Restaurant patrons should meticulously review their bank statements for unauthorized charges, as hidden fees and erroneous additions can easily slip unnoticed during the dining experience, potentially costing consumers significant sums. With increased instances of unexpected charges post-meal, vigilant monitoring is crucial to prevent financial discrepancies.

The prevalence of digital payment systems and the speed of transactions often overshadow the need for immediate and thorough review, creating opportunities for unintentional or, in some cases, deliberate overcharging. Experts advise diners to adopt proactive measures to safeguard their finances and ensure they are only paying for what they consumed.

The ease with which charges can be added or altered underscores the importance of scrutiny. Whether it’s an extra drink added to the bill, a service fee not clearly disclosed, or a simple mathematical error, these discrepancies can accumulate and impact personal budgets.

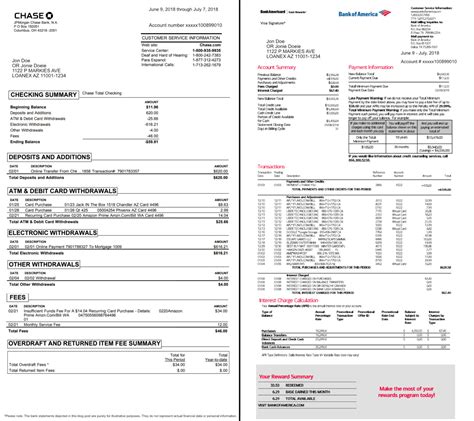

According to consumer advocates, taking a few extra moments to verify charges can save individuals from unnecessary financial strain. This process involves not only checking the total amount but also scrutinizing each item listed on the bill. Comparing the physical receipt with the digital transaction is essential.

Beyond individual vigilance, the issue also raises questions about transparency and ethical business practices within the restaurant industry. While most establishments operate with integrity, the potential for exploitation exists, making consumer awareness a critical component of financial protection.

One key aspect of preventing hidden restaurant charges involves understanding common tactics and potential pitfalls. For instance, some restaurants might automatically add gratuity for large parties, a practice that is acceptable but should be clearly communicated to the customer upfront. Failure to do so can lead to confusion and overpayment, especially if customers are unaware of the existing gratuity and add an additional tip.

Another area of concern is the increasing use of technology in ordering and payment processes. While digital menus and online payment systems offer convenience, they can also create opportunities for errors or hidden fees. Customers should carefully review their orders before submitting them and double-check the final bill before authorizing payment.

In addition to vigilance, consumers should also be aware of their rights and the steps they can take to dispute unauthorized charges. This includes contacting the restaurant directly to resolve the issue and, if necessary, filing a complaint with their credit card company or bank. Documenting all interactions and retaining copies of receipts and bills is crucial for building a strong case.

The problem of hidden restaurant charges is not new, but its prevalence has increased in recent years due to the changing landscape of the restaurant industry. Factors such as rising operating costs, labor shortages, and increased competition have put pressure on restaurants to find new ways to generate revenue. While these challenges are understandable, they should not come at the expense of transparency and ethical business practices.

Consumers can also leverage technology to their advantage by using budgeting apps and financial tracking tools to monitor their spending and identify any discrepancies. Setting up alerts for unusual transactions can provide early warnings of potential fraud or errors.

Furthermore, educating friends and family members about the importance of checking bank statements and reviewing restaurant bills can help spread awareness and protect others from falling victim to hidden charges. Sharing personal experiences and tips can empower others to take control of their finances and avoid unnecessary expenses.

The rise of online reviews and social media platforms also provides consumers with a powerful tool for holding restaurants accountable. By sharing their experiences, both positive and negative, customers can influence business practices and encourage greater transparency. Restaurants that consistently engage in unethical behavior risk damaging their reputation and losing customers.

“One thing you should always do when signing at a restaurant? Check your bank statement!” stresses the importance of proactive monitoring to identify any discrepancies that may arise after the transaction. This simple act can be surprisingly effective in preventing financial losses.

The convenience of modern payment methods, such as contactless payments and mobile wallets, can sometimes lead to a lack of attention to detail. Customers may be more focused on speed and ease of use than on carefully reviewing the bill. However, taking a few extra seconds to verify the charges can make a significant difference.

Moreover, the increasing complexity of restaurant bills, with various fees, taxes, and surcharges, can make it challenging for customers to understand exactly what they are paying for. Restaurants should strive to provide clear and transparent billing practices, with detailed explanations of all charges.

In addition to checking bank statements, consumers should also be wary of common scams and fraudulent practices that can occur in restaurants. These include skimming devices attached to card readers, which can steal credit card information, and fake menus with inflated prices. Customers should always use reputable payment methods and be cautious of any suspicious activity.

The impact of hidden restaurant charges extends beyond individual consumers. It can also have broader implications for the economy, as it erodes consumer confidence and reduces spending. When people feel that they cannot trust businesses to be transparent and ethical, they are less likely to spend money, which can negatively affect economic growth.

Therefore, addressing the problem of hidden restaurant charges requires a multi-faceted approach that involves individual vigilance, industry self-regulation, and government oversight. Consumers must be proactive in protecting their finances, restaurants must adopt ethical business practices, and regulators must enforce consumer protection laws.

By working together, stakeholders can create a more transparent and trustworthy restaurant industry that benefits both businesses and consumers. This will require a commitment to open communication, accountability, and a shared understanding of the importance of fair and ethical practices.

The advice to check bank statements should be seen as a fundamental aspect of responsible financial management. It’s a proactive step that empowers consumers to take control of their spending and protect themselves from fraud and errors. In an increasingly digital and complex financial landscape, vigilance is more important than ever.

“The reality is, mistakes happen,” notes one financial expert, highlighting the human element that can contribute to billing errors. However, even unintentional mistakes can have financial consequences for consumers, making it essential to verify charges and promptly address any discrepancies.

Furthermore, consumers should be aware of their rights under consumer protection laws. These laws provide remedies for deceptive and unfair business practices, including hidden fees and unauthorized charges. If a restaurant engages in such practices, consumers may be entitled to compensation.

The key to resolving disputes over hidden restaurant charges is documentation. Consumers should keep copies of all receipts, bills, and communication with the restaurant. This documentation can be used as evidence when filing a complaint with a credit card company or bank.

In addition to checking bank statements and retaining documentation, consumers should also be assertive in addressing any issues with the restaurant. If they notice an unauthorized charge, they should immediately contact the restaurant and explain the situation. In many cases, the restaurant will be willing to resolve the issue amicably.

However, if the restaurant is unwilling to cooperate, consumers should escalate the issue to their credit card company or bank. They can file a dispute and provide evidence to support their claim. The credit card company or bank will then investigate the matter and determine whether the charge is valid.

The process of disputing unauthorized charges can be time-consuming and frustrating, but it is important to persevere. By taking action, consumers can not only recover their money but also help prevent similar incidents from happening to others.

“It’s a small thing, but it can save you a lot of money and hassle in the long run,” says a consumer advocate, emphasizing the importance of checking bank statements regularly. This simple habit can have a significant impact on financial well-being.

The problem of hidden restaurant charges is not limited to any particular type of restaurant or geographic location. It can occur in fine dining establishments, casual eateries, and fast-food chains. It is a widespread issue that affects consumers across the country.

Therefore, it is important for consumers to be vigilant regardless of where they are dining. They should always review their bills carefully and check their bank statements regularly. By taking these precautions, they can protect themselves from hidden restaurant charges.

The rise of technology has also created new opportunities for restaurants to engage in deceptive billing practices. For example, some restaurants may use software that automatically adds gratuity to bills without clearly disclosing this fact to customers. Others may use dynamic pricing algorithms that inflate prices during peak hours.

These practices are often difficult for consumers to detect, as they may not be aware of the underlying technology. However, by being informed and vigilant, consumers can protect themselves from these types of scams.

In addition to individual vigilance, there is also a need for greater industry self-regulation. Restaurants should adopt clear and transparent billing practices and provide adequate training to their staff on how to avoid billing errors. They should also be responsive to customer complaints and willing to resolve disputes fairly.

Industry associations can play a role in promoting ethical business practices and educating their members about the importance of transparency. They can also work with regulators to develop standards for billing and pricing.

Government oversight is also necessary to protect consumers from hidden restaurant charges. Regulators should enforce consumer protection laws and investigate complaints of deceptive billing practices. They should also work with industry associations to develop best practices for billing and pricing.

By combining individual vigilance, industry self-regulation, and government oversight, we can create a more transparent and trustworthy restaurant industry that benefits both businesses and consumers. This will require a commitment to open communication, accountability, and a shared understanding of the importance of fair and ethical practices.

The frequency with which individuals dine out, especially in urban areas, significantly increases the potential exposure to these types of discrepancies. Consistent monitoring is not just a recommendation but a necessity for maintaining financial health.

The availability of digital banking apps makes checking bank statements easier than ever. Most apps allow users to view transactions in real-time and set up alerts for unusual activity. This level of convenience empowers consumers to stay on top of their finances and detect any potential problems quickly.

Furthermore, consumers should be aware of the different types of fees that restaurants may charge. These include service fees, gratuity, corkage fees, and delivery fees. Restaurants should clearly disclose these fees to customers before they place their orders.

Service fees are often added to bills for large parties or special events. Gratuity is a tip that is given to the server for their service. Corkage fees are charged when customers bring their own wine to the restaurant. Delivery fees are charged when customers order food for delivery.

By understanding these different types of fees, consumers can avoid surprises when they receive their bills. They can also ask the restaurant to explain any fees that they do not understand.

In addition to fees, consumers should also be aware of potential scams related to gift cards. Some restaurants may sell fake gift cards or offer discounts on gift cards that are not valid. Consumers should only purchase gift cards from reputable sources and be wary of any offers that seem too good to be true.

They should also check the expiration date on the gift card and use it before it expires. Some gift cards may have hidden fees or restrictions, so it is important to read the terms and conditions carefully.

The importance of safeguarding personal financial information cannot be overstated. When paying at a restaurant, avoid using debit cards, which are directly linked to your bank account. Opt for credit cards, which offer greater fraud protection and dispute resolution mechanisms. Regularly review your credit card statements for any unauthorized activity.

Also, be cautious of restaurant Wi-Fi networks, which can be unsecured and vulnerable to hacking. Avoid conducting financial transactions on public Wi-Fi networks. Use a virtual private network (VPN) to encrypt your internet traffic and protect your data.

The rise of contactless payment methods has made it easier for criminals to steal credit card information. Skimmers can be placed on card readers to steal data when you tap your card. Be wary of suspicious-looking card readers and always inspect them before using them.

Consider using mobile payment apps like Apple Pay or Google Pay, which offer enhanced security features. These apps use tokenization to protect your credit card information. Tokenization replaces your actual credit card number with a unique token that is used for the transaction. This makes it more difficult for criminals to steal your data.

In addition to checking your bank statements and protecting your financial information, it is also important to be aware of your rights as a consumer. You have the right to receive a clear and accurate bill. You have the right to dispute unauthorized charges. You have the right to file a complaint with the restaurant or with a consumer protection agency.

By knowing your rights, you can protect yourself from unfair business practices and hold restaurants accountable for their actions.

The long-term impact of consistently overpaying for restaurant meals, even by small amounts, can be substantial. These seemingly insignificant sums can accumulate over time, eroding savings and hindering financial progress. Regular monitoring and prompt action are essential to mitigating these cumulative effects.

Restaurants should implement robust internal controls to prevent billing errors and unauthorized charges. This includes training staff on proper billing procedures, regularly auditing bills, and implementing security measures to protect against fraud.

Restaurants should also be transparent about their pricing and fees. They should clearly display prices on menus and disclose any additional fees, such as service fees or gratuity, before the customer places their order.

Restaurants should also be responsive to customer complaints and willing to resolve disputes fairly. They should have a process in place for handling customer complaints and should investigate all complaints thoroughly.

Consumers can also play a role in promoting ethical business practices by supporting restaurants that are transparent and honest. They can also leave reviews online and share their experiences with others.

By working together, consumers and restaurants can create a more transparent and trustworthy dining experience. This will benefit both businesses and consumers.

The digital age has brought many conveniences, but it has also created new challenges for consumers. It is more important than ever to be vigilant and proactive in protecting your financial information. By following the tips in this article, you can reduce your risk of falling victim to hidden restaurant charges.

Remember, checking your bank statement is a simple but effective way to prevent financial losses. It is a habit that can save you a lot of money and hassle in the long run.

Frequently Asked Questions (FAQs)

Q1: What are some common examples of hidden restaurant charges?

A1: Common examples include unauthorized items added to the bill, inflated prices compared to the menu, automatic gratuity added without clear notification, undisclosed service fees, errors in calculations leading to an overcharge, and fraudulent activities like double billing or skimming card information. According to the original article, the simple act of just looking at your bank statement can prevent these potential problems.

Q2: What should I do immediately if I notice an unauthorized charge on my restaurant bill or bank statement?

A2: First, contact the restaurant directly to inquire about the charge and attempt to resolve the issue. If the restaurant is uncooperative or unable to provide a satisfactory explanation, file a dispute with your credit card company or bank, providing all relevant documentation such as receipts, bills, and communication records. Ensure that you act promptly, as there may be time limits for filing disputes.

Q3: How can I protect my credit card information when paying at a restaurant to prevent fraud?

A3: Use credit cards instead of debit cards for added fraud protection. Inspect card readers for skimming devices before using them. Consider using mobile payment apps like Apple Pay or Google Pay, which use tokenization to protect your card number. Avoid using unsecured public Wi-Fi networks for financial transactions.

Q4: Are restaurants required to disclose service fees or automatic gratuity?

A4: While regulations vary by location, most jurisdictions require restaurants to clearly disclose any mandatory service fees or automatic gratuity charges before the meal. This information should be prominently displayed on the menu or communicated verbally to the customer. Failure to do so may be considered deceptive or misleading.

Q5: What role do consumer protection laws play in addressing hidden restaurant charges?

A5: Consumer protection laws provide remedies for deceptive and unfair business practices, including hidden fees and unauthorized charges. These laws empower consumers to file complaints, seek compensation, and hold restaurants accountable for their actions. Regulatory agencies can investigate complaints, impose fines, and require restaurants to change their business practices. Consumers should familiarize themselves with their rights under these laws and be prepared to exercise them when necessary.