Claiming Social Security at age 70 statistically maximizes lifetime benefits for most individuals, though personal circumstances should dictate the optimal claiming age.

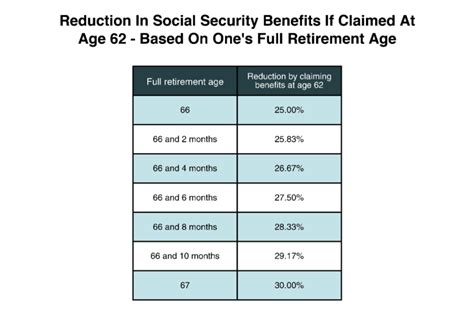

For many Americans, navigating the complexities of Social Security can feel like a daunting task, particularly when deciding the right age to begin receiving benefits. While 62 is the earliest age to claim, doing so results in a permanently reduced benefit. Conversely, delaying benefits past the full retirement age (FRA) – which is 67 for those born in 1960 or later – increases the monthly payout up to age 70. However, the “statistically smartest” age to begin claiming Social Security benefits is 70, according to a recent analysis. This is because, for many, it provides the highest guaranteed lifetime income stream.

The Benefit of Delaying

Delaying Social Security benefits provides a significant advantage: credits toward increased payments. For each year you delay claiming benefits past your full retirement age, you accrue delayed retirement credits. These credits increase your benefit by 8% per year until you reach age 70. This means that if your full retirement age is 67, waiting until age 70 will result in a 24% increase in your monthly benefit amount. This increase is permanent and will continue for the rest of your life.

According to the Social Security Administration (SSA), the full retirement age is 67 for those born in 1960 or later. Claiming at 62 results in roughly a 30% reduction in monthly benefits, whereas waiting until 70 provides a roughly 24% increase above the full retirement age amount. This substantial difference highlights the financial incentive to delay.

Longevity and Break-Even Points

The concept of “break-even age” is crucial when deciding when to claim Social Security. This refers to the age at which the cumulative benefits received from claiming later surpass the cumulative benefits received from claiming earlier. For instance, while claiming at 62 provides more years of receiving payments, the lower monthly amount means it takes longer to accumulate the same total benefit as someone who waited until 70.

Financial planners often use life expectancy data to estimate the break-even point for various claiming ages. If an individual expects to live a long life, delaying benefits to age 70 generally becomes more advantageous. A person who claims early might receive benefits for a longer period, but the reduced monthly amount might ultimately result in a lower total payout compared to someone who claimed later and received a higher monthly benefit for a shorter period.

Personal Circumstances Matter Most

While claiming at 70 might be statistically optimal for maximizing lifetime benefits, it is essential to consider individual circumstances. Health, financial needs, and personal preferences play a significant role in determining the ideal claiming age.

-

Health: If an individual has significant health issues or a shorter life expectancy, claiming benefits earlier might be a more prudent decision. In such cases, the goal might be to maximize benefits received in the shorter term rather than focusing on long-term accumulation.

-

Financial Needs: Some individuals may need to claim Social Security benefits early to cover essential living expenses. If retirement savings are insufficient, claiming at 62 or soon thereafter might be the only viable option. Delaying benefits to age 70 is not feasible for everyone, particularly those who cannot afford to wait.

-

Marital Status: Married couples need to coordinate their Social Security claiming strategies to maximize their combined benefits. Spousal benefits and survivor benefits can significantly impact the overall financial well-being of the couple. Often, the higher-earning spouse delays claiming benefits to increase the survivor benefit for the surviving spouse.

-

Tax Implications: Social Security benefits may be subject to federal and state income taxes. The amount of taxes owed depends on the individual’s other sources of income and filing status. Consulting with a tax advisor can help individuals understand the potential tax implications of claiming Social Security at different ages.

-

Employment Status: Continuing to work while receiving Social Security benefits can impact the amount of benefits received, especially before reaching full retirement age. Earnings limits apply, and benefits may be reduced if earnings exceed these limits. After reaching full retirement age, there are no earnings limits, and individuals can receive their full Social Security benefit regardless of their earnings.

Alternatives to Delaying Social Security

For those who need income before age 70 but still want to maximize their Social Security benefits, alternative strategies exist. These include:

-

Part-Time Work: Continuing to work part-time can provide income to cover living expenses, allowing individuals to delay claiming Social Security benefits. This can be an effective way to bridge the gap between retirement and claiming Social Security.

-

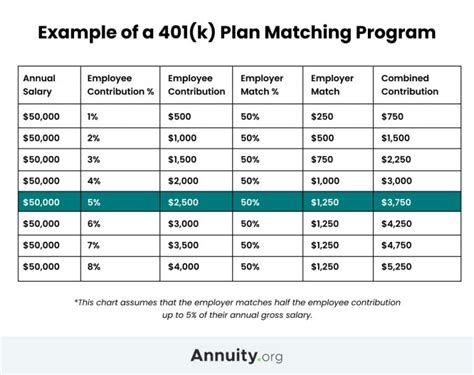

Retirement Savings: Drawing down on retirement savings, such as 401(k)s, IRAs, or other investment accounts, can provide income while delaying Social Security. This allows individuals to avoid claiming Social Security early and potentially increase their lifetime benefits.

-

Annuities: Purchasing an annuity can provide a guaranteed income stream to supplement retirement income. Annuities can be structured to provide payments for a fixed period or for the rest of the individual’s life.

-

Reverse Mortgages: For homeowners, a reverse mortgage can provide access to home equity to cover living expenses. However, reverse mortgages come with risks and should be carefully considered before pursuing this option.

Social Security’s Future and Potential Changes

The long-term solvency of Social Security is a topic of ongoing debate and concern. The Social Security Administration projects that the Social Security trust funds will be depleted in the coming years, potentially leading to benefit cuts if Congress does not take action.

Several potential solutions have been proposed to address Social Security’s funding challenges, including:

-

Raising the Retirement Age: Increasing the full retirement age would reduce the number of years individuals receive full benefits, thereby reducing program costs.

-

Increasing the Payroll Tax Rate: Increasing the payroll tax rate would increase the amount of revenue flowing into the Social Security trust funds.

-

Adjusting the Cost-of-Living Adjustment (COLA): The COLA is used to adjust Social Security benefits each year to account for inflation. Adjusting the COLA formula could reduce the rate at which benefits increase over time.

-

Means-Testing Benefits: Means-testing Social Security benefits would limit benefits for higher-income individuals, thereby reducing program costs.

Any changes to Social Security could have a significant impact on retirement planning. Individuals should stay informed about potential changes and consider how these changes might affect their claiming strategies.

The Impact of Inflation

Inflation can significantly impact the purchasing power of Social Security benefits. While Social Security benefits are adjusted annually for inflation through the COLA, the rate of inflation can vary, and the COLA might not fully offset the impact of rising prices.

High inflation can erode the value of fixed income sources, such as Social Security, making it more challenging for retirees to maintain their standard of living. Individuals should consider the potential impact of inflation when planning for retirement and claiming Social Security benefits.

Expert Opinions and Recommendations

Financial advisors and retirement experts generally recommend carefully evaluating all options before deciding when to claim Social Security benefits. They emphasize the importance of considering individual circumstances, health, financial needs, and life expectancy.

Many experts recommend consulting with a financial advisor to develop a personalized retirement plan that incorporates Social Security claiming strategies. A financial advisor can help individuals assess their financial situation, evaluate their options, and make informed decisions about when to claim Social Security benefits.

Maximizing Spousal and Survivor Benefits

For married couples, coordinating Social Security claiming strategies can significantly impact the overall financial well-being of the couple. Spousal benefits and survivor benefits can provide valuable income to the surviving spouse after the death of the other spouse.

-

Spousal Benefits: A spouse who did not work or who earned less than their spouse may be eligible for spousal benefits. Spousal benefits are based on the other spouse’s earnings record and can provide a significant source of income.

-

Survivor Benefits: After the death of a spouse, the surviving spouse may be eligible for survivor benefits. Survivor benefits are based on the deceased spouse’s earnings record and can provide a crucial source of income for the surviving spouse.

Delaying claiming benefits can also increase the survivor benefit, which can provide greater financial security for the surviving spouse.

Social Security Claiming Strategies for Different Scenarios

The optimal Social Security claiming strategy can vary depending on individual circumstances. Here are some examples of claiming strategies for different scenarios:

-

Single Individuals with Good Health: For single individuals with good health and a long life expectancy, delaying benefits to age 70 is often the best strategy to maximize lifetime benefits.

-

Single Individuals with Poor Health: For single individuals with poor health or a shorter life expectancy, claiming benefits earlier might be a more prudent decision.

-

Married Couples with Similar Earnings: For married couples with similar earnings, both spouses may consider delaying benefits to age 70 to maximize their combined benefits and survivor benefits.

-

Married Couples with Disparate Earnings: For married couples with disparate earnings, the higher-earning spouse may consider delaying benefits to age 70 to increase the survivor benefit for the lower-earning spouse.

-

Divorced Individuals: Divorced individuals may be eligible for benefits based on their ex-spouse’s earnings record, even if the ex-spouse has remarried.

The Impact of Government Policy and Legislation

Government policy and legislation can significantly impact Social Security benefits. Changes to the Social Security program can affect the amount of benefits received, the eligibility requirements, and the claiming strategies.

Individuals should stay informed about government policy and legislation that could affect Social Security and consider how these changes might impact their retirement planning.

Long-Term Care Considerations

The cost of long-term care can be substantial and can significantly impact retirement finances. Individuals should consider the potential need for long-term care when planning for retirement and claiming Social Security benefits.

Delaying claiming benefits can provide a larger monthly income stream that can help cover the cost of long-term care. Additionally, some long-term care insurance policies can help cover the cost of care.

Using Online Tools and Resources

The Social Security Administration (SSA) provides a variety of online tools and resources to help individuals plan for retirement and claim Social Security benefits. These tools include:

-

Retirement Estimator: The Retirement Estimator allows individuals to estimate their future Social Security benefits based on their earnings history.

-

Benefit Calculators: Benefit calculators can help individuals estimate their benefits at different claiming ages.

-

Online Account: Individuals can create an online account with the SSA to view their earnings record, estimate their benefits, and manage their Social Security information.

Social Security and Estate Planning

Social Security benefits are generally not considered part of an estate and cannot be passed on to heirs. However, survivor benefits can provide income to the surviving spouse or dependent children after the death of the beneficiary.

Individuals should consider how Social Security benefits fit into their overall estate planning strategy.

The Emotional Aspect of Retirement Decisions

Retirement decisions are not solely financial; they also have an emotional component. Deciding when to retire and claim Social Security benefits can be a significant life change that can impact individuals’ sense of identity, purpose, and social connections.

Individuals should consider the emotional aspects of retirement decisions and seek support from family, friends, or a therapist if needed.

The Role of Financial Literacy

Financial literacy plays a crucial role in making informed decisions about retirement planning and claiming Social Security benefits. Individuals with a strong understanding of financial concepts are better equipped to evaluate their options, assess their risks, and make sound financial decisions.

Promoting financial literacy is essential to ensuring that individuals can make informed decisions about retirement and Social Security.

Common Misconceptions About Social Security

There are many common misconceptions about Social Security. Some of these misconceptions include:

-

Social Security is going bankrupt. While the Social Security trust funds face challenges, the program is not going bankrupt.

-

Claiming early is always a bad idea. Claiming early can be a good idea for individuals with poor health or a shorter life expectancy.

-

Delaying benefits is always the best strategy. Delaying benefits is not always the best strategy, particularly for individuals who need income earlier in retirement.

-

Social Security benefits are not taxable. Social Security benefits may be subject to federal and state income taxes.

Conclusion: A Tailored Approach to Social Security Claiming

In conclusion, while claiming Social Security at age 70 often maximizes lifetime benefits, it’s not a one-size-fits-all solution. The optimal claiming age depends on a multitude of factors, including health, financial circumstances, marital status, tax implications, and personal preferences. Seeking personalized financial advice and carefully considering all available options is crucial to making the best decision for your individual situation. The “statistically smartest” age serves as a valuable guideline, but the most important step is aligning your claiming strategy with your unique needs and goals.

Frequently Asked Questions (FAQ)

-

What is the “statistically smartest” age to claim Social Security?

According to statistical analysis, claiming Social Security at age 70 generally maximizes lifetime benefits for most individuals. This is because delaying benefits increases the monthly payout by 8% per year after full retirement age until age 70. However, this may not be the best strategy for everyone, as personal circumstances should be considered.

-

What happens if I claim Social Security before my full retirement age?

Claiming Social Security before your full retirement age (FRA) results in a permanently reduced monthly benefit. For example, claiming at age 62, the earliest age to claim, can result in a reduction of up to 30% compared to claiming at your FRA, which is 67 for those born in 1960 or later.

-

What are delayed retirement credits?

Delayed retirement credits are credits you earn for each year you delay claiming Social Security benefits past your full retirement age, up to age 70. These credits increase your benefit amount by 8% per year, leading to a higher monthly payment.

-

How does my health affect my Social Security claiming decision?

Your health can significantly impact your Social Security claiming decision. If you have significant health issues or a shorter life expectancy, claiming benefits earlier may be a more prudent decision to maximize the benefits you receive over your lifetime.

-

Will Social Security benefits be enough to cover my retirement expenses?

Social Security benefits are typically designed to replace only a portion of your pre-retirement income. Most financial advisors recommend having additional sources of retirement income, such as savings, investments, or a pension, to ensure a comfortable retirement. The specific amount needed varies depending on individual spending habits and lifestyle.