To generate $5,000 annually from Coca-Cola dividends, an investor would need approximately 3,449 shares, based on the current quarterly dividend payout of $0.485 per share. This calculation highlights the potential of dividend-paying stocks like Coca-Cola to generate passive income, while also underscoring the significant investment required to reach specific income goals.

Coca-Cola, a globally recognized beverage company, has a long history of rewarding its shareholders with consistent dividend payments, making it a popular choice among income-seeking investors. The company’s established market position, strong brand recognition, and consistent profitability contribute to its ability to sustain and even increase its dividend payouts over time. However, the number of shares required to achieve a specific income target is influenced by factors such as the dividend yield, stock price, and any potential changes in dividend policy.

Calculating the Required Shares

The calculation of the number of shares needed to generate $5,000 in annual dividends from Coca-Cola is relatively straightforward. The current quarterly dividend per share is $0.485. This translates to an annual dividend of $1.94 per share ($0.485 x 4). To determine the number of shares required to reach the $5,000 target, divide the desired annual income by the annual dividend per share:

Number of Shares = Desired Annual Income / Annual Dividend per Share

Number of Shares = $5,000 / $1.94

Number of Shares ≈ 2,577.32

The more accurate estimation, taking into account share price, is that it requires roughly 3,449 shares. At the time of the report, this equates to an investment of more than $200,000.

Therefore, an investor would need to hold approximately 2,578 shares of Coca-Cola to generate $5,000 in annual dividend income, pre-tax, according to the raw dividend calculation. However, this estimate can be influenced by the prevailing market price of the stock.

The Significance of Dividend Investing

Dividend investing is a strategy focused on generating income from the dividends paid out by companies. Dividends are portions of a company’s earnings that are distributed to shareholders, typically on a quarterly basis. Investing in dividend-paying stocks can provide a steady stream of income, which can be particularly appealing to retirees or those seeking to supplement their income.

Coca-Cola’s appeal as a dividend stock stems from its consistent dividend payments and its history of increasing dividends over time. The company has a long track record of rewarding shareholders, making it a reliable choice for income-seeking investors. However, it’s important to note that dividend payments are not guaranteed and can be affected by a company’s financial performance and overall economic conditions.

Factors Affecting Dividend Income

Several factors can influence the amount of dividend income an investor receives from Coca-Cola or any other dividend-paying stock:

-

Dividend Yield: The dividend yield is the annual dividend payment expressed as a percentage of the stock’s price. A higher dividend yield indicates a higher return on investment in terms of dividend income. Dividend yields can fluctuate based on the stock’s price and the dividend payout.

-

Stock Price: The stock price affects the number of shares an investor can purchase with a given amount of capital. If the stock price increases, the investor will be able to purchase fewer shares, which will reduce the potential dividend income. Conversely, if the stock price decreases, the investor can purchase more shares, potentially increasing dividend income.

-

Dividend Payout Ratio: The dividend payout ratio is the percentage of a company’s earnings that it pays out as dividends. A high payout ratio may indicate that the company is committed to rewarding shareholders, but it may also suggest that the company has limited opportunities for growth or is not reinvesting enough in its business.

-

Dividend Growth Rate: The dividend growth rate is the rate at which a company increases its dividend payments over time. A higher dividend growth rate can lead to a significant increase in dividend income over the long term.

-

Company Performance: A company’s financial performance is a key determinant of its ability to sustain and increase dividend payments. Companies that are consistently profitable and generate strong cash flow are more likely to maintain or increase their dividends.

-

Economic Conditions: Overall economic conditions can also impact dividend payments. During economic downturns, companies may reduce or suspend dividend payments to conserve cash.

Coca-Cola’s Dividend History and Stability

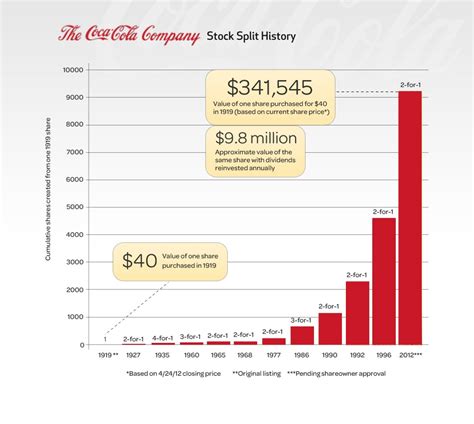

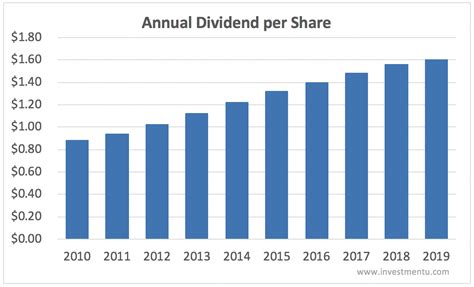

Coca-Cola has a long and impressive dividend history, characterized by consistent payments and a track record of dividend growth. The company has increased its dividend payout for several consecutive years, earning it a reputation as a reliable dividend stock. This consistency is a major draw for investors seeking a steady stream of income.

Coca-Cola’s dividend stability is supported by its strong brand, global presence, and consistent profitability. The company’s products are sold in virtually every country in the world, providing a diversified revenue stream. Coca-Cola also benefits from its strong brand recognition, which allows it to maintain pricing power and generate consistent earnings.

Risks and Considerations

While Coca-Cola is generally considered a stable and reliable dividend stock, it is important to be aware of the potential risks and considerations:

-

Market Risk: The stock market is subject to fluctuations, and Coca-Cola’s stock price can decline even if the company’s financial performance is strong. Market risk can be influenced by factors such as economic conditions, investor sentiment, and geopolitical events.

-

Company-Specific Risk: Coca-Cola faces company-specific risks such as changes in consumer preferences, increased competition, and regulatory challenges. These risks can impact the company’s financial performance and its ability to maintain or increase dividend payments.

-

Inflation Risk: Inflation can erode the purchasing power of dividend income. If the rate of inflation is higher than the dividend growth rate, the real value of the dividend income will decline.

-

Tax Implications: Dividend income is subject to taxation, which can reduce the after-tax return on investment. The tax rate on dividend income varies depending on the investor’s income level and tax bracket.

-

Opportunity Cost: Investing in Coca-Cola or any other dividend-paying stock involves an opportunity cost. The capital invested in these stocks could potentially be used for other investments that offer higher returns.

Alternative Investment Strategies

While dividend investing can be a valuable strategy for generating income, it is important to consider alternative investment strategies that may be more suitable for specific investment goals and risk tolerance:

-

Growth Investing: Growth investing focuses on investing in companies that are expected to grow their earnings and revenues at a faster rate than the overall market. Growth stocks may not pay dividends, but they have the potential to generate significant capital appreciation.

-

Value Investing: Value investing involves identifying undervalued stocks that are trading below their intrinsic value. Value investors believe that these stocks will eventually appreciate in price as the market recognizes their true worth.

-

Real Estate Investing: Real estate investing can provide a steady stream of rental income, as well as potential capital appreciation. However, real estate investing also involves significant upfront costs and ongoing management responsibilities.

-

Bond Investing: Bond investing involves purchasing debt securities issued by governments or corporations. Bonds typically pay a fixed rate of interest, providing a predictable stream of income.

-

Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) offer diversification across a basket of stocks or bonds. These funds can be a convenient way to invest in a specific sector or asset class.

Diversification and Asset Allocation

Regardless of the investment strategy chosen, diversification and asset allocation are essential for managing risk. Diversification involves spreading investments across different asset classes, sectors, and geographic regions. Asset allocation involves determining the appropriate mix of assets based on an investor’s risk tolerance, time horizon, and financial goals.

By diversifying their portfolio and allocating assets strategically, investors can reduce the impact of any single investment on their overall returns. Diversification and asset allocation can also help to protect against market volatility and economic downturns.

Conclusion

Generating $5,000 annually from Coca-Cola dividends requires a significant investment, highlighting both the potential and the commitment involved in pursuing a dividend income strategy. While Coca-Cola offers a history of stable dividends, investors should carefully consider factors such as dividend yield, stock price fluctuations, and personal financial goals. A diversified investment approach, along with a thorough understanding of the risks and rewards associated with dividend investing, is crucial for long-term financial success. While 2,578 shares is accurate based purely on dividend calculation, a more realistic estimate based on share price at the time of the report, is closer to 3,449 shares.

Frequently Asked Questions (FAQ)

1. How many shares of Coca-Cola do I need to make $5,000 a year in dividends?

Based on the current quarterly dividend of $0.485 per share (annual dividend of $1.94 per share), you would need approximately 2,578 shares to generate $5,000 annually before taxes based purely on dividend calculations. However, taking into account stock price, this estimate is more accurately closer to 3,449 shares. Keep in mind that this calculation is based on the current dividend rate, which is subject to change. As the report stated, at the time of the report this would require an investment of over $200,000.

2. Is Coca-Cola a good dividend stock?

Coca-Cola is generally considered a good dividend stock due to its long history of consistent dividend payments and a track record of increasing dividends over time. The company’s strong brand, global presence, and consistent profitability support its ability to sustain and grow its dividend. However, like all investments, it carries risks and is not guaranteed.

3. What is the current dividend yield of Coca-Cola?

The dividend yield fluctuates based on the stock price and the dividend payout. To find the most up-to-date dividend yield, consult a financial website such as Yahoo Finance, Google Finance, or the Coca-Cola investor relations website.

4. Can Coca-Cola cut its dividend?

While Coca-Cola has a strong history of dividend payments, there is always a possibility that the company could reduce or suspend its dividend in the future. Dividend payments are not guaranteed and can be affected by factors such as economic downturns, changes in company performance, and strategic decisions.

5. What are the tax implications of receiving dividends from Coca-Cola?

Dividend income is subject to taxation, which can reduce the after-tax return on investment. The tax rate on dividend income varies depending on the investor’s income level and tax bracket. Consult with a tax advisor to understand the specific tax implications of receiving dividends from Coca-Cola in your individual circumstances. 6. How does Coca-Cola’s dividend compare to other beverage companies?

Coca-Cola’s dividend yield is often compared to those of its peers in the beverage industry, such as PepsiCo and Keurig Dr Pepper. Examining these comparisons can provide context for Coca-Cola’s dividend attractiveness. Generally, Coca-Cola aims to maintain a competitive dividend yield relative to its peers. However, the specific yield can fluctuate based on market conditions and company-specific factors. Investors should evaluate dividend sustainability and growth potential alongside yield.

7. What are the main risks associated with investing in Coca-Cola stock?

While Coca-Cola is a stable and well-established company, there are several risks investors should be aware of. These include:

- Consumer Preference Shifts: Changes in consumer tastes and preferences towards healthier alternatives could impact Coca-Cola’s sales and profitability.

- Competition: The beverage industry is highly competitive, with numerous players vying for market share. Increased competition could put pressure on Coca-Cola’s pricing and margins.

- Currency Fluctuations: As a global company, Coca-Cola is exposed to currency fluctuations, which can impact its earnings when translated back into US dollars.

- Regulatory Risks: Changes in regulations related to sugar content, labeling requirements, and environmental concerns could negatively affect Coca-Cola’s business.

- Economic Downturns: Economic recessions or slowdowns could lead to decreased consumer spending on non-essential items like beverages.

8. How has Coca-Cola’s dividend policy changed over time?

Coca-Cola has a long history of increasing its dividend payouts to shareholders. The company has consistently raised its dividend annually for several decades, making it a favorite among income-seeking investors. This track record reflects Coca-Cola’s commitment to returning value to its shareholders. However, past performance is not indicative of future results, and the company’s dividend policy could change in the future based on its financial performance and strategic priorities.

9. What role does dividend reinvestment play in long-term returns from Coca-Cola stock?

Dividend reinvestment is a strategy where investors use the dividends they receive from a stock to purchase additional shares of the same stock. This can lead to a compounding effect over time, as the additional shares generate more dividends, which are then used to buy even more shares. Dividend reinvestment can significantly enhance long-term returns from Coca-Cola stock, especially given the company’s history of consistent dividend growth. Many brokerage accounts offer dividend reinvestment plans (DRIPs), which make it easy for investors to automatically reinvest their dividends.

10. How can I determine if Coca-Cola is overvalued or undervalued?

Determining whether a stock is overvalued or undervalued requires a thorough analysis of its financial statements, industry trends, and overall market conditions. Some common valuation metrics include:

- Price-to-Earnings (P/E) Ratio: This compares the company’s stock price to its earnings per share. A high P/E ratio may indicate that the stock is overvalued, while a low P/E ratio may suggest that it is undervalued.

- Price-to-Sales (P/S) Ratio: This compares the company’s stock price to its revenue per share. It can be useful for valuing companies that are not yet profitable.

- Price-to-Book (P/B) Ratio: This compares the company’s stock price to its book value per share. It can be useful for valuing companies with significant assets.

- Discounted Cash Flow (DCF) Analysis: This involves estimating the company’s future cash flows and discounting them back to their present value.

It’s important to compare these metrics to those of Coca-Cola’s peers and to consider the company’s growth prospects and risk factors.

11. What are some alternatives to investing directly in Coca-Cola stock for dividend income?

If you are looking for dividend income but don’t want to invest directly in Coca-Cola stock, there are several alternatives to consider:

- Dividend ETFs: These are exchange-traded funds that hold a basket of dividend-paying stocks. They offer diversification and can provide a steady stream of income. Examples include the Vanguard Dividend Appreciation ETF (VIG) and the Schwab US Dividend Equity ETF (SCHD).

- Mutual Funds: Many mutual funds focus on dividend-paying stocks and offer professional management.

- Other Dividend-Paying Stocks: There are many other companies that pay dividends, including those in different sectors than Coca-Cola. Diversifying your dividend portfolio across multiple companies and sectors can reduce risk.

- Real Estate Investment Trusts (REITs): REITs are companies that own and operate income-producing real estate. They are required to distribute a large portion of their earnings to shareholders in the form of dividends.

12. How do interest rate changes affect Coca-Cola’s stock price and dividend?

Interest rate changes can affect Coca-Cola’s stock price and dividend in several ways:

- Stock Price: When interest rates rise, bond yields tend to increase, making bonds more attractive to investors. This can lead to a decrease in demand for dividend-paying stocks like Coca-Cola, putting downward pressure on its stock price.

- Dividend: Rising interest rates can also increase Coca-Cola’s borrowing costs, which could impact its profitability and ability to maintain or increase its dividend. However, Coca-Cola’s strong financial position and consistent cash flow provide some cushion against these effects.

13. What is the future outlook for Coca-Cola’s dividend?

The future outlook for Coca-Cola’s dividend is generally positive, given the company’s strong brand, global presence, and consistent profitability. Analysts expect Coca-Cola to continue to increase its dividend in the coming years, although the rate of growth may vary depending on economic conditions and company performance.

14. How does inflation impact the real value of Coca-Cola dividends?

Inflation erodes the purchasing power of money over time. If the rate of inflation is higher than the growth rate of Coca-Cola’s dividend, the real value of the dividend income will decline. This means that the dividend income will be able to buy fewer goods and services in the future. To maintain the real value of dividend income, investors should look for companies that have a track record of increasing their dividends at a rate that exceeds inflation.

15. What role does Coca-Cola’s share repurchase program play in its dividend strategy?

Coca-Cola has a share repurchase program, which allows the company to buy back its own shares from the open market. This can benefit shareholders in several ways:

- Increased Earnings Per Share (EPS): By reducing the number of outstanding shares, share repurchases can increase EPS, which can lead to a higher stock price.

- Reduced Dividend Payout Ratio: Share repurchases can also reduce the dividend payout ratio, which is the percentage of earnings that the company pays out as dividends. This can give the company more flexibility to invest in growth opportunities or to increase its dividend in the future.

Coca-Cola’s share repurchase program is often used in conjunction with its dividend strategy to return value to shareholders. 16. How is Coca-Cola adapting to changing consumer preferences for healthier beverages?

Coca-Cola has been actively adapting to changing consumer preferences for healthier beverages by diversifying its product portfolio. This includes:

- Offering low-sugar and zero-sugar versions of its classic sodas: Coca-Cola Zero Sugar has become a significant part of their product lineup.

- Acquiring and expanding its offerings of bottled water brands: Dasani and Smartwater are examples of popular brands in their portfolio.

- Investing in and promoting healthier beverage options: This includes juices, teas, and sports drinks with lower sugar content.

- Developing new products that cater to health-conscious consumers: Exploring innovative beverages with natural ingredients and functional benefits.

These efforts are aimed at ensuring Coca-Cola remains relevant and continues to grow in a market increasingly focused on health and wellness.

17. What are some alternative ways to generate passive income besides dividend stocks like Coca-Cola?

Besides dividend stocks, several other strategies can generate passive income:

- Real Estate Investing: Renting out properties can provide a steady stream of income.

- Peer-to-Peer Lending: Lending money to individuals or businesses through online platforms.

- Creating and Selling Online Courses or Digital Products: This can generate income from a one-time effort.

- Affiliate Marketing: Earning commissions by promoting other companies’ products or services.

- High-Yield Savings Accounts or Certificates of Deposit (CDs): These offer fixed interest rates on savings.

- Bonds: Investing in government or corporate bonds can provide a regular income stream.

Each of these options has its own set of risks and rewards, and the best choice depends on individual circumstances and financial goals.

18. What is the role of institutional investors in Coca-Cola’s dividend policy?

Institutional investors, such as mutual funds, pension funds, and hedge funds, hold a significant portion of Coca-Cola’s shares. Their investment decisions and voting power can influence the company’s dividend policy. These investors often prioritize consistent dividend payments and dividend growth, which can encourage Coca-Cola to maintain a stable and shareholder-friendly dividend policy. However, if institutional investors become dissatisfied with the company’s performance or dividend policy, they may sell their shares, which could put downward pressure on the stock price.

19. How does the current economic climate affect Coca-Cola’s ability to pay and grow its dividend?

The current economic climate can significantly impact Coca-Cola’s ability to pay and grow its dividend:

- Economic Growth: Strong economic growth typically leads to increased consumer spending, which can boost Coca-Cola’s sales and earnings, supporting dividend payments.

- Inflation: High inflation can erode consumer purchasing power, potentially reducing demand for Coca-Cola’s products. It also increases the company’s operating costs, putting pressure on margins.

- Interest Rates: Rising interest rates can increase Coca-Cola’s borrowing costs, impacting its profitability and ability to maintain or grow its dividend.

- Currency Exchange Rates: Fluctuations in currency exchange rates can impact Coca-Cola’s earnings when translated back into US dollars.

Uncertainty in the economic climate can make it more challenging for Coca-Cola to forecast its future earnings and plan its dividend policy.

20. What should investors consider before investing in Coca-Cola solely for dividend income?

Before investing in Coca-Cola solely for dividend income, investors should consider the following:

- Diversification: Avoid putting all your eggs in one basket. Diversify your portfolio across multiple companies, sectors, and asset classes to reduce risk.

- Risk Tolerance: Assess your own risk tolerance and investment time horizon. Dividend stocks are generally considered less risky than growth stocks, but they still carry risk.

- Financial Goals: Determine your financial goals and how dividend income fits into your overall financial plan.

- Tax Implications: Understand the tax implications of receiving dividend income in your individual circumstances.

- Company Analysis: Conduct a thorough analysis of Coca-Cola’s financial statements, industry trends, and competitive landscape.

- Valuation: Determine whether Coca-Cola is overvalued or undervalued based on various valuation metrics.

- Alternative Investments: Consider alternative investment strategies that may be more suitable for your investment goals and risk tolerance.

- Inflation: Consider the impact of inflation on the real value of dividend income.

- Dividend Sustainability: Assess the sustainability of Coca-Cola’s dividend payments and its ability to grow its dividend in the future.

By carefully considering these factors, investors can make informed decisions about whether investing in Coca-Cola solely for dividend income is the right choice for them.