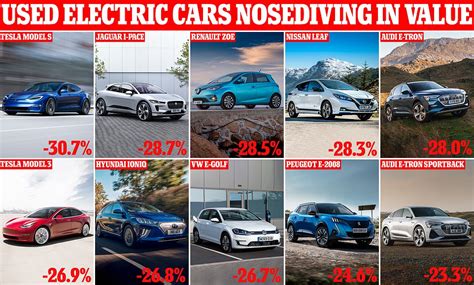

Used car values are depreciating, and a new study reveals the models experiencing the steepest decline in 2025, with electric vehicles and luxury cars dominating the list of biggest losers in retained value. iSeeCars.com analyzed over 1.7 million used car sales from the past year to determine which vehicles experienced the largest dollar depreciation between their original sale price and their current used value.

Significant Depreciation Hits Specific Used Car Models

The study pinpoints ten specific models that have seen the most significant drop in value, reflecting broader market trends impacting certain segments more than others. “While the used car market has largely stabilized, some cars are depreciating more than others,” said Karl Brauer, iSeeCars.com Executive Analyst. “The cars on this list highlight the risks of buying a new car, as they lose value quickly once they leave the dealership.”

Top 10 Cars with the Largest Depreciation (Dollar Amount):

- Maserati Quattroporte: Depreciation: $47,806.00 (60.8%)

- Nissan LEAF: Depreciation: $21,748.00 (68.2%)

- BMW 5 Series: Depreciation: $21,348.00 (42.9%)

- Jaguar F-PACE: Depreciation: $20,301.00 (46.5%)

- Mercedes-Benz E-Class: Depreciation: $20,242.00 (41.6%)

- Audi A5: Depreciation: $19,344.00 (45.8%)

- BMW 3 Series: Depreciation: $19,039.00 (43.6%)

- Mercedes-Benz C-Class: Depreciation: $18,784.00 (45.1%)

- Infiniti QX80: Depreciation: $18,589.00 (31.7%)

- Cadillac XT5: Depreciation: $17,993.00 (44.7%)

Luxury Cars and Electric Vehicles Dominate Depreciation List

Luxury vehicles, particularly the Maserati Quattroporte, occupy the top spot, showcasing the rapid depreciation often associated with high-end brands. Electric vehicles, like the Nissan LEAF, also feature prominently, indicating potential concerns about battery life, technological obsolescence, and government incentives impacting resale values. The data underscores that certain vehicle types are more susceptible to significant depreciation, creating potential risks for new car buyers but opportunities for used car shoppers.

In-Depth Analysis of the Top 10 Losers

-

Maserati Quattroporte: The Maserati Quattroporte leads the pack with a staggering depreciation of $47,806, representing a 60.8% loss in value. This substantial drop is likely due to high initial purchase price, costly maintenance, and limited consumer demand in the used car market. The Quattroporte, while offering luxurious features and performance, faces stiff competition and may not hold its value as well as more mainstream luxury sedans. This makes it a potentially attractive option for buyers willing to accept the risks associated with owning a depreciating luxury vehicle. The high cost of ownership, including repairs and insurance, also deters some buyers, contributing to its rapid depreciation.

-

Nissan LEAF: The Nissan LEAF, an all-electric vehicle, experiences a significant depreciation of $21,748, equating to a 68.2% loss in value. Several factors contribute to this decline, including advancements in electric vehicle technology, concerns about battery degradation, and government incentives for new EV purchases. As newer electric models with longer ranges and improved features become available, the demand for older models like the LEAF diminishes, driving down their resale value. The limited range of older LEAF models compared to newer EVs is a major factor affecting its desirability in the used car market. Additionally, potential battery replacement costs further contribute to buyer apprehension.

-

BMW 5 Series: The BMW 5 Series, a popular luxury sedan, depreciates by $21,348, representing a 42.9% loss in value. While BMWs are known for their performance and luxury, they also tend to depreciate faster than some other brands due to higher maintenance costs and the availability of newer models with updated features. The 5 Series faces competition from other luxury sedans and SUVs, which can also impact its resale value. The advanced technology and complex systems in BMW vehicles can also lead to higher repair bills, contributing to their depreciation.

-

Jaguar F-PACE: The Jaguar F-PACE, a luxury SUV, experiences a depreciation of $20,301, translating to a 46.5% loss in value. Jaguars, in general, tend to depreciate more quickly than some other luxury brands due to concerns about reliability and higher maintenance costs. The F-PACE, while offering stylish design and sporty performance, faces stiff competition in the crowded luxury SUV market. The brand perception of Jaguar and its historical reliability issues can also contribute to its depreciation.

-

Mercedes-Benz E-Class: The Mercedes-Benz E-Class, another popular luxury sedan, depreciates by $20,242, representing a 41.6% loss in value. Similar to the BMW 5 Series, the E-Class experiences depreciation due to higher maintenance costs, the availability of newer models, and competition from other luxury vehicles. While Mercedes-Benz is a highly regarded brand, its vehicles can be expensive to maintain, which impacts their resale value. The constant evolution of technology and features in new Mercedes-Benz models also drives down the value of older versions.

-

Audi A5: The Audi A5, a stylish coupe and convertible, depreciates by $19,344, equating to a 45.8% loss in value. The A5’s depreciation can be attributed to factors such as higher maintenance costs, the availability of newer models with updated designs and technology, and competition from other sporty vehicles. The coupe and convertible market segments are also smaller than sedans and SUVs, which can limit the demand for used A5 models. Audi’s reputation for complex engineering can also lead to higher repair costs, contributing to depreciation.

-

BMW 3 Series: The BMW 3 Series, a popular entry-level luxury sedan, depreciates by $19,039, representing a 43.6% loss in value. Similar to the 5 Series, the 3 Series depreciates due to higher maintenance costs and the availability of newer models. As BMW’s entry-level model, the 3 Series also faces competition from non-luxury brands, which can impact its resale value. The 3 Series is a high-volume seller, which also contributes to its depreciation as there are many used models available on the market.

-

Mercedes-Benz C-Class: The Mercedes-Benz C-Class, another entry-level luxury sedan, depreciates by $18,784, translating to a 45.1% loss in value. The C-Class experiences depreciation for reasons similar to the 3 Series, including higher maintenance costs, newer models, and competition from non-luxury brands. The C-Class is also a high-volume seller, contributing to its depreciation. The complex systems and advanced technology in the C-Class can also lead to higher repair bills, impacting its resale value.

-

Infiniti QX80: The Infiniti QX80, a large luxury SUV, depreciates by $18,589, representing a 31.7% loss in value. While the QX80’s depreciation is lower than some other models on the list, it still represents a significant dollar amount. The QX80’s depreciation can be attributed to its large size, lower fuel economy, and competition from other luxury SUVs. The QX80’s older design and technology compared to newer SUVs can also impact its resale value.

-

Cadillac XT5: The Cadillac XT5, a mid-size luxury SUV, depreciates by $17,993, equating to a 44.7% loss in value. The XT5’s depreciation can be attributed to competition from other luxury SUVs, the availability of newer models with updated features, and Cadillac’s brand perception. The XT5’s relatively bland styling compared to some of its competitors can also impact its resale value. Cadillac’s efforts to reposition itself as a more modern and innovative brand may also impact the resale value of older models like the XT5.

Factors Contributing to Depreciation

Several factors contribute to the depreciation of vehicles, including:

-

Market Demand: High demand for a particular model can help it retain its value, while low demand can lead to rapid depreciation.

-

Vehicle Condition: The condition of a used vehicle, including its maintenance history and any damage, significantly impacts its value.

-

Mileage: Higher mileage typically leads to lower resale value.

-

Fuel Efficiency: Vehicles with poor fuel economy may depreciate more quickly as fuel prices fluctuate.

-

Brand Reputation: Brands with a reputation for reliability and durability tend to retain their value better.

-

Maintenance Costs: Vehicles with high maintenance costs may depreciate more quickly as potential buyers anticipate higher expenses.

-

Technological Advancements: Rapid advancements in technology can make older models seem outdated, leading to depreciation.

-

Government Incentives: Government incentives for new vehicle purchases can impact the resale value of older models.

-

Economic Conditions: Overall economic conditions can influence the demand for used vehicles, affecting depreciation rates.

Implications for Car Buyers

The depreciation data has important implications for car buyers:

-

New Car Buyers: New car buyers should be aware of the potential for rapid depreciation, particularly for luxury vehicles and electric vehicles. Choosing a model with a history of good resale value can help minimize losses.

-

Used Car Buyers: Used car buyers can take advantage of the depreciation of certain models to purchase vehicles at a significant discount. Focusing on models with high depreciation can offer substantial savings.

-

Leasing: Leasing can be a viable option for those who want to drive a new car without the long-term commitment and risk of depreciation.

Expert Opinions and Industry Insights

According to Karl Brauer, Executive Analyst at iSeeCars.com, “While the used car market has largely stabilized, some cars are depreciating more than others. The cars on this list highlight the risks of buying a new car, as they lose value quickly once they leave the dealership.” This insight underscores the importance of considering depreciation when making a car purchase.

Other industry experts suggest that the increasing popularity of SUVs and crossovers is impacting the resale value of sedans, while advancements in electric vehicle technology are affecting the depreciation of older EVs. The ongoing chip shortage and supply chain disruptions have also contributed to fluctuations in the used car market, making it essential to stay informed about current trends.

Long-Term Trends and Future Outlook

The trend of luxury vehicles and electric vehicles experiencing higher depreciation is likely to continue in the coming years. As technology continues to evolve and new models are introduced, older vehicles will inevitably lose value. Factors such as battery technology improvements, the expansion of charging infrastructure, and government regulations will also play a role in shaping the future of the used car market.

Consumers are becoming more aware of the environmental impact of their vehicles, which may lead to increased demand for fuel-efficient and electric models, further impacting the resale value of older, less efficient cars. The growth of ride-sharing services and autonomous driving technology could also disrupt the traditional car ownership model, potentially affecting depreciation rates.

Detailed Analysis by Vehicle Type

-

Luxury Sedans: Luxury sedans, such as the Maserati Quattroporte, BMW 5 Series, and Mercedes-Benz E-Class, tend to depreciate more quickly due to their high initial purchase prices, higher maintenance costs, and competition from newer models with updated features. The luxury segment is also characterized by rapid innovation, which can make older models seem outdated.

-

Electric Vehicles: Electric vehicles, like the Nissan LEAF, are experiencing significant depreciation due to concerns about battery life, technological obsolescence, and government incentives for new EV purchases. As battery technology improves and charging infrastructure expands, the demand for older EVs may decline, leading to further depreciation.

-

Luxury SUVs: Luxury SUVs, such as the Jaguar F-PACE and Infiniti QX80, are depreciating due to competition from other SUVs, higher maintenance costs, and brand-specific factors. The SUV market is highly competitive, with numerous models vying for consumer attention, which can impact resale values.

-

Entry-Level Luxury Cars: Entry-level luxury cars, such as the BMW 3 Series and Mercedes-Benz C-Class, are depreciating due to higher maintenance costs, newer models, and competition from non-luxury brands. These models are often leased, which can increase the supply of used vehicles and contribute to depreciation.

Regional Variations in Depreciation

Depreciation rates can vary depending on the region. Factors such as climate, local demand, and the availability of specific models can influence resale values. For example, vehicles with four-wheel drive may retain their value better in regions with harsh winters, while fuel-efficient cars may be more popular in urban areas with high gas prices.

Local market conditions and economic factors can also play a role in depreciation rates. Areas with strong economies and high consumer confidence may see higher resale values, while areas with economic challenges may experience lower demand and increased depreciation.

Consumer Tips for Minimizing Depreciation

-

Choose a Vehicle with a Good Resale Value: Research the resale value of different models before making a purchase. Consider factors such as brand reputation, reliability, and fuel efficiency.

-

Maintain Your Vehicle Properly: Regular maintenance and timely repairs can help maintain your vehicle’s condition and preserve its value.

-

Keep Mileage Low: Driving fewer miles can help reduce wear and tear and maintain your vehicle’s resale value.

-

Consider Leasing: Leasing can be a viable option for those who want to drive a new car without the long-term commitment and risk of depreciation.

-

Be Aware of Market Trends: Stay informed about current market trends and factors that may impact depreciation rates.

The Impact of COVID-19 on Used Car Values

The COVID-19 pandemic had a significant impact on the used car market, with prices initially falling due to reduced demand and economic uncertainty. However, as the economy recovered and supply chain disruptions impacted new car production, used car prices surged. This unusual situation created both opportunities and challenges for car buyers and sellers.

While the used car market has largely stabilized, the pandemic has highlighted the importance of understanding market dynamics and making informed decisions. The long-term effects of the pandemic on depreciation rates remain to be seen, but it is clear that the used car market is subject to a variety of factors beyond traditional economic forces.

Conclusion

The depreciation of vehicles is a complex issue influenced by a variety of factors, including market demand, vehicle condition, brand reputation, and technological advancements. Luxury vehicles and electric vehicles are currently experiencing some of the highest depreciation rates, creating both risks and opportunities for car buyers and sellers. By understanding the factors that contribute to depreciation and staying informed about market trends, consumers can make more informed decisions and minimize their financial losses. The iSeeCars.com study provides valuable insights into the current state of the used car market, highlighting the importance of considering depreciation when making a car purchase. As the automotive industry continues to evolve, it is essential to stay informed and adapt to changing market conditions.

Frequently Asked Questions (FAQ)

1. Why are luxury cars depreciating so rapidly?

Luxury cars typically depreciate faster due to their high initial purchase price, higher maintenance costs, and the rapid pace of technological innovation in the luxury segment. Newer models often come with advanced features that make older models seem outdated, leading to a decrease in their resale value. Also, the cost of repairs on luxury vehicles tends to be higher, deterring some used car buyers.

2. What makes electric vehicles depreciate so much?

Electric vehicle depreciation is influenced by factors such as rapid advancements in battery technology, concerns about battery degradation, and government incentives for new EV purchases. As newer EVs offer longer ranges and improved performance, older models become less desirable, driving down their resale value. The uncertainty surrounding battery replacement costs also contributes to buyer apprehension.

3. How can I minimize the depreciation of my car?

To minimize depreciation, choose a vehicle with a good resale value, maintain it properly with regular servicing, keep the mileage low, and consider factors like fuel efficiency. Researching the historical depreciation rates of different models before purchasing can also help. Protecting the car from damage and keeping it clean can also positively influence its value.

4. Is leasing a better option than buying to avoid depreciation?

Leasing can be a better option if you want to avoid the long-term commitment and risk of depreciation. With a lease, you essentially pay for the portion of the vehicle’s value that you use during the lease term. At the end of the lease, you return the vehicle to the dealership, avoiding the hassle of selling it and the potential loss from depreciation. However, leasing may not be the most cost-effective option in the long run if you typically keep your cars for many years.

5. How has the COVID-19 pandemic affected used car depreciation?

The COVID-19 pandemic caused significant fluctuations in the used car market. Initially, prices fell due to reduced demand. Later, supply chain disruptions and a shortage of new cars led to a surge in used car prices. While the market has largely stabilized, the pandemic highlighted the importance of understanding market dynamics and making informed decisions. The long-term effects on depreciation rates are still unfolding, but the pandemic underscores the volatility of the used car market.