Mounting financial strain and sibling resentment are surfacing as aging parents with depleted savings increasingly rely on their adult children for support, creating complex family dynamics.

An anonymous individual, identified as “Disappointed Daughter,” shared her predicament on MarketWatch’s “Moneyist” column, detailing the financial burden she faces supporting her aging mother and grandmother while her siblings contribute little or nothing. This situation highlights a growing trend: as more Americans live longer, many haven’t adequately saved for retirement, leaving their children to shoulder the responsibility, often unevenly, leading to familial discord.

Disappointed Daughter explains that her mother and grandmother have “no savings,” and she has been “helping them financially for years.” This assistance includes covering essential expenses and managing their affairs. The core of her frustration stems from the unequal distribution of responsibility among her siblings. While she bears the brunt of the financial and emotional load, her siblings offer minimal support, prompting feelings of anger and resentment. She asks the Moneyist, Quentin Fottrell, “Am I wrong to be bitter?”

Fottrell’s response acknowledges the validity of her feelings and emphasizes the importance of open communication and establishing clear boundaries. He suggests a family meeting to discuss the situation transparently and fairly, potentially involving a professional mediator to facilitate constructive dialogue. He notes that while Disappointed Daughter has been generous, enabling the lack of contribution from her siblings, he suggests they all need to be involved in the decision-making. Fottrell also advises that she not set herself on fire to keep others warm – this is not a financial or emotional problem to be solved by one person.

The situation presented by Disappointed Daughter is not unique. Millions of Americans face similar challenges, navigating the complexities of caring for aging parents with limited financial resources. Several factors contribute to this trend, including inadequate retirement planning, rising healthcare costs, and unexpected financial emergencies.

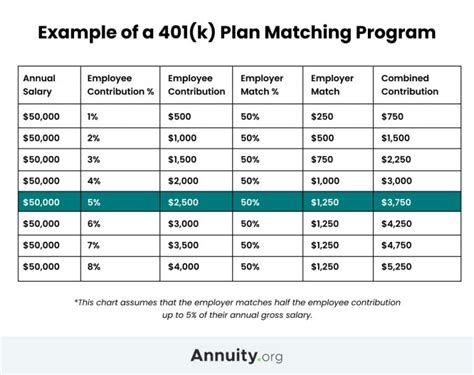

According to a 2023 report by the Employee Benefit Research Institute (EBRI), many Americans are not on track to retire comfortably. The report found that nearly half of all households are at risk of not having enough money to maintain their living standards in retirement. This shortfall is particularly acute among lower-income individuals and those who have not consistently saved throughout their working lives.

The financial strain of supporting aging parents can have significant consequences for adult children. It can impact their own savings and retirement plans, limit their ability to invest in their own future, and increase stress and anxiety. Furthermore, the emotional toll of caregiving can lead to burnout and strained relationships with family members.

One of the key challenges in these situations is the lack of open communication among family members. Often, siblings avoid discussing financial matters due to discomfort, fear of conflict, or a sense of obligation. However, avoiding these conversations can exacerbate the problem and lead to resentment and mistrust.

Financial experts recommend that families proactively address the issue of aging parents’ financial needs. This includes assessing their current financial situation, developing a budget, and exploring potential sources of income and support. It’s also important to have open and honest conversations about expectations and responsibilities.

“It’s essential to have these conversations early on, before a crisis occurs,” says certified financial planner Mary Johnson. “This allows families to make informed decisions and avoid misunderstandings.”

When families struggle to communicate effectively, professional mediation can be a valuable resource. A mediator can facilitate constructive dialogue, help family members understand each other’s perspectives, and develop a plan that works for everyone.

Moreover, families should explore available government and community resources. Programs such as Medicaid, Social Security, and the Department of Veteran Affairs (VA) offer financial assistance and support services for eligible seniors. Local Area Agencies on Aging (AAA) can provide information and referrals to a wide range of services, including transportation, meal programs, and home healthcare.

In Disappointed Daughter’s case, Fottrell suggests a direct approach: “You and your siblings need to have a meeting. If that’s not possible, a phone call. If that’s not possible, emails.” He underlines the importance of clearly outlining the financial needs and the contributions expected from each sibling.

Furthermore, Fottrell addresses the potential for resentment by acknowledging that Disappointed Daughter’s anger is valid. He writes, “You’re angry. Who wouldn’t be? You have been subsidizing your mother and grandmother — and, by extension, your siblings — for years.”

The situation also raises the issue of financial boundaries. While helping family members in need is commendable, it’s important to establish clear limits to protect one’s own financial well-being. This may involve setting a budget for financial assistance, prioritizing one’s own savings goals, and saying “no” when necessary.

Financial planners advise creating a written caregiving agreement that outlines the responsibilities of each family member and the financial contributions expected from them. This agreement can help prevent misunderstandings and ensure that everyone is on the same page.

The rise of the “sandwich generation,” individuals who are simultaneously caring for their children and their aging parents, has further complicated the financial landscape. These individuals often face competing financial demands, making it difficult to save for their own retirement.

A study by Pew Research Center found that nearly half of adults in their 40s and 50s have provided financial support to both a child and a parent in the past year. This financial strain can have a significant impact on their overall well-being.

To mitigate the financial burden of caring for aging parents, some families are exploring alternative living arrangements, such as co-housing or multigenerational homes. These arrangements can reduce housing costs and provide opportunities for shared caregiving responsibilities.

However, these arrangements also require careful planning and open communication to ensure that everyone’s needs are met. It’s important to consider issues such as privacy, personal space, and decision-making authority.

The trend of aging parents relying on their adult children for financial support is likely to continue in the coming years. As the population ages and healthcare costs rise, more families will face the challenges highlighted by Disappointed Daughter’s story.

Addressing this issue requires a multi-faceted approach, including proactive financial planning, open communication, and access to government and community resources. It also requires a shift in societal attitudes towards aging and caregiving, recognizing the importance of supporting families who are providing care for their loved ones.

The impact on women is also disproportionate. Women are more likely to be caregivers, and this role often comes with significant financial consequences. They may have to reduce their work hours or leave the workforce altogether, impacting their earnings and retirement savings.

“Women often bear the brunt of caregiving responsibilities, which can have a devastating impact on their financial security,” says economist Sarah Brown. “We need to provide more support for women who are caring for aging parents.”

Some companies are beginning to offer caregiver benefits, such as flexible work arrangements, paid leave, and access to support services. However, these benefits are still relatively rare, and more needs to be done to support working caregivers.

Ultimately, addressing the financial challenges of aging parents requires a collective effort from individuals, families, employers, and policymakers. By working together, we can ensure that all Americans have the resources they need to age with dignity and security.

Furthermore, the concept of “filial responsibility” laws, which exist in some states, can add another layer of complexity. These laws hold adult children legally responsible for the financial support of their indigent parents. While these laws are rarely enforced, they can create legal obligations for adult children who are already struggling to make ends meet.

Navigating these complex issues requires careful planning, open communication, and a willingness to compromise. It’s important for families to seek professional advice from financial planners, attorneys, and social workers to ensure that they are making informed decisions and protecting their own financial well-being.

The original poster’s situation perfectly illustrates the rising challenges faced by families, forcing them to confront difficult financial realities and potentially straining familial bonds. The increase in elderly individuals coupled with insufficient retirement savings creates a scenario where adult children, especially women, are increasingly tasked with providing financial support.

Disappointed Daughter also highlights the emotional aspects of this challenge. The sense of resentment and the burden of responsibility can take a significant toll on caregivers’ mental and emotional well-being. This underscores the need for caregivers to prioritize their own self-care and seek support from friends, family, or professional therapists.

In conclusion, the story of Disappointed Daughter serves as a cautionary tale and a call to action. It highlights the importance of proactive financial planning, open communication, and a commitment to supporting families who are caring for their aging loved ones. It is a reminder that addressing the financial challenges of aging requires a collective effort from individuals, families, employers, and policymakers. The complexities of this issue demand innovative solutions and a willingness to adapt to the changing needs of an aging population.

The need for broader societal changes, such as improved access to affordable healthcare and long-term care insurance, as well as increased financial literacy education, is also evident. These changes would help individuals better prepare for retirement and reduce the burden on their families.

The financial strain of supporting aging parents also affects decisions about where they live. Some families opt for in-home care, which can be expensive but allows parents to remain in familiar surroundings. Others consider assisted living facilities or nursing homes, which offer a range of services but can be even more costly.

The decision of where an aging parent will live is often a difficult one, requiring careful consideration of their needs, preferences, and financial resources. It’s important to involve the parent in the decision-making process as much as possible, and to respect their wishes and preferences.

However, when financial resources are limited, the options may be constrained. This can lead to difficult choices and potential conflicts among family members.

The availability of government and community resources can play a crucial role in helping families navigate these challenges. Programs such as Medicaid, Social Security, and the VA offer financial assistance and support services for eligible seniors. Local Area Agencies on Aging (AAA) can provide information and referrals to a wide range of services, including transportation, meal programs, and home healthcare.

By utilizing these resources, families can reduce the financial burden of caring for aging parents and improve their quality of life.

The importance of legal planning cannot be overstated. It’s essential for aging parents to have a will, a durable power of attorney, and advance healthcare directives in place. These documents ensure that their wishes are respected and that their affairs are managed according to their instructions.

A will specifies how their assets will be distributed after their death. A durable power of attorney allows them to appoint someone to make financial decisions on their behalf if they become incapacitated. Advance healthcare directives, such as a living will, allow them to express their wishes regarding medical treatment and end-of-life care.

Without these documents, families may face legal challenges and disputes over the management of their parents’ affairs.

The complexities of caring for aging parents also highlight the need for improved training and support for caregivers. Caregivers often face a steep learning curve, as they navigate the challenges of managing their parents’ health, finances, and personal care.

They may benefit from training in areas such as medication management, fall prevention, and dementia care. They also need access to emotional support and respite care, which allows them to take breaks from their caregiving responsibilities.

By providing caregivers with the training and support they need, we can improve their well-being and the quality of care they provide to their aging parents.

The story of Disappointed Daughter serves as a reminder that caring for aging parents is a complex and multifaceted challenge. It requires proactive financial planning, open communication, access to resources, and a commitment to supporting families who are providing care for their loved ones.

It is a challenge that will only become more pressing in the years to come, as the population ages and the demand for long-term care services increases. Addressing this challenge requires a collective effort from individuals, families, employers, and policymakers. By working together, we can ensure that all Americans have the resources they need to age with dignity and security.

Frequently Asked Questions (FAQ)

1. What are the key factors contributing to the growing trend of adult children financially supporting their aging parents?

Several factors are at play. First, many individuals haven’t saved adequately for retirement due to various reasons, including economic downturns, job losses, or simply not prioritizing retirement savings early enough. Second, healthcare costs are rising rapidly, putting a significant strain on seniors’ finances. Third, people are living longer, which means they need more money to cover their expenses throughout their retirement years. Finally, unexpected financial emergencies, such as medical bills or home repairs, can deplete savings quickly.

2. What steps can families take to address the financial needs of aging parents proactively?

Families should begin by having open and honest conversations about their parents’ financial situation, including their income, expenses, assets, and debts. Next, they should assess their parents’ eligibility for government assistance programs such as Social Security, Medicare, and Medicaid. They should create a budget that outlines their parents’ essential expenses and identify areas where they can reduce costs. They should also explore potential sources of income, such as part-time work or selling assets. Finally, they should consider consulting with a financial planner to develop a comprehensive retirement plan.

3. What resources are available to families who are struggling to care for aging parents?

Numerous resources are available to support families. Local Area Agencies on Aging (AAA) can provide information and referrals to a wide range of services, including transportation, meal programs, home healthcare, and caregiver support groups. The Eldercare Locator is a national directory of services for seniors and their families. The National Council on Aging (NCOA) offers a variety of programs and resources to help seniors maintain their independence and well-being. The Family Caregiver Alliance provides support and advocacy for family caregivers. Additionally, some employers offer caregiver benefits, such as flexible work arrangements and paid leave.

4. How can families address sibling resentment when it comes to caring for aging parents?

Sibling resentment often arises when one sibling feels that they are bearing a disproportionate share of the caregiving burden. To address this issue, families should hold open and honest conversations about expectations and responsibilities. They should strive to divide the caregiving tasks fairly, taking into account each sibling’s availability, skills, and financial resources. If necessary, they should consider involving a professional mediator to facilitate constructive dialogue. It’s also important for siblings to acknowledge and validate each other’s feelings. Remind everyone that this is not a sprint, but a marathon.

5. What are some legal considerations when caring for aging parents?

It’s crucial for aging parents to have essential legal documents in place, including a will, a durable power of attorney, and advance healthcare directives. A will specifies how their assets will be distributed after their death. A durable power of attorney allows them to appoint someone to make financial decisions on their behalf if they become incapacitated. Advance healthcare directives, such as a living will, allow them to express their wishes regarding medical treatment and end-of-life care. Without these documents, families may face legal challenges and disputes over the management of their parents’ affairs. Additionally, families should be aware of filial responsibility laws, which exist in some states and hold adult children legally responsible for the financial support of their indigent parents. Consult with an attorney specializing in elder law for personalized guidance.