Boosting 401(k) contributions, especially early in one’s career, is the single most impactful move Americans can make to secure a comfortable retirement, according to financial expert and bestselling author, Ramit Sethi. His advice centers on leveraging the power of compounding and maximizing employer matching programs to build substantial long-term savings.

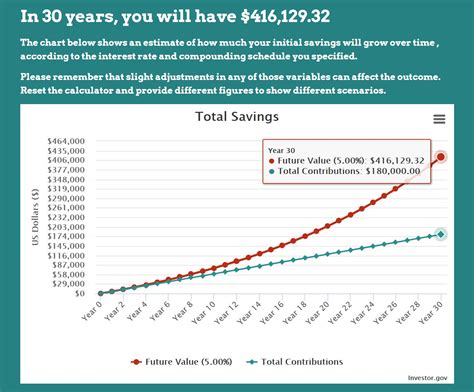

Retirement security often feels like a distant concern, particularly for younger workers grappling with immediate financial pressures such as student loan debt and rising living costs. However, Sethi argues that delaying significant contributions to retirement accounts is a costly mistake. The cornerstone of his strategy involves harnessing the potential of compound interest, where earnings generate further earnings over time, resulting in exponential growth. “The single most impactful thing you can do is start early and contribute as much as you can, especially to get the employer match,” Sethi emphasized in a recent interview.

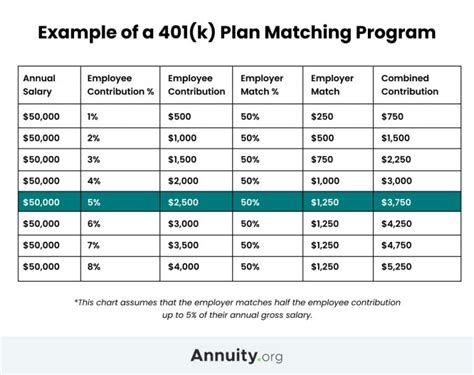

The significance of employer matching programs cannot be overstated. Many companies offer to match a portion of employee contributions to their 401(k) plans, effectively providing “free money” that can significantly accelerate retirement savings. For example, a common matching structure might involve an employer matching 50% of employee contributions up to 6% of their salary. In such a scenario, an employee earning $60,000 per year who contributes 6% of their salary ($3,600) would receive an additional $1,800 from their employer, bringing their total annual contribution to $5,400. Over several decades, these matching contributions, combined with investment gains, can dramatically increase the overall value of the retirement account.

Sethi acknowledges that contributing a substantial portion of one’s income to a 401(k) can be challenging, especially for individuals with limited disposable income. However, he advocates for prioritizing retirement savings and making incremental increases to contribution levels over time. Even small increases, such as boosting contributions by 1% or 2% each year, can have a significant impact on long-term retirement outcomes. He advises, “Automate your contributions, so you don’t even have to think about it.” Setting up automatic payroll deductions ensures consistent contributions and eliminates the temptation to delay or skip contributions due to competing financial demands.

Beyond the immediate financial benefits, contributing to a 401(k) plan also offers valuable tax advantages. Contributions are typically made on a pre-tax basis, meaning that the amount contributed is deducted from the employee’s taxable income, reducing their current tax liability. Furthermore, the earnings within the 401(k) account grow tax-deferred, meaning that taxes are not paid on the investment gains until retirement. This tax-advantaged structure allows savings to grow more rapidly than they would in a taxable investment account.

To maximize the benefits of a 401(k) plan, Sethi recommends carefully considering investment options. Many plans offer a range of mutual funds and other investment vehicles, each with different risk and return profiles. He suggests diversifying investments across different asset classes, such as stocks, bonds, and real estate, to reduce overall portfolio risk. For individuals who are unsure about which investment options to choose, he recommends considering target-date funds, which automatically adjust the asset allocation over time based on the employee’s anticipated retirement date. “Target-date funds are a great option for those who want a hands-off approach to investing,” Sethi noted.

Moreover, Sethi stresses the importance of regularly reviewing and rebalancing the 401(k) portfolio. Market fluctuations can cause the asset allocation to drift away from the desired target, so it is important to periodically rebalance the portfolio to maintain the appropriate level of risk. Rebalancing involves selling some of the assets that have increased in value and buying more of the assets that have declined in value, thereby ensuring that the portfolio remains aligned with the investor’s long-term goals.

In addition to maximizing 401(k) contributions, Sethi emphasizes the importance of developing a comprehensive financial plan that addresses all aspects of personal finance, including budgeting, debt management, and insurance. A well-rounded financial plan can help individuals achieve their financial goals, build wealth, and secure their financial future. He encourages people to “create a conscious spending plan” that aligns with their values and priorities.

Sethi’s advice resonates with a growing awareness of the need for improved retirement savings among Americans. According to recent studies, a significant percentage of Americans are not adequately prepared for retirement, and many are at risk of outliving their savings. Contributing early and consistently to a 401(k) plan is a critical step in addressing this retirement savings gap. By following Sethi’s recommendations and taking proactive steps to manage their finances, Americans can increase their chances of achieving a comfortable and secure retirement.

The current maximum contribution to a 401(k) for 2024 is $23,000, with an additional $7,500 catch-up contribution allowed for those aged 50 and over. These limits are subject to change annually based on inflation adjustments. It’s important to stay informed about these limits to maximize the tax advantages and savings potential of a 401(k) plan. Consulting with a qualified financial advisor can provide personalized guidance on retirement planning and investment strategies tailored to individual circumstances.

Ultimately, securing a comfortable retirement requires a long-term commitment to saving and investing. By starting early, maximizing employer matching contributions, and making informed investment decisions, Americans can take control of their financial future and achieve their retirement goals. Ramit Sethi’s top tip serves as a timely reminder of the power of compounding and the importance of prioritizing retirement savings. The sooner individuals embrace this strategy, the greater the potential for building a substantial nest egg and ensuring a secure and fulfilling retirement.

Furthermore, Sethi often advocates for negotiating a higher salary, arguing that even a small increase in annual income can have a significant impact on long-term wealth accumulation. A higher salary not only provides more disposable income for saving and investing, but also increases the employer’s matching contributions to the 401(k) plan. He urges individuals to research industry benchmarks, highlight their accomplishments, and confidently negotiate for fair compensation. He believes, “Negotiating your salary is one of the most effective ways to increase your lifetime earnings.”

Another critical aspect of Sethi’s financial philosophy is the importance of automating financial tasks. He recommends automating bill payments, savings contributions, and investment transfers to streamline financial management and prevent missed opportunities. Automation eliminates the need for constant monitoring and decision-making, allowing individuals to focus on other priorities while their finances are managed efficiently. Sethi emphasizes, “Automation is the key to building wealth without constant effort.”

Moreover, Sethi emphasizes the significance of understanding the fees associated with 401(k) plans. Management fees, administrative fees, and other expenses can erode investment returns over time. He advises individuals to carefully review the fee structure of their 401(k) plan and consider switching to a lower-cost alternative if available. Even a small reduction in fees can result in significant savings over the long term. He encourages people to “scrutinize your 401(k) fees and make sure you’re not paying too much.”

Sethi also highlights the importance of avoiding common retirement savings mistakes, such as cashing out a 401(k) early or taking out loans against the account. Early withdrawals are typically subject to taxes and penalties, significantly reducing the amount available for retirement. Similarly, taking out loans against a 401(k) can disrupt the compounding process and potentially lead to missed investment opportunities. He warns, “Avoid the temptation to raid your 401(k) for short-term needs.”

In addition to traditional 401(k) plans, Sethi also advocates for exploring other retirement savings options, such as Roth IRAs. Roth IRAs offer tax-free withdrawals in retirement, providing a valuable source of tax-advantaged income. He recommends consulting with a financial advisor to determine the most appropriate retirement savings strategy based on individual circumstances and financial goals. He suggests, “Consider a Roth IRA for tax-free income in retirement.”

The impact of starting early and maximizing contributions is dramatically illustrated through hypothetical scenarios. Consider two individuals, Sarah and Tom, who both start working at age 25. Sarah starts contributing 10% of her $50,000 salary to her 401(k) immediately, while Tom delays contributing for 10 years. Both receive a 50% employer match up to 6% of their salary and earn an average annual return of 7%. By age 65, Sarah’s 401(k) would be significantly larger than Tom’s, highlighting the power of compounding and the importance of starting early. Even though Tom eventually contributes more in total dollars, Sarah’s early start gives her a substantial advantage.

Furthermore, Sethi’s advice extends to managing debt effectively. He argues that high-interest debt, such as credit card debt, can undermine retirement savings efforts. He recommends prioritizing debt repayment and developing a plan to eliminate debt as quickly as possible. Reducing debt frees up more cash flow for saving and investing, accelerating progress toward retirement goals. He advises, “Prioritize paying off high-interest debt to free up more money for saving.”

Moreover, Sethi emphasizes the importance of developing a positive mindset towards money. He encourages individuals to cultivate a healthy relationship with money and to view it as a tool for achieving their goals. He believes that financial success is not just about accumulating wealth, but also about using money to create a fulfilling and meaningful life. He suggests, “Develop a positive mindset towards money and use it to create the life you want.”

In conclusion, Ramit Sethi’s top tip for Americans seeking retirement security centers on the power of early and consistent 401(k) contributions, particularly when coupled with employer matching programs. His advice is grounded in the principles of compound interest, tax advantages, and disciplined financial planning. By following his recommendations, individuals can significantly increase their chances of achieving a comfortable and secure retirement, regardless of their current financial circumstances. The key is to start now, automate contributions, maximize employer matching, and stay focused on long-term financial goals.

Frequently Asked Questions (FAQ)

-

What is Ramit Sethi’s top tip for Americans to secure their retirement?

Ramit Sethi’s top tip is to start contributing to a 401(k) as early as possible and to contribute as much as you can, especially to maximize any employer matching programs. He emphasizes the power of compounding and the “free money” offered by employer matches.

-

Why is starting early so important when it comes to 401(k) contributions?

Starting early allows you to take full advantage of compound interest. Compound interest is essentially earning interest on your initial investment and on the accumulated interest over time. The earlier you start, the more time your money has to grow exponentially.

-

What is an employer matching program, and why is it important to take advantage of it?

An employer matching program is a benefit offered by many companies where they match a percentage of your 401(k) contributions, up to a certain limit. It’s important to take advantage of it because it’s essentially “free money” that can significantly boost your retirement savings. For instance, if a company matches 50% of your contributions up to 6% of your salary, you should aim to contribute at least 6% to get the full match.

-

How can I increase my 401(k) contributions if I’m currently struggling financially?

Even small, incremental increases to your 401(k) contributions can make a big difference over time. Try increasing your contributions by 1% or 2% each year. Automating your contributions through payroll deductions can also help you stay consistent and avoid the temptation to skip contributions. Consider also re-evaluating your budget to identify areas where you can cut expenses and reallocate those funds to your retirement savings. Negotiating a higher salary can also provide more disposable income for savings.

-

What are the tax advantages of contributing to a 401(k)?

Contributions to a traditional 401(k) are typically made on a pre-tax basis, meaning that the amount you contribute is deducted from your taxable income, reducing your current tax liability. Additionally, the earnings within the 401(k) account grow tax-deferred, meaning that you don’t pay taxes on the investment gains until you withdraw the money in retirement. This tax-advantaged structure allows your savings to grow more rapidly than they would in a taxable investment account. However, you will pay income taxes on withdrawals in retirement. Roth 401(k) plans offer a different tax advantage; contributions are made after-tax, but qualified withdrawals in retirement are tax-free.

-

What are target-date funds and how can they help with 401(k) investing?

Target-date funds are a type of mutual fund that automatically adjusts its asset allocation over time based on the investor’s anticipated retirement date. These funds typically start with a higher allocation to stocks (which offer higher growth potential) and gradually shift towards a more conservative mix of bonds as the retirement date approaches. Target-date funds are a good option for investors who want a hands-off approach to investing and prefer to have their asset allocation managed for them.

-

What should I do if I’m not sure which investment options to choose within my 401(k)?

If you’re unsure about which investment options to choose, consider consulting with a qualified financial advisor. They can help you assess your risk tolerance, investment goals, and time horizon, and recommend a suitable investment strategy for your 401(k). You can also consider target-date funds as a simple, diversified option.

-

How often should I review and rebalance my 401(k) portfolio?

It’s generally a good idea to review your 401(k) portfolio at least once a year, or more frequently if there are significant market fluctuations. Rebalancing involves selling some of the assets that have increased in value and buying more of the assets that have declined in value, to maintain your desired asset allocation. Rebalancing helps to control risk and ensure that your portfolio remains aligned with your long-term goals.

-

What are some common mistakes to avoid when managing a 401(k)?

Some common mistakes to avoid include cashing out your 401(k) early (which can result in taxes and penalties), taking out loans against your 401(k) (which can disrupt the compounding process), and failing to contribute enough to maximize your employer match. Additionally, neglecting to review and rebalance your portfolio or paying excessive fees can also negatively impact your retirement savings.

-

What are the current maximum contribution limits for 401(k) plans?

For 2024, the maximum employee contribution to a 401(k) is $23,000. Those aged 50 and over can make an additional “catch-up” contribution of $7,500, for a total of $30,500. The total combined contribution limit (including employer contributions) is $69,000, or $76,500 for those aged 50 and over. These limits are subject to change annually based on inflation adjustments, so it’s important to stay informed.

-

What is a Roth IRA and how does it differ from a traditional 401(k)?

A Roth IRA is another type of retirement savings account that offers different tax advantages than a traditional 401(k). With a Roth IRA, you make contributions with after-tax dollars, but your qualified withdrawals in retirement are tax-free. With a traditional 401(k), you make contributions with pre-tax dollars, and your withdrawals in retirement are taxed as ordinary income. The choice between a Roth IRA and a traditional 401(k) depends on your individual circumstances and expectations about future tax rates. If you expect your tax rate to be higher in retirement, a Roth IRA may be more advantageous.

-

How can I create a comprehensive financial plan to complement my 401(k) savings?

A comprehensive financial plan should address all aspects of your personal finances, including budgeting, debt management, insurance, and investments. Start by creating a budget to track your income and expenses, and identify areas where you can save more. Develop a plan to pay off high-interest debt, such as credit card debt. Make sure you have adequate insurance coverage to protect yourself against financial risks. And diversify your investments across different asset classes to reduce overall portfolio risk. Consider consulting with a financial advisor to help you develop a personalized financial plan that meets your specific needs and goals.

-

What are the benefits of automating my financial tasks?

Automating financial tasks, such as bill payments, savings contributions, and investment transfers, can streamline financial management and prevent missed opportunities. Automation eliminates the need for constant monitoring and decision-making, allowing you to focus on other priorities while your finances are managed efficiently. It can also help you stay consistent with your savings and investment goals, even when you’re busy or distracted.

-

How can I negotiate a higher salary to boost my retirement savings?

Negotiating a higher salary can significantly impact your long-term wealth accumulation. Research industry benchmarks for your position and experience level to determine a fair salary range. Highlight your accomplishments and contributions to your current employer. And be confident and assertive when negotiating your salary. Even a small increase in your annual income can provide more disposable income for saving and investing, and increase your employer’s matching contributions to your 401(k).

-

How can I develop a positive mindset towards money?

Developing a positive mindset towards money involves cultivating a healthy relationship with money and viewing it as a tool for achieving your goals. Focus on gratitude for what you have and avoid comparing yourself to others. Set clear financial goals and create a plan to achieve them. Practice mindful spending and align your spending with your values and priorities. Remember that financial success is not just about accumulating wealth, but also about using money to create a fulfilling and meaningful life.

-

What is the impact of fees on my 401(k) returns, and how can I minimize them? Fees, such as management fees and administrative fees, can significantly erode your investment returns over time. Carefully review the fee structure of your 401(k) plan. Consider switching to a lower-cost alternative if available. Even a small reduction in fees can result in significant savings over the long term. Look for index funds or exchange-traded funds (ETFs) that typically have lower expense ratios than actively managed funds.

-

How does debt management play a role in my overall retirement plan?

High-interest debt, such as credit card debt, can undermine your retirement savings efforts. Prioritize debt repayment and develop a plan to eliminate debt as quickly as possible. Reducing debt frees up more cash flow for saving and investing, accelerating progress toward your retirement goals. Consider strategies such as the debt snowball or debt avalanche method to effectively manage and eliminate debt.

- What resources are available to help me learn more about retirement planning?

There are numerous resources available to help you learn more about retirement planning. Consult with a qualified financial advisor for personalized guidance. Utilize online calculators and tools to estimate your retirement needs and project your savings. Read books, articles, and blogs on personal finance and retirement planning. Attend workshops or seminars on financial literacy and retirement planning. And take advantage of resources offered by your employer, such as financial wellness programs and retirement planning seminars.

-

What are some alternative retirement savings options besides a 401(k)? Besides a 401(k), consider other retirement savings options such as a Roth IRA or a traditional IRA. Self-employed individuals can explore options like SEP IRAs or SIMPLE IRAs. Health Savings Accounts (HSAs) can also be used as a retirement savings vehicle, as contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

-

How can I estimate how much money I’ll need for retirement? Estimating your retirement needs involves considering factors such as your current expenses, desired lifestyle in retirement, inflation, and life expectancy. Use online retirement calculators or consult with a financial advisor to project your retirement income needs. Factor in sources of income such as Social Security, pensions, and investment income. And plan for potential healthcare expenses and long-term care costs.