Living frugally, often born out of necessity, can lead to unexpected financial benefits and improved quality of life, according to online discussions where individuals shared their “poor person habits” that ultimately saved them money and enhanced their lives. These habits, ranging from simple resourcefulness to mindful spending, offer valuable lessons applicable to people across various income levels.

Many of these practices focus on maximizing existing resources and minimizing waste. Repairing items instead of immediately replacing them emerged as a common theme. One participant emphasized the importance of learning basic repair skills, stating, “Learning how to repair things instead of throwing them away has saved me thousands.” This includes mending clothes, fixing appliances, and performing basic car maintenance. The ability to extend the lifespan of possessions not only reduces expenses but also promotes a more sustainable lifestyle.

Cooking at home and meal planning were also frequently cited as effective money-saving strategies. Preparing meals from scratch is significantly cheaper than eating out or relying on pre-packaged foods. “Cooking at home is not only healthier but also much cheaper,” noted one contributor. Planning meals in advance and utilizing leftovers further minimizes food waste and maximizes the value of grocery purchases.

Another prevalent habit involved carefully tracking expenses and budgeting. Understanding where money is going is crucial for identifying areas where spending can be reduced. Many individuals advocated for using budgeting apps or spreadsheets to monitor income and expenses. “Tracking every penny has helped me become more aware of my spending habits and make informed financial decisions,” explained one participant.

Beyond financial benefits, many of these habits contributed to a greater sense of resourcefulness, creativity, and self-sufficiency. The ability to make do with less fostered a mindset of appreciation and contentment. “Being forced to be frugal taught me to value what I have and to appreciate the simple things in life,” shared one individual.

Detailed Breakdown of “Poor Person Habits”

The online discussion highlighted a wide array of habits, each offering unique insights into frugal living. These practices can be broadly categorized into several key areas:

1. Resourcefulness and Repair:

- Repairing Items: A cornerstone of frugal living is the ability to repair broken items instead of immediately replacing them. This applies to clothing, appliances, electronics, and even furniture. Learning basic repair skills can save significant amounts of money over time. Online tutorials and community workshops can provide valuable resources for acquiring these skills.

- Reusing and Repurposing: Finding new uses for old items is another effective way to reduce waste and save money. Old clothing can be repurposed into cleaning rags or craft projects. Glass jars and containers can be reused for food storage or organization. Thinking creatively about how to reuse items can minimize the need to purchase new products.

- Borrowing and Sharing: Instead of buying items that are only used occasionally, consider borrowing them from friends, family, or neighbors. Tools, equipment, and even clothing can be shared within a community, reducing the overall cost for everyone involved.

- Freecycling: Utilizing online platforms such as Freecycle or Craigslist to give away unwanted items and acquire needed items for free. This reduces landfill waste and saves money on purchases.

2. Mindful Spending and Budgeting:

- Tracking Expenses: Keeping a detailed record of all income and expenses is essential for understanding where money is going. This can be done using budgeting apps, spreadsheets, or even a simple notebook. Identifying areas where spending can be reduced is the first step towards achieving financial goals.

- Budgeting: Creating a budget helps to allocate income towards essential expenses and savings goals. There are various budgeting methods available, such as the 50/30/20 rule (allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment) or zero-based budgeting (allocating every dollar of income to a specific purpose).

- Delayed Gratification: Avoiding impulse purchases and waiting before buying non-essential items can prevent unnecessary spending. Giving yourself time to consider whether an item is truly needed can help to avoid buyer’s remorse.

- Comparison Shopping: Before making a purchase, compare prices from different retailers to ensure you are getting the best deal. Online tools and apps can help to automate this process.

- Negotiating Prices: Don’t be afraid to negotiate prices, especially for larger purchases such as cars or appliances. Haggling can often result in significant savings.

- Using Coupons and Discounts: Take advantage of coupons, discounts, and promotional offers whenever possible. Many retailers offer loyalty programs and email newsletters that provide exclusive discounts to subscribers.

- Paying with Cash: Using cash instead of credit cards can help to curb spending. Studies have shown that people tend to spend less when they are physically handing over cash.

- Avoiding Debt: Minimizing debt is crucial for financial stability. High-interest debt, such as credit card debt, can quickly erode income and make it difficult to achieve financial goals.

3. Food and Cooking:

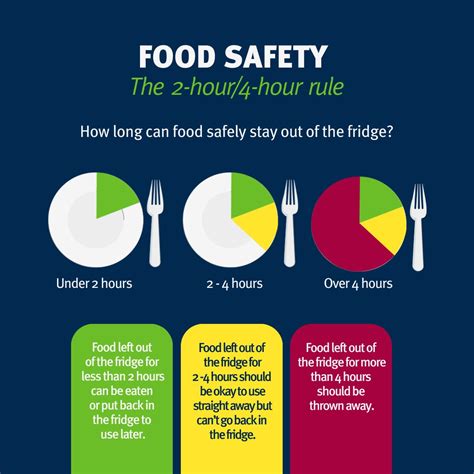

- Cooking at Home: Preparing meals at home is significantly cheaper than eating out or ordering takeout. Planning meals in advance and utilizing leftovers can further minimize food waste and maximize the value of grocery purchases.

- Meal Planning: Planning meals for the week ahead can help to avoid impulse purchases and ensure that you are using all of the ingredients you buy. Creating a shopping list based on your meal plan can also help to stay within budget.

- Batch Cooking: Cooking large batches of food and freezing portions for later use can save time and money. This is especially helpful for busy individuals who don’t have time to cook every day.

- Utilizing Leftovers: Leftovers can be repurposed into new meals or used for lunches. Getting creative with leftovers can help to reduce food waste and save money.

- Growing Your Own Food: Growing your own fruits, vegetables, and herbs can significantly reduce grocery costs. Even a small garden can provide a substantial amount of fresh produce.

- Foraging: Identifying and harvesting edible wild plants can supplement your diet and save money on groceries. However, it is important to be knowledgeable about local plants and to avoid consuming anything that you are not sure about.

- Reducing Food Waste: Minimizing food waste is not only environmentally responsible but also financially beneficial. Properly storing food, using leftovers creatively, and composting food scraps can all help to reduce waste.

4. Transportation:

- Walking, Biking, and Public Transportation: Choosing alternative modes of transportation, such as walking, biking, or public transportation, can save money on gas, car maintenance, and parking.

- Carpooling: Sharing rides with others can reduce transportation costs and minimize traffic congestion.

- Maintaining Your Vehicle: Regularly maintaining your vehicle can prevent costly repairs down the road. This includes changing the oil, checking tire pressure, and keeping the engine tuned.

- Driving Efficiently: Practicing fuel-efficient driving habits, such as accelerating smoothly and avoiding excessive idling, can save money on gas.

5. Housing and Utilities:

- Conserving Energy: Conserving energy can significantly reduce utility bills. This includes turning off lights when leaving a room, unplugging electronics when not in use, and using energy-efficient appliances.

- Water Conservation: Conserving water can also lower utility bills. This includes taking shorter showers, fixing leaky faucets, and using water-efficient appliances.

- Negotiating Rent: When renewing a lease, don’t be afraid to negotiate the rent. Researching comparable properties in the area can provide leverage in negotiations.

- Downsizing: If possible, consider downsizing to a smaller home or apartment to reduce housing costs.

- DIY Home Maintenance: Performing basic home maintenance tasks yourself can save money on professional services. This includes painting, caulking, and repairing minor plumbing issues.

6. Entertainment and Leisure:

- Free Activities: Take advantage of free activities in your community, such as parks, museums, and libraries.

- Borrowing Books and Movies: Borrowing books and movies from the library is a free and convenient way to access entertainment.

- Potlucks and Game Nights: Hosting potlucks and game nights with friends and family is a low-cost way to socialize and have fun.

- Utilizing Free Online Resources: Numerous free online resources are available for learning new skills, accessing entertainment, and connecting with others.

7. Healthcare:

- Preventive Care: Investing in preventive care, such as regular checkups and screenings, can help to prevent costly medical problems down the road.

- Generic Medications: Choosing generic medications instead of brand-name drugs can save significant amounts of money.

- Health Savings Account (HSA): If eligible, contributing to a Health Savings Account (HSA) can provide tax benefits and help to cover healthcare expenses.

The Psychological Benefits of Frugal Living

Beyond the tangible financial benefits, adopting “poor person habits” can also have a positive impact on mental and emotional well-being. The act of repairing something oneself can foster a sense of accomplishment and self-reliance. Learning to live with less can cultivate gratitude and appreciation for what one already has. The process of budgeting and tracking expenses can promote financial awareness and control, reducing stress and anxiety related to money.

As one contributor to the online discussion noted, “Frugality isn’t just about saving money; it’s about being mindful of your resources and making conscious choices about how you spend your time and energy.”

Criticisms and Considerations

While these “poor person habits” can be beneficial, it’s important to acknowledge potential drawbacks and limitations. Some practices, such as extensive repair work, may require significant time and effort. For individuals with limited time or physical capabilities, these habits may not be feasible. Additionally, some cost-saving measures, such as buying used clothing or appliances, may involve compromising on quality or aesthetics.

It’s also crucial to avoid equating frugality with deprivation. The goal is not to deny oneself essential needs or to live in a state of constant scarcity. Rather, it’s about making informed choices and prioritizing spending on things that truly matter.

“It’s about finding a balance between saving money and enjoying life,” emphasized one participant. “The key is to be intentional about your spending and to avoid unnecessary expenses.”

The Modern Relevance of Frugal Living

In an era of consumerism and instant gratification, the principles of frugal living are more relevant than ever. The habits shared in the online discussion offer a practical guide to managing finances responsibly and living a more sustainable lifestyle. By adopting these practices, individuals can not only save money but also cultivate a greater sense of resourcefulness, resilience, and contentment.

The discussion further highlighted that these habits are not solely applicable to those in financial hardship. Many individuals, regardless of their income level, choose to embrace frugal living as a way to achieve financial independence, reduce their environmental impact, and live a more meaningful life.

“Frugality is a mindset, not a circumstance,” concluded one participant. “It’s about making conscious choices that align with your values and goals.”

The Enduring Wisdom of Resourcefulness

The “poor person habits” discussed online represent a timeless set of principles that can benefit anyone seeking to improve their financial well-being and overall quality of life. By embracing resourcefulness, mindful spending, and a commitment to sustainability, individuals can take control of their finances and live a more fulfilling life, regardless of their income level. The core message resonates: true wealth lies not in the abundance of possessions, but in the ability to make the most of what one has.

Frequently Asked Questions (FAQ)

Q1: Are these “poor person habits” only for people with low incomes?

A: No. While many of these habits originate from necessity due to financial constraints, they are valuable for anyone looking to save money, reduce waste, and live more sustainably. They promote mindful spending and resourcefulness, which can benefit individuals at any income level. As one participant noted, “Frugality is a mindset, not a circumstance.”

Q2: How can I start incorporating these habits into my daily life if I’m used to spending freely?

A: Start small and focus on one or two habits at a time. Begin by tracking your expenses to identify areas where you can cut back. Try meal planning to reduce food waste and avoid eating out. Learn a basic repair skill to fix items instead of replacing them. The key is to make gradual changes and find habits that fit your lifestyle.

Q3: Is it possible to be too frugal? Can it lead to deprivation or a lower quality of life?

A: Yes, it is possible to be too frugal. The goal is not to deprive yourself of essential needs or enjoyable experiences. Frugality should be balanced with a focus on overall well-being. It’s about making conscious choices about where you spend your money and prioritizing things that truly matter to you. “It’s about finding a balance between saving money and enjoying life,” as one contributor stated.

Q4: What are some resources available for learning these “poor person habits,” such as repair skills or budgeting techniques?

A: Many resources are available online and in local communities. Online tutorials, YouTube videos, and DIY websites can teach basic repair skills. Budgeting apps and websites can help you track expenses and create a budget. Libraries offer free books and resources on personal finance. Community workshops and classes may also be available for learning skills like cooking, gardening, or home repair.

Q5: How can these habits contribute to a more sustainable lifestyle?

A: Many of these habits directly reduce waste and promote sustainability. Repairing items instead of replacing them reduces consumption and landfill waste. Cooking at home and reducing food waste minimizes your environmental impact. Conserving energy and water lowers your carbon footprint. By adopting these practices, you can live a more environmentally responsible and sustainable lifestyle.

Q6: What’s the best way to handle social situations where frugality might be perceived as cheap or stingy?

A: Communication is key. Be open and honest with friends and family about your financial goals and lifestyle choices. Explain that you’re focused on saving money or reducing waste, not being cheap. Suggest alternative activities that are more budget-friendly, such as potlucks or free events. Focus on spending quality time together rather than spending a lot of money.

Q7: How can I teach these habits to my children?

A: Lead by example. Involve your children in budgeting, meal planning, and household repairs. Teach them the value of saving money and making conscious spending choices. Explain the importance of reducing waste and protecting the environment. By instilling these values at a young age, you can help your children develop lifelong habits of frugality and responsibility.

Q8: What are the dangers of extreme couponing and is it worth the effort?

A: While couponing can save money, extreme couponing can lead to overspending on items you don’t need, stockpiling unnecessary products that expire, and spending excessive time searching for deals. Evaluate the time commitment and potential savings before engaging in extreme couponing. Focus on using coupons for items you regularly purchase.

Q9: How do I balance saving money with occasional indulgences or treats?

A: Budget for discretionary spending. Allocate a certain amount of money each month for fun activities, treats, or indulgences. This allows you to enjoy life without feeling guilty or jeopardizing your financial goals. Prioritize experiences over material possessions.

Q10: What if my partner or family members aren’t on board with frugal living?

A: Communication and compromise are essential. Have an open and honest conversation about your financial goals and values. Explain the benefits of frugal living and how it can improve your family’s financial security. Be willing to compromise and find solutions that work for everyone. Focus on shared goals and priorities.

Q11: Can frugal living still be relevant in a high-inflation environment?

A: Absolutely. In fact, frugal living becomes even more important during periods of high inflation. Inflation erodes the purchasing power of money, making it crucial to stretch your dollars further. By adopting frugal habits, you can mitigate the impact of inflation and maintain your financial stability.

Q12: How can I find affordable entertainment options?

A: Look for free or low-cost activities in your community. Explore local parks, museums, and libraries. Attend free concerts or events. Organize potlucks or game nights with friends and family. Take advantage of free online resources for entertainment, such as streaming services with free trials or ad-supported options.

Q13: What are some tips for reducing food waste?

A: Plan meals in advance and create a shopping list. Store food properly to extend its shelf life. Use leftovers creatively in new meals. Freeze food that you won’t be able to use before it expires. Compost food scraps to reduce landfill waste.

Q14: How can I save money on transportation costs?

A: Walk, bike, or use public transportation whenever possible. Carpool with others to reduce gas costs. Maintain your vehicle to prevent costly repairs. Drive efficiently to save on gas. Consider selling your car if you can live without it.

Q15: What are some strategies for negotiating prices?

A: Do your research to understand the fair market value of the item you’re purchasing. Be polite and respectful when negotiating. Be prepared to walk away if the price is too high. Look for discounts or promotional offers. Ask for a price match if you find a lower price elsewhere.

Q16: How does frugal living affect retirement planning? A: Frugal living significantly aids retirement planning by freeing up more income for savings and investments. By minimizing unnecessary expenses throughout your working life, you can allocate a larger percentage of your income to retirement accounts, allowing for greater compounding and long-term growth. A frugal lifestyle can also reduce your overall retirement expenses, meaning you’ll need less saved to maintain your desired lifestyle.

Q17: What role does DIY (Do-It-Yourself) play in frugal living? A: DIY is a cornerstone of frugal living. Taking on projects such as home repairs, crafting, and even making your own cleaning products can drastically reduce costs compared to hiring professionals or buying pre-made items. DIY projects also foster a sense of accomplishment and self-sufficiency. The internet provides a wealth of resources and tutorials for learning new DIY skills.

Q18: How can I leverage technology to support a frugal lifestyle? A: Technology offers numerous tools to support frugal living. Budgeting apps can help track spending and identify areas for savings. Price comparison websites can help find the best deals on products. Streaming services offer affordable entertainment options. Online communities can connect you with others who share your frugal values.

Q19: What are some common misconceptions about frugal living? A: One misconception is that frugal living means being miserly or depriving yourself of enjoyment. In reality, it’s about making conscious spending choices and prioritizing experiences over material possessions. Another misconception is that it’s only for people with low incomes. Frugal living can benefit anyone who wants to save money, reduce waste, and live a more intentional life.

Q20: How can I track my progress and stay motivated on my frugal living journey? A: Set realistic goals and track your progress using a budgeting app or spreadsheet. Celebrate your successes along the way. Join an online community of frugal living enthusiasts for support and inspiration. Remind yourself of the reasons why you’re pursuing a frugal lifestyle, such as achieving financial independence or reducing your environmental impact. Visualizing your goals can help you stay motivated.