Warren Buffett’s preferred ETF, the Vanguard S&P 500 ETF (VOO), offers investors a low-cost avenue to track the performance of the S&P 500, suggesting that a $1,000 investment could yield substantial long-term growth. Buffett has consistently advocated for index funds as a cornerstone of investment strategy, particularly for those seeking to build wealth over time without the complexities of stock picking.

Warren Buffett, the chairman and CEO of Berkshire Hathaway, has long been a proponent of index fund investing, particularly for individuals seeking long-term wealth accumulation. His consistent endorsement of the Vanguard S&P 500 ETF (VOO) highlights his belief in the power of simplicity and diversification in achieving financial success. The VOO ETF offers investors a cost-effective way to track the performance of the S&P 500, which comprises the 500 largest publicly traded companies in the United States.

Buffett’s advocacy for index funds stems from his observation that actively managed funds often fail to outperform the market over the long term, especially after accounting for fees and expenses. In his 2013 letter to Berkshire Hathaway shareholders, Buffett famously stated, “My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.)” This recommendation underscores his conviction that a passive investment approach, focused on broad market exposure, is a reliable path to wealth creation for most investors.

The Vanguard S&P 500 ETF (VOO) stands out due to its exceptionally low expense ratio, which is currently at 0.03%. This means that for every $10,000 invested, investors pay only $3 in annual fees. This low-cost structure is a significant advantage, as it minimizes the drag on returns and allows investors to retain a larger portion of their investment gains.

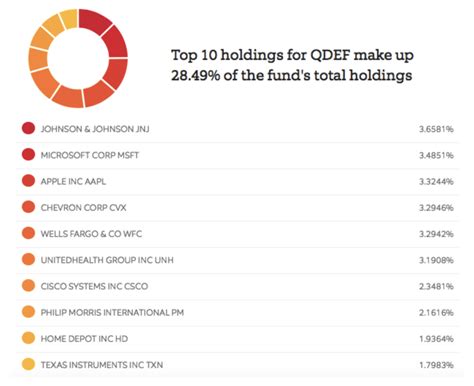

The S&P 500 index itself is a widely recognized benchmark for the overall health of the U.S. stock market. It includes a diverse range of companies across various sectors, providing investors with exposure to a broad spectrum of the economy. By investing in the VOO ETF, individuals can effectively own a small piece of each of these 500 companies, mitigating the risk associated with investing in individual stocks.

Buffett’s long-term investment horizon is another key factor in his endorsement of index funds. He emphasizes the importance of staying invested through market fluctuations and avoiding the temptation to time the market. His famous quote, “Our favorite holding period is forever,” reflects his belief that patience and discipline are essential for successful investing.

The potential for growth in a $1,000 investment in the VOO ETF is significant, especially when considering the historical performance of the S&P 500. While past performance is not indicative of future results, the S&P 500 has historically delivered average annual returns of around 10% over the long term. If this trend continues, a $1,000 investment in the VOO ETF could potentially double in value in approximately seven years, thanks to the power of compounding.

However, it is important to note that investment returns are not guaranteed, and the stock market can be volatile. Market downturns and economic recessions can impact the value of investments, and investors should be prepared for potential losses. A diversified investment portfolio, that includes other asset classes such as bonds, real estate, or international stocks, is generally recommended to mitigate risk.

Buffett’s investment philosophy also emphasizes the importance of financial literacy and understanding the basics of investing. He encourages individuals to educate themselves about the stock market, different investment options, and the risks involved. By understanding these concepts, investors can make informed decisions and avoid common pitfalls.

The VOO ETF is readily accessible to most investors through brokerage accounts and retirement plans. Its simplicity and low cost make it an attractive option for both novice and experienced investors alike. The ETF’s liquidity, which means that it can be easily bought and sold, is another advantage.

In conclusion, Warren Buffett’s endorsement of the Vanguard S&P 500 ETF (VOO) underscores his belief in the power of passive investing, diversification, and long-term commitment. While investment returns are not guaranteed, the VOO ETF offers investors a cost-effective way to track the performance of the S&P 500 and potentially build wealth over time. A $1,000 investment in the VOO ETF could serve as a starting point for a successful long-term investment strategy, especially when combined with financial literacy and a disciplined approach. Investors should carefully consider their own risk tolerance, investment goals, and financial circumstances before making any investment decisions.

Further Elaboration on the Benefits of VOO and Buffett’s Investment Strategy:

1. Diversification and Risk Mitigation:

The VOO ETF provides instant diversification across 500 of the largest U.S. companies. This diversification significantly reduces the risk compared to investing in individual stocks. If one company in the S&P 500 underperforms, the impact on the overall portfolio is minimized. This broad exposure across various sectors of the economy, including technology, healthcare, finance, and consumer discretionary, helps to balance the portfolio and mitigate sector-specific risks.

2. Low Expense Ratio and Cost Efficiency:

The extremely low expense ratio of 0.03% is a key advantage of the VOO ETF. Over the long term, even seemingly small differences in expense ratios can have a significant impact on investment returns. A lower expense ratio means that more of the investment gains are retained by the investor, leading to higher overall returns. This cost efficiency makes the VOO ETF an attractive option for investors who are conscious of fees and expenses.

3. Passive Investment Strategy and Reduced Emotional Decision-Making:

Buffett’s endorsement of index funds reflects his preference for a passive investment strategy. Passive investing involves tracking a market index, such as the S&P 500, rather than actively trying to pick individual stocks or time the market. This approach eliminates the need for constant monitoring of the market and reduces the risk of making emotional decisions based on short-term market fluctuations.

4. Long-Term Investment Horizon and Compounding Returns:

Buffett’s emphasis on a long-term investment horizon is crucial for maximizing the potential of the VOO ETF. The power of compounding, which refers to the ability of investment gains to generate further gains over time, is most effective when investments are held for extended periods. By staying invested through market ups and downs, investors can benefit from the long-term growth potential of the S&P 500.

5. Accessibility and Liquidity:

The VOO ETF is readily accessible to most investors through brokerage accounts and retirement plans. Its high liquidity means that it can be easily bought and sold, allowing investors to adjust their positions as needed. This accessibility and liquidity make the VOO ETF a convenient and flexible investment option.

6. Alignment with Buffett’s Value Investing Principles:

While Buffett is known for his value investing approach, which involves identifying undervalued companies and holding them for the long term, his endorsement of index funds demonstrates his understanding of the challenges that individual investors face in consistently picking winning stocks. The VOO ETF provides a simple and effective way for investors to participate in the overall growth of the U.S. economy, without the need for extensive stock analysis.

7. The S&P 500 as a Benchmark for Market Performance:

The S&P 500 is a widely recognized benchmark for the overall health of the U.S. stock market. It is a market-capitalization-weighted index, which means that the weight of each company in the index is proportional to its market capitalization. This weighting method ensures that the index accurately reflects the performance of the largest and most influential companies in the U.S.

8. Tax Efficiency of ETFs:

ETFs, including VOO, are generally more tax-efficient than mutual funds. Due to their structure, ETFs tend to generate fewer capital gains distributions, which can reduce the amount of taxes that investors owe. This tax efficiency is another advantage of the VOO ETF.

9. The Role of Dividends:

The VOO ETF distributes dividends to its shareholders, providing a stream of income in addition to potential capital appreciation. Dividends can be reinvested to purchase additional shares of the ETF, further enhancing the power of compounding.

10. Understanding Market Volatility:

While the VOO ETF offers diversification and long-term growth potential, it is important to understand that the stock market can be volatile. Market downturns and economic recessions can impact the value of the ETF, and investors should be prepared for potential losses. However, historical data suggests that the S&P 500 has consistently recovered from market downturns over the long term.

Expanding on Warren Buffett’s Investment Philosophy:

Warren Buffett’s investment philosophy is deeply rooted in the principles of value investing, a strategy he learned from his mentor, Benjamin Graham. Graham’s book, “The Intelligent Investor,” outlines the key principles of value investing, which include focusing on intrinsic value, buying companies at a discount to their intrinsic value, and maintaining a long-term investment horizon.

Buffett has adapted and refined these principles over his long and successful career. He emphasizes the importance of understanding a company’s business model, competitive advantages, and management team. He looks for companies with durable competitive advantages, also known as “economic moats,” which protect them from competition and allow them to generate consistent profits over the long term.

Buffett also stresses the importance of investing within one’s circle of competence. This means focusing on industries and companies that one understands well, rather than trying to invest in everything. By sticking to what he knows, Buffett is able to make more informed investment decisions and avoid costly mistakes.

Another key aspect of Buffett’s investment philosophy is his emphasis on patience and discipline. He is willing to wait for the right opportunities to arise and is not afraid to hold cash if he cannot find attractive investments. He also avoids the temptation to time the market, recognizing that it is virtually impossible to consistently predict short-term market movements.

Buffett’s long-term investment horizon is also crucial to his success. He believes that the best way to build wealth is to invest in high-quality companies and hold them for the long term, allowing the power of compounding to work its magic. He famously said, “Our favorite holding period is forever.”

Buffett’s endorsement of index funds, such as the VOO ETF, reflects his recognition that most individual investors lack the time, expertise, and discipline to consistently outperform the market. By investing in a low-cost index fund, investors can effectively participate in the overall growth of the U.S. economy, without the need for extensive stock analysis or market timing.

However, it is important to note that Buffett’s personal investment portfolio, managed by Berkshire Hathaway, consists primarily of individual stocks. This reflects his belief that he and his team have the skills and resources to identify and invest in undervalued companies that have the potential to generate superior returns. For the average investor, however, he believes index funds are the most prudent and effective strategy.

The Vanguard Group and the Philosophy of John C. Bogle:

The Vanguard Group, the issuer of the VOO ETF, was founded by John C. Bogle, a pioneer in the field of index fund investing. Bogle believed that mutual funds should be managed in the best interests of their investors, rather than for the benefit of the fund management company.

He championed the concept of low-cost index funds, arguing that they offer a simple and effective way for investors to achieve their financial goals. Bogle’s philosophy was rooted in the belief that actively managed funds often fail to outperform the market over the long term, especially after accounting for fees and expenses.

Vanguard is structured as a client-owned company, which means that its investors are also its owners. This unique structure aligns the interests of the fund management company with those of its investors, ensuring that the focus is on delivering long-term value.

Bogle’s legacy continues to influence Vanguard’s approach to investment management. The company remains committed to providing low-cost, high-quality investment products that are designed to help investors achieve their financial goals.

Potential Risks and Considerations:

While the VOO ETF offers many benefits, it is important to be aware of the potential risks and considerations before investing:

- Market Risk: The value of the VOO ETF can fluctuate based on overall market conditions and economic factors. Market downturns and recessions can lead to significant losses.

- Inflation Risk: Inflation can erode the purchasing power of investment returns. It is important to consider the impact of inflation when evaluating the potential long-term returns of the VOO ETF.

- Sector Concentration: The S&P 500 is heavily weighted towards certain sectors, such as technology. This means that the VOO ETF may be more susceptible to risks specific to those sectors.

- Interest Rate Risk: Rising interest rates can negatively impact the value of bonds, which can indirectly affect the stock market and the VOO ETF.

- Geopolitical Risk: Global political and economic events can also impact the stock market and the VOO ETF.

- Tracking Error: While the VOO ETF is designed to track the S&P 500, there may be slight differences in performance due to factors such as fees and expenses. This is known as tracking error.

Diversification Beyond the S&P 500:

While the VOO ETF provides diversification across 500 U.S. companies, it is important to consider diversifying beyond the S&P 500 to further reduce risk. This can be achieved by investing in other asset classes, such as bonds, real estate, and international stocks.

- Bonds: Bonds can provide a source of income and can help to reduce the overall volatility of a portfolio.

- Real Estate: Real estate can provide diversification and potential inflation protection.

- International Stocks: Investing in international stocks can provide exposure to different economies and markets, further diversifying the portfolio.

Conclusion:

Warren Buffett’s endorsement of the Vanguard S&P 500 ETF (VOO) highlights the power of passive investing, diversification, and long-term commitment. The VOO ETF offers investors a cost-effective way to track the performance of the S&P 500 and potentially build wealth over time. However, it is important to understand the potential risks and considerations before investing, and to diversify beyond the S&P 500 to further reduce risk. A $1,000 investment in the VOO ETF can be a good starting point, but a well-rounded investment strategy should align with an individual’s specific financial goals, risk tolerance, and time horizon. Understanding the market, being patient, and staying the course are key to success.

Frequently Asked Questions (FAQ):

Q1: What is the Vanguard S&P 500 ETF (VOO)? A1: The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund that aims to track the performance of the Standard & Poor’s 500 (S&P 500) index. It holds stocks of the 500 largest publicly traded companies in the United States, offering investors broad market exposure.

Q2: Why does Warren Buffett recommend the VOO ETF? A2: Warren Buffett recommends the VOO ETF primarily because it offers a low-cost, diversified way for average investors to participate in the growth of the U.S. stock market. He believes that actively managed funds often underperform the S&P 500 over the long term, especially after considering fees and expenses. He emphasizes the importance of simplicity and a long-term investment horizon.

Q3: What are the benefits of investing in the VOO ETF? A3: The key benefits of investing in the VOO ETF include:

- Diversification: Exposure to 500 of the largest U.S. companies.

- Low Cost: An expense ratio of only 0.03%, minimizing investment costs.

- Simplicity: Easy to understand and invest in.

- Liquidity: Can be easily bought and sold on major stock exchanges.

- Long-Term Growth Potential: Tracks the performance of the S&P 500, which has historically delivered strong returns over the long term.

Q4: What are the risks associated with investing in the VOO ETF? A4: The primary risks include:

- Market Risk: The value of the ETF can fluctuate with market conditions.

- Economic Risk: Economic downturns can negatively impact stock prices.

- Inflation Risk: Inflation can erode the purchasing power of returns.

- Sector Concentration: Overweighting in specific sectors may increase risk if those sectors underperform.

Q5: How much would a $1,000 investment in the VOO ETF potentially grow? A5: The growth of a $1,000 investment in the VOO ETF depends on the performance of the S&P 500. Historically, the S&P 500 has averaged annual returns of around 10%. If this trend continues, a $1,000 investment could potentially double in about seven years, thanks to the power of compounding. However, past performance is not indicative of future results, and investment returns are not guaranteed. Market volatility can affect returns significantly.