risk tolerance, investment knowledge, and financial situation before investing in real estate or any other asset class. They also recommend diversifying investments to mitigate risk and avoiding the use of debt to finance speculative investments.

The couple’s story serves as a reminder that financial success requires a combination of discipline, knowledge, and a willingness to adapt to changing circumstances. While following established financial principles can be beneficial, it is equally important to understand the underlying risks and make informed decisions based on individual circumstances. The narrative underscores the need for personalized financial planning and the importance of consulting with qualified professionals before making significant financial decisions, particularly those involving debt and investments. It also exemplifies the potential pitfalls of deviating from conservative financial strategies without a comprehensive understanding of the risks involved.

The case of Sara and her husband also brings to light the psychological aspects of financial decision-making. Having experienced the initial success of debt elimination, the couple may have developed a sense of overconfidence, leading them to underestimate the risks associated with real estate investing. This phenomenon, known as the “disposition effect,” can lead individuals to hold onto losing investments for too long, hoping for a turnaround, while selling winning investments too quickly.

Furthermore, the allure of potential wealth accumulation through real estate may have clouded their judgment, leading them to overlook the inherent uncertainties and potential downsides of the market. This highlights the importance of maintaining a rational and objective perspective when making financial decisions, especially when emotions are involved.

The Business Insider article also touches upon the broader debate surrounding the effectiveness and suitability of different financial philosophies. While Ramsey’s approach has resonated with millions of individuals seeking to escape debt and achieve financial stability, it is not without its critics. Some argue that his methods are too conservative and may not be optimal for individuals seeking to maximize their wealth over the long term. Others criticize his emphasis on debt elimination at the expense of other financial goals, such as saving for retirement or investing in education.

Ultimately, the best financial strategy is one that aligns with an individual’s specific goals, risk tolerance, and financial situation. There is no one-size-fits-all approach to personal finance, and it is important to carefully consider the pros and cons of different strategies before making any decisions.

Sara and her husband’s experience serves as a valuable lesson for anyone considering investing in real estate or deviating from established financial principles. It underscores the importance of conducting thorough research, understanding the risks involved, and seeking professional advice before making any significant financial decisions. It also highlights the potential consequences of overconfidence, emotional decision-making, and the dangers of using debt to finance speculative investments. The couple’s journey from debt freedom to debt accumulation serves as a compelling reminder that financial success requires a combination of discipline, knowledge, and a willingness to adapt to changing circumstances. Their story emphasizes that while general financial advice can be valuable, it should be tailored to individual circumstances and supplemented with professional guidance when making complex financial decisions.

The article also indirectly points to the need for continuous financial education. The financial landscape is constantly evolving, with new investment opportunities and challenges emerging regularly. To make informed decisions, individuals need to stay abreast of the latest trends and developments and continually update their knowledge and skills. This can involve reading financial news, attending seminars and workshops, or consulting with financial professionals.

The couple’s situation also prompts a reflection on the cultural pressures surrounding wealth accumulation. In a society that often equates success with material possessions, there can be a strong urge to pursue high-return investments, even if they involve significant risks. This pressure can lead individuals to make hasty decisions and overlook potential downsides. It is important to remember that financial success is not just about accumulating wealth, but also about achieving financial security and peace of mind.

The narrative of Sara and her husband’s experience resonates with many individuals who have attempted to navigate the complexities of personal finance. Their story serves as a reminder that financial success is a journey, not a destination, and that setbacks are inevitable. The key is to learn from mistakes, adapt to changing circumstances, and remain committed to achieving long-term financial goals. Their transparency in sharing their experience offers valuable insights for others seeking to build a secure financial future.

The couple’s story highlights a common pitfall: mistaking initial success for guaranteed future outcomes. Eliminating debt provides a significant psychological and financial boost, but it doesn’t automatically translate into expertise in investment management. It’s crucial to recognize the distinction between debt management and wealth creation, and to approach each with the appropriate level of caution and expertise.

Another important aspect of this story is the role of communication within the couple. Financial decisions, especially those involving significant amounts of money and risk, should be made collaboratively and transparently. Open and honest communication can help to identify potential risks and ensure that both partners are on the same page regarding financial goals and strategies.

Furthermore, the couple’s experience underscores the importance of having a well-defined investment plan. Before investing in any asset class, it is essential to develop a clear understanding of the investment’s objectives, risks, and potential returns. This plan should also include a strategy for managing risk, such as diversification and stop-loss orders.

In conclusion, the story of Sara and her husband serves as a valuable cautionary tale about the importance of understanding the risks of investing, the need for personalized financial planning, and the potential consequences of deviating from established financial principles without a comprehensive understanding of the implications. Their experience underscores the significance of continuous financial education, open communication, and a well-defined investment plan. It highlights the fact that financial success is a journey that requires discipline, knowledge, and a willingness to adapt to changing circumstances. The article serves as a reminder that while general financial advice can be helpful, it should always be tailored to individual circumstances and supplemented with professional guidance when making complex financial decisions. The lessons learned from this couple’s experience can help others avoid similar pitfalls and build a more secure financial future.

Here are 5 frequently asked questions (FAQ) related to the news:

FAQ

1. What exactly happened to the couple who followed Dave Ramsey’s advice?

The couple initially achieved debt freedom, including student loans and car payments, by following Dave Ramsey’s debt snowball method. However, they then took out a home equity line of credit (HELOC) to invest in real estate, a move Ramsey advises against. These investments didn’t perform as expected, leading them to accrue $46,000 in debt.

2. What is Dave Ramsey’s typical advice regarding debt and investments?

Dave Ramsey strongly advises against using debt for investments. His core philosophy centers on eliminating all debt (except, sometimes, a mortgage), building an emergency fund, and then investing with cash. He promotes a risk-averse approach focused on slow and steady wealth building.

3. Why did the couple deviate from Ramsey’s advice and take out a HELOC for real estate investing?

The article suggests they were emboldened by their initial success in paying off debt and believed they could handle the complexities of real estate investing. They likely sought to accelerate their wealth accumulation, despite Ramsey’s warnings about using debt for investments. The Business Insider article indicates that they had been long-time followers of Ramsey’s advice and had initially found great success in paying off their debts. “We were debt-free, including student loans and car payments,” she said.

4. What lessons can be learned from this couple’s experience?

Several lessons can be learned:

- Thoroughly understand the risks associated with investments.

- Consider individual circumstances and risk tolerance when applying general financial advice.

- Seek professional financial advice before making significant investment decisions, especially when using borrowed money.

- Avoid using debt to finance speculative investments.

- Maintain a rational and objective perspective when making financial decisions.

- Have a well-defined investment plan.

5. Does this story invalidate Dave Ramsey’s financial advice?

No, it doesn’t necessarily invalidate his advice. Ramsey’s principles have helped many people get out of debt and build a solid financial foundation. However, this story highlights that his advice may not be suitable for everyone, especially those seeking higher-risk, higher-reward investments. It underscores the importance of tailoring financial strategies to individual circumstances and seeking professional guidance when making complex financial decisions.