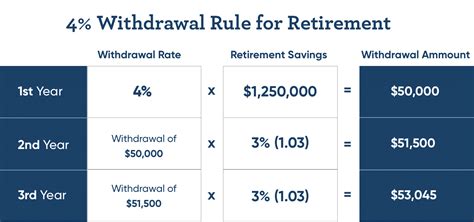

The creator of the 4% retirement rule, William Bengen, now suggests retirees may need to withdraw even less than 4% annually to ensure their savings last throughout retirement. Bengen, in a recent interview with Barron’s, revised his guidance due to factors like higher equity valuations and lower bond yields, suggesting a withdrawal rate between 4.5% and 5% might be sustainable only if retirees are flexible with their spending and adjust their withdrawals based on market performance.

William Bengen, the financial planner who introduced the widely-used 4% rule for retirement withdrawals nearly 30 years ago, is now urging caution, suggesting that retirees might need to withdraw less than previously recommended to safeguard their nest eggs. In an interview with Barron’s, Bengen expressed concerns about the current economic climate, characterized by high equity valuations and persistently low bond yields, prompting him to revise his guidance. The 4% rule, initially outlined in his 1994 paper, “Determining Withdrawal Rates Using Historical Data,” proposed that retirees could safely withdraw 4% of their initial retirement savings each year, adjusted for inflation, and expect their portfolio to last at least 30 years. This rule became a cornerstone of retirement planning, offering a seemingly simple and reliable framework for managing retirement income. However, Bengen’s updated perspective reflects the evolving economic landscape and the need for retirees to adapt their strategies accordingly.

Bengen’s initial research was based on historical market data, specifically analyzing stock and bond market returns from 1926 to the early 1990s. His simulations indicated that a 4% withdrawal rate, coupled with a portfolio allocation of roughly 50% stocks and 50% bonds, had a high probability of success, meaning the portfolio would likely sustain withdrawals for at least three decades without being depleted. The 4% rule gained traction among financial advisors and retirees alike, offering a quantifiable benchmark for retirement planning. Its simplicity and historical backing made it an appealing and seemingly robust strategy.

However, the financial world has changed significantly since Bengen first formulated his rule. Interest rates have remained persistently low for over a decade, and equity valuations have soared, leading to concerns about future returns. These shifts have prompted Bengen to reassess the viability of the 4% rule in the current environment. He now suggests that a withdrawal rate between 4.5% and 5% might be sustainable, but only under specific conditions. Specifically, retirees need to be flexible with their spending, adjusting their withdrawals based on market performance. This means being prepared to reduce withdrawals during market downturns and potentially increase them during periods of strong growth. This flexibility is crucial to ensuring the longevity of their retirement savings.

According to Bengen, the success of a higher withdrawal rate hinges on the retiree’s willingness to adapt to market fluctuations. “The key is flexibility,” Bengen emphasized in the Barron’s interview. “If you’re willing to cut back on spending when the market declines, you can potentially withdraw a bit more.” This adaptive approach requires retirees to actively monitor their portfolio’s performance and make informed decisions about their spending habits. It moves away from the rigid, fixed withdrawal strategy that the 4% rule initially represented and encourages a more dynamic and responsive approach to retirement income management.

The updated guidance reflects a more nuanced understanding of retirement planning, acknowledging the inherent uncertainties of the market and the importance of individual circumstances. While the 4% rule provided a valuable starting point, it’s essential for retirees to consider their unique financial situations, risk tolerance, and spending needs when determining their optimal withdrawal rate. Consulting with a qualified financial advisor is crucial to developing a personalized retirement plan that aligns with their individual goals and objectives.

The revision of the 4% rule also highlights the importance of diversification in retirement portfolios. While Bengen’s initial research suggested a 50/50 stock-bond allocation, retirees should consider a broader range of asset classes to mitigate risk and enhance returns. This may include investing in real estate, commodities, or alternative investments, depending on their risk tolerance and financial goals. Diversification can help to cushion the impact of market volatility and improve the long-term sustainability of retirement savings.

Furthermore, Bengen’s updated perspective underscores the need for retirees to plan for unexpected expenses and healthcare costs. Healthcare expenses, in particular, can be a significant burden on retirement savings, and retirees should factor in potential long-term care costs when developing their financial plans. Having a contingency fund to cover unexpected expenses can provide peace of mind and prevent the need to drastically reduce withdrawals during market downturns.

The 4% rule, while still a useful guideline, should not be viewed as a rigid, one-size-fits-all solution. Retirees need to take a holistic approach to retirement planning, considering their individual circumstances, market conditions, and long-term financial goals. Bengen’s updated guidance serves as a reminder that retirement planning is an ongoing process that requires regular monitoring, adjustments, and professional advice.

Factors Influencing the Withdrawal Rate:

Several factors influence the sustainability of retirement withdrawal rates. These include:

-

Portfolio Allocation: The mix of assets in a retirement portfolio significantly impacts its potential returns and risk. A portfolio heavily weighted towards stocks may offer higher potential returns but also carries greater volatility. Bonds, on the other hand, provide stability but typically offer lower returns. The optimal portfolio allocation depends on the retiree’s risk tolerance, time horizon, and financial goals.

-

Market Conditions: The prevailing market conditions, including interest rates, inflation, and equity valuations, can significantly impact the performance of a retirement portfolio. Low-interest rates can reduce the income generated from bonds, while high equity valuations may indicate lower future returns. Retirees need to be aware of these market trends and adjust their withdrawal strategies accordingly.

-

Inflation: Inflation erodes the purchasing power of retirement savings over time. Retirees need to factor in inflation when calculating their withdrawal rates to ensure that their income keeps pace with rising prices. Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can help to mitigate the impact of inflation on retirement savings.

-

Longevity: Life expectancy plays a crucial role in determining the sustainability of retirement withdrawals. Retirees who expect to live longer need to withdraw less each year to ensure that their savings last throughout their retirement. It’s essential to consider family history and personal health when estimating life expectancy.

-

Spending Needs: The amount of money a retiree needs to cover their living expenses is a primary factor in determining the appropriate withdrawal rate. Retirees with higher spending needs may need to withdraw a larger percentage of their savings each year, which could increase the risk of depleting their portfolio.

-

Taxes: Taxes can significantly impact retirement income. Retirees need to consider the tax implications of their withdrawals and plan accordingly. Strategies such as Roth IRA conversions can help to minimize taxes in retirement.

Alternative Retirement Withdrawal Strategies:

In addition to the 4% rule, several alternative retirement withdrawal strategies can help retirees manage their income and ensure the longevity of their savings. These include:

-

The Variable Percentage Withdrawal (VPW) Strategy: This strategy involves adjusting the withdrawal rate each year based on the portfolio’s performance. During years of strong market performance, the withdrawal rate increases, while during years of poor performance, the withdrawal rate decreases. This approach helps to preserve capital during market downturns and allows retirees to take advantage of market gains.

-

The Required Minimum Distribution (RMD) Strategy: This strategy is based on the IRS’s required minimum distribution rules for retirement accounts. Retirees calculate their RMD each year based on their age and account balance. This approach ensures that retirees are taking withdrawals in a tax-efficient manner and helps to avoid penalties for under-withdrawing.

-

The Bucketing Strategy: This strategy involves dividing retirement savings into different “buckets” based on time horizon and risk tolerance. The first bucket contains cash and short-term investments to cover immediate living expenses. The second bucket contains intermediate-term investments to cover expenses in the next few years. The third bucket contains long-term investments to provide growth potential for the future. This approach allows retirees to match their investments to their spending needs and manage risk effectively.

-

The Safety-First Approach: This strategy prioritizes guaranteed income sources, such as Social Security, pensions, and annuities, to cover essential living expenses. Retirees then use their remaining savings to supplement their income and pursue their financial goals. This approach provides a high level of security and reduces the risk of running out of money in retirement.

-

The 3% Rule: A more conservative approach than the 4% rule, this suggests withdrawing 3% of initial savings annually, adjusted for inflation. While it may provide a higher likelihood of portfolio longevity, it also means having less disposable income each year.

The Role of Financial Advisors:

Given the complexities of retirement planning, working with a qualified financial advisor can be invaluable. A financial advisor can help retirees:

-

Assess their financial situation and goals: A financial advisor can help retirees assess their current financial situation, including their assets, liabilities, and income sources. They can also help retirees define their retirement goals, such as their desired lifestyle, travel plans, and legacy aspirations.

-

Develop a personalized retirement plan: Based on the retiree’s financial situation and goals, a financial advisor can develop a personalized retirement plan that outlines their savings, investment, and withdrawal strategies.

-

Manage their investments: A financial advisor can help retirees manage their investments, including selecting appropriate asset allocations, monitoring portfolio performance, and rebalancing their portfolio as needed.

-

Provide ongoing guidance and support: A financial advisor can provide ongoing guidance and support to retirees, helping them to stay on track with their retirement plan and make adjustments as needed. They can also help retirees navigate life events, such as job changes, health issues, and family emergencies, that may impact their retirement savings.

-

Provide Estate Planning Advice: Financial advisors can assist with estate planning, ensuring assets are distributed according to the retiree’s wishes and minimizing potential tax implications for heirs.

The Importance of Continuous Monitoring and Adjustment:

Retirement planning is not a one-time event but an ongoing process that requires continuous monitoring and adjustment. Retirees need to regularly review their retirement plan to ensure that it remains aligned with their goals and circumstances. This includes:

-

Monitoring portfolio performance: Retirees should regularly monitor the performance of their retirement portfolio to ensure that it is on track to meet their goals. This includes tracking investment returns, asset allocation, and expenses.

-

Adjusting withdrawal rates as needed: Retirees should be prepared to adjust their withdrawal rates based on market conditions and their spending needs. This may involve reducing withdrawals during market downturns or increasing withdrawals during periods of strong growth.

-

Rebalancing the portfolio: Retirees should periodically rebalance their portfolio to maintain their desired asset allocation. This involves selling assets that have outperformed and buying assets that have underperformed.

-

Updating the retirement plan: Retirees should update their retirement plan regularly to reflect changes in their circumstances, such as changes in their health, family situation, or financial goals.

-

Staying Informed: Keeping up-to-date with financial news and changes to retirement regulations is crucial for making informed decisions.

The Impact of Sequence of Returns Risk:

Sequence of returns risk refers to the risk that negative investment returns early in retirement can significantly deplete a portfolio, making it difficult to recover even if returns improve later on. This is because withdrawals are taken from a smaller base, leaving less capital to benefit from future gains. Bengen’s revised guidance indirectly addresses this risk by suggesting lower initial withdrawal rates, which can help protect against early losses.

To mitigate sequence of returns risk, retirees can consider:

- Lowering initial withdrawal rates: As Bengen suggests, withdrawing a smaller percentage of savings in the early years of retirement can help preserve capital and reduce vulnerability to early losses.

- Using a variable withdrawal strategy: Adjusting withdrawal rates based on market performance, as described earlier, can help avoid depleting the portfolio during downturns.

- Delaying retirement: Working a few extra years can allow savings to grow and provide a larger buffer against early losses.

- Purchasing an annuity: An annuity provides a guaranteed stream of income, reducing reliance on portfolio withdrawals and mitigating sequence of returns risk.

Long-Term Care Planning:

One of the most significant risks to retirement security is the potential need for long-term care. Long-term care expenses can be substantial and can quickly deplete retirement savings. Retirees should consider the following strategies for addressing this risk:

- Purchasing long-term care insurance: Long-term care insurance can help cover the costs of nursing home care, assisted living, and home health care.

- Planning for Medicaid eligibility: Medicaid can help cover long-term care expenses for individuals who meet certain income and asset requirements.

- Considering a health savings account (HSA): HSAs can be used to save for future healthcare expenses, including long-term care.

- Exploring alternative living arrangements: Consider options like continuing care retirement communities (CCRCs) that offer a range of care services.

Social Security Optimization:

Social Security is a critical component of retirement income for many Americans. Optimizing Social Security benefits can significantly enhance retirement security. Retirees should consider the following strategies:

- Delaying claiming benefits: Delaying claiming Social Security benefits until age 70 can result in a significantly higher monthly payment.

- Coordinating benefits with a spouse: Married couples can coordinate their Social Security benefits to maximize their combined income.

- Understanding the impact of working while receiving benefits: Working while receiving Social Security benefits can reduce benefits if income exceeds certain limits.

The Psychological Aspects of Retirement Planning:

Retirement planning is not just about numbers; it’s also about psychology. Many retirees struggle with the transition from working life to retirement, and it’s essential to address the psychological aspects of retirement planning.

- Defining purpose and meaning: Retirement can be a time of great freedom, but it can also be a time of uncertainty and loss of purpose. Retirees should define their purpose and meaning in retirement by pursuing hobbies, volunteering, or engaging in other meaningful activities.

- Maintaining social connections: Social connections are crucial for mental and emotional well-being in retirement. Retirees should maintain their social connections by staying in touch with friends and family, joining clubs or organizations, or volunteering in their community.

- Managing emotions: Retirement can be a time of significant emotional changes, such as feelings of loneliness, anxiety, or depression. Retirees should seek professional help if they are struggling with their emotions.

- Financial anxiety: It’s normal to feel anxious about finances in retirement. Creating a solid plan and regularly monitoring progress can help alleviate these concerns.

FAQ Section:

Q1: What is the 4% rule, and why is William Bengen now suggesting it might be too high?

A1: The 4% rule is a guideline suggesting retirees can withdraw 4% of their initial retirement savings annually, adjusted for inflation, and expect their portfolio to last at least 30 years. William Bengen, the rule’s creator, now believes it might be too high due to current high equity valuations and low bond yields, which could lead to lower future returns and portfolio depletion.

Q2: What withdrawal rate does Bengen now recommend, and what conditions apply?

A2: Bengen suggests a withdrawal rate between 4.5% and 5%, but only if retirees are flexible with their spending. This means being willing to reduce withdrawals during market downturns and potentially increase them during periods of strong growth. Flexibility is key to ensuring the longevity of their retirement savings.

Q3: What factors should retirees consider besides the 4% rule when planning their retirement withdrawals?

A3: Retirees should consider their individual circumstances, risk tolerance, spending needs, portfolio allocation, inflation, longevity expectations, and potential healthcare costs. Consulting with a financial advisor is crucial to developing a personalized retirement plan. Other strategies such as the variable percentage withdrawal, bucketing and safety-first approach should also be considered.

Q4: How does sequence of returns risk impact retirement planning, and what can retirees do to mitigate it?

A4: Sequence of returns risk refers to the risk that negative investment returns early in retirement can significantly deplete a portfolio. To mitigate this risk, retirees can lower initial withdrawal rates, use a variable withdrawal strategy, delay retirement, or purchase an annuity.

Q5: Why is it important to seek professional financial advice for retirement planning, especially given the changing economic landscape?

A5: A financial advisor can provide personalized guidance based on individual circumstances, help develop a comprehensive retirement plan, manage investments, and provide ongoing support and adjustments as needed. The evolving economic landscape requires expert knowledge to navigate market volatility and ensure retirement security. They can also assist with estate planning and long-term care planning.